Overnight – Microsoft wins, Google loses in mixed mega tech earnings

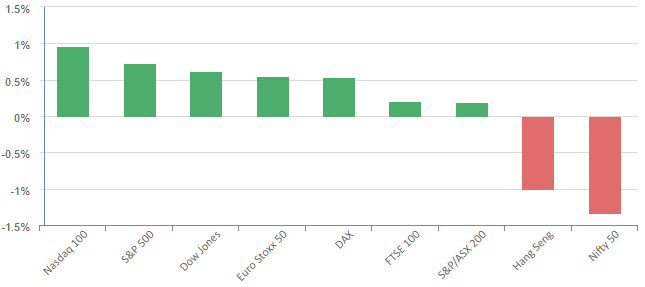

Stocks finished higher on Tuesday as a spate of solid corporate earnings and upbeat forecasts stoked investor risk appetite and sparked a broad rally.

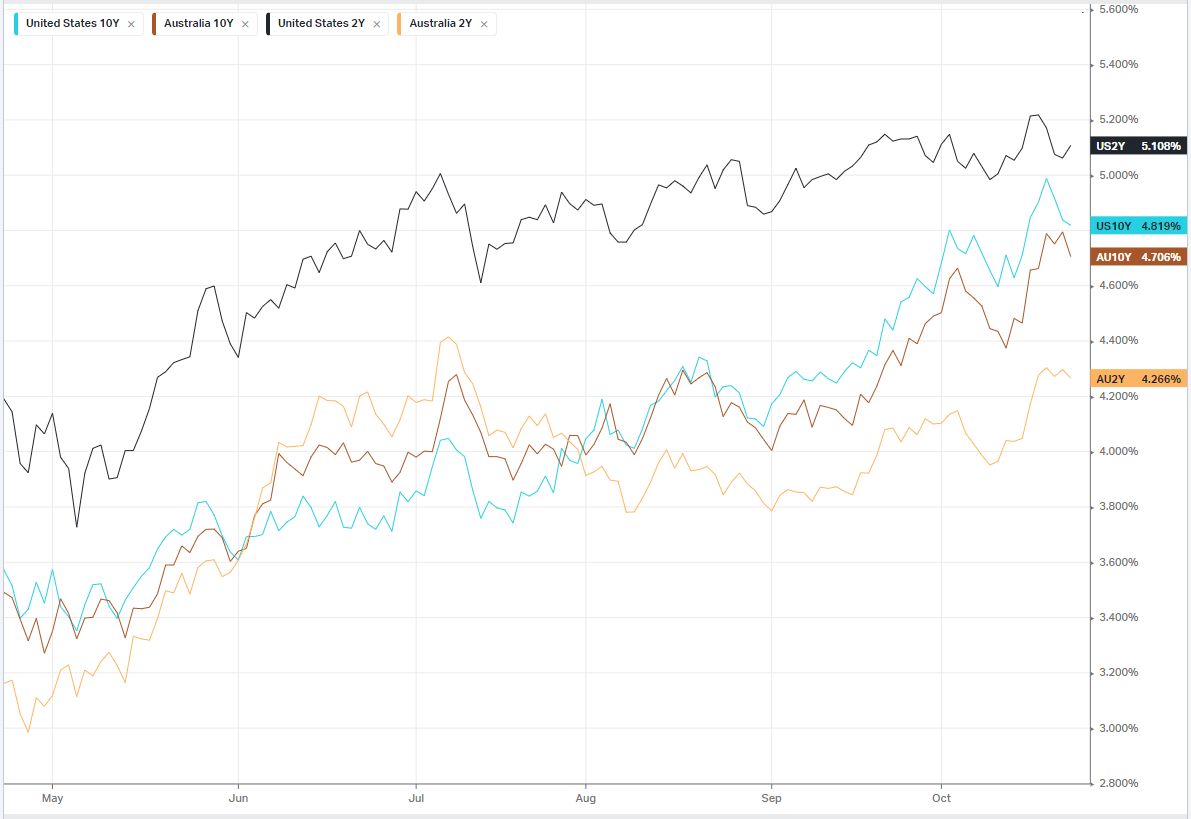

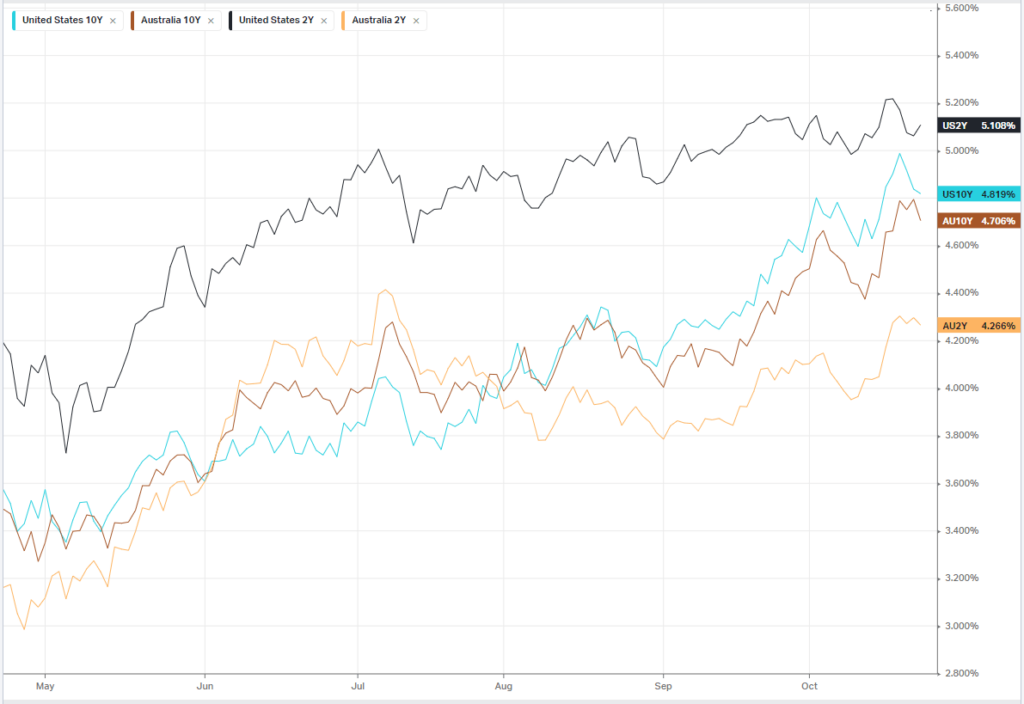

All three major U.S. stock indexes advanced, with interest rate sensitive megacaps providing much of the upside lift as benchmark Treasury yields held steady, comfortably below their recent spike to 5%.

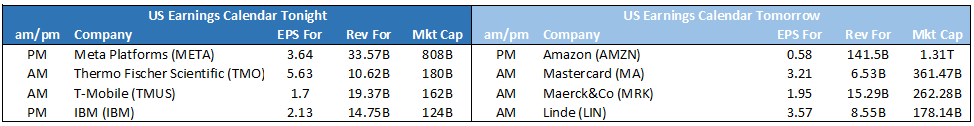

Third quarter earnings season has shifted into high gear, and this week nearly a third of the companies in the S&P500 are expected to post results.

On the macro front, investors will be watching third quarter GDP tomorrow night, which is seen showing a robust acceleration to 4.3% from 2.1% in the second quarter. On Friday, the closely watched Personal Consumption Expenditures (PCE) report, will provide further clues regarding if inflation is slowly cooling down toward the Federal Reserve’s average annual 2% target rate.

Nasdaq futures have fallen 0.37% since the close (as at 845am)

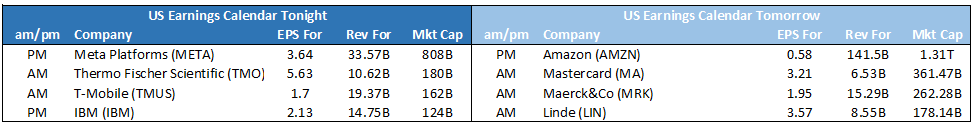

Earnings Results

Alphabet (GOOG) – shares fell more than 5% in after-hours trading after weaker than expected gains in revenue from its cloud computing operation. Overall, revenue was up 11%. Cloud revenue rose 22% to $8.4 billion but was short of expectations for $8.6 billion. Google said revenue from search and other businesses rose 11% to $44 billion, and YouTube advertising revenue rose 12% to $7.9 billion.

Microsoft (MSFT) – conversely, Microsoft shares rose around 4% in afterhours trade as its quarterly results beat estimates. The move was driven by stronger growth in the companies cloud business, Azure, growing by 29% compared to estimates of 26%

Coca-Cola – hiked its annual sales outlook, sending its stock up 2.9%, while

3M – rose 5.3% on the heels of its upbeat quarterly report.

Verizon – surged 9.3% after raising its annual free cash flow forecast

General Electric – rose 6.5% after the conglomerate lifted its full-year profit forecast.

S&P 500 - Heatmap

The Day Ahead

ASX SPI 6890 (+0.35%)

The ASX should see a recovery of sorts today, although Quarterly CPI numbers at 1130 will be key to any significant move after comments from newly appointed RBA Governor Bullock that the central bank would not hesitate to raise rates if inflation were to pick up.

Materials should be helped by a spike in iron ore prices and a recover in lithium stocks globally.

Sales and earnings results also are scheduled for Champion Iron, Mirvