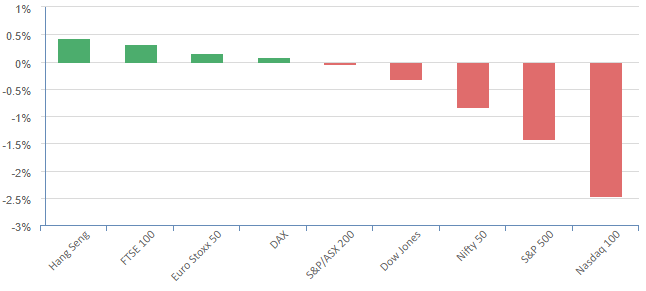

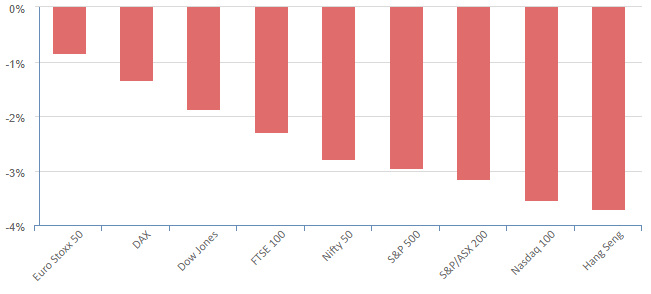

Overnight – Nasdaq slumps to its worst day since February, dragging equities to 4-month lows

Big tech led the market lower overnight, pressured by rising Treasury yields and Alphabet-led weakness in tech following disappointing quarterly results in its cloud business.

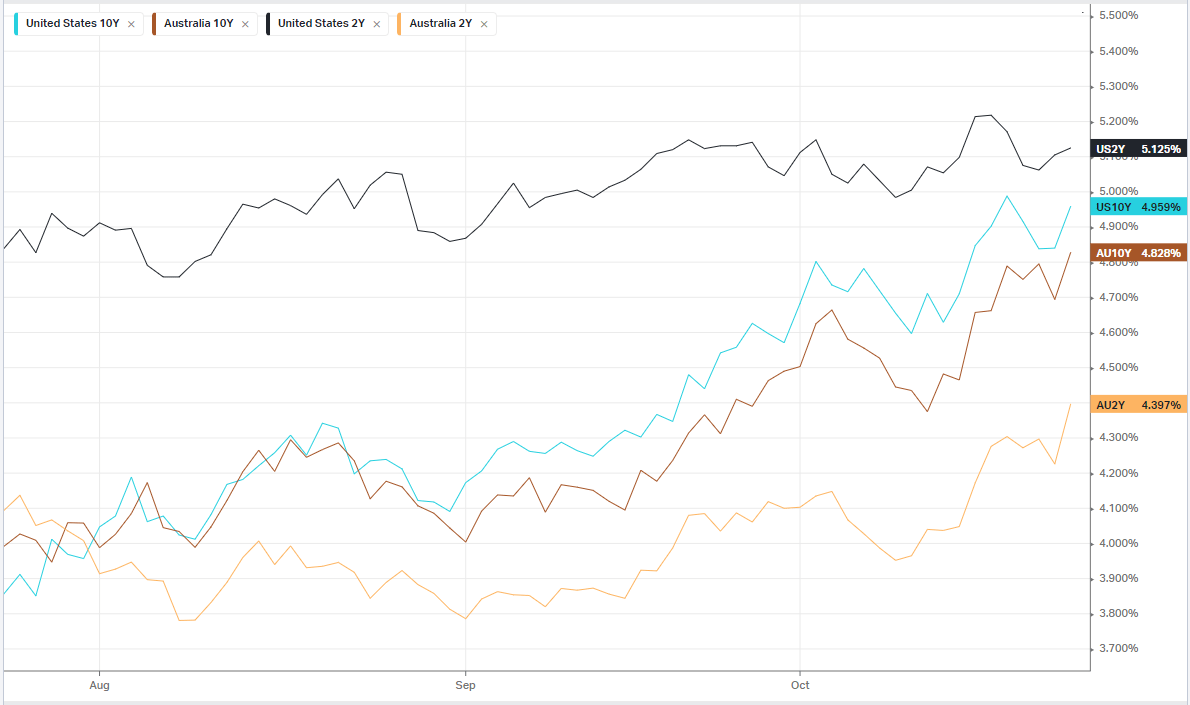

The recent string of strong economic numbers in the US is causing headaches for the Federal reserve, forcing their hand to raise rates or risk another wave of inflation. This saw treasury yields push back towards the 5% mark, after 2 days of respite from the recent rally.

In big tech, Microsoft was the only shining light in the tech sector, up 3% on yesterday’s positive earnings result, Alphabet (GOOG) fell 10% despite a better then expected headline result as cloud volumes disappointed investors.

Todays close in the S&P500 notches a fifth daily decline in six sessions, closing below the key 4,200 level. The Nasdaq slumped to 4-month lows, having its biggest single-session percentage drop since February, breaking the key 14,500 level, also the 200ma

Investors are finally realizing the lofty valuations for the “magnificent 7” combined with high bond yields make the chance of a “bull run” from here very difficult. A significant breakdown from these prices is possible and caution is warranted

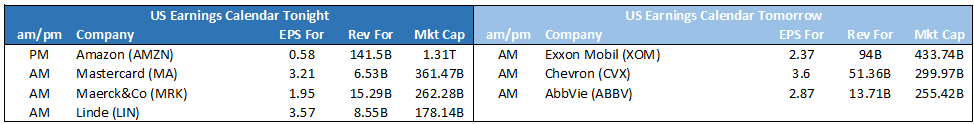

Earnings Results

Meta Platforms (META) – rose more than 4% in afterhours trading as third-quarter results that topped Wall Street expectations and stronger guidance for the current quarter as cost cuts boosted margins. Advertising revenue jumped 23% to $33.64B from $27.24B. Facebook daily active users, or DAUs, rose 7% to 3.14B, while monthly active people, or MAUs, rose 3% to 3.05B. Looking ahead, the company said it expects third quarter revenue to be in the range of $36.5B to $40B, beating estimates for $38.84B.

IBM (IBM) – Shares rose 2% after beating expectations on profit for the third quarter and reaffirming its outlook. Software revenue, which includes its artificial intelligence platform, rose 8%, consulting revenue rose 6%, and infrastructure revenue fell 2%

Boeing (BA) – fell more than 2% after the aircraft maker reported a wider than expected loss and cut its annual guidance on 737 Max deliveries amid a manufacturing problem with the aircraft.

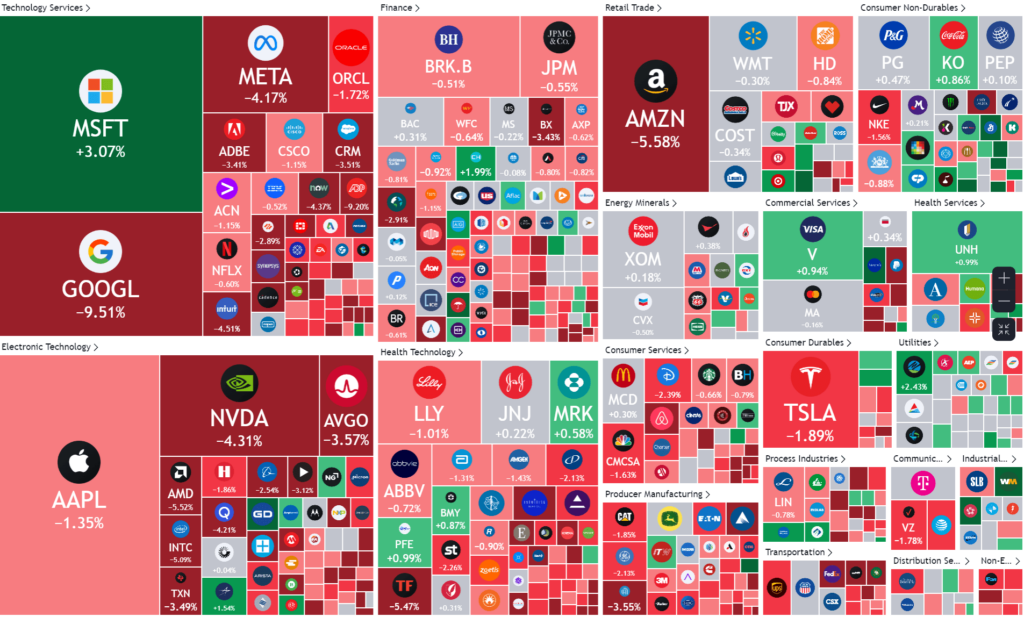

S&P 500 - Heatmap

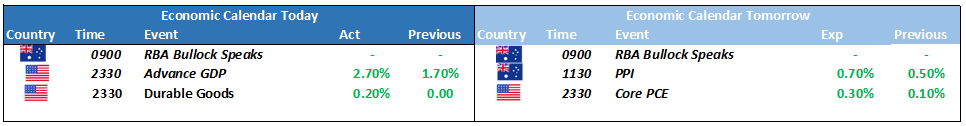

The Day Ahead

ASX SPI 6845 (-0.20%)

While sentiment may sour due to the large move in the US overnight, the AU market has already seen weakness ahead of the move overnight and is likely to fare better than offshore markets.

The likely laggards for the day will be tech due to the US lead, and consumer discretionary as worries around a possible Melbourne Cup rate hike weigh.

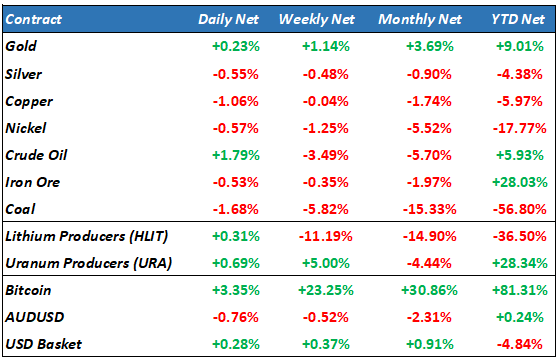

Energy will be supported by the rally in oil and uranium overnight while the materials sector is likely to be buoyed by very positive talks between the AU and US on critical minerals. Australian Resources Minister, Madeline King is currently in the US holding talks with the Biden Administration around critical minerals, rare earths and the processing of those minerals to lessen China’s dominant global position.

Today’s AGMs: Challenger, Woolworths, Reliance Worldwide, APA, JB Hifi, Boral, South32, Wesfarmers, Austal

PLS has delivered a quarterly update with revenues falling 42% on the drop in the lithium price, largely priced in with the stock down 30% since August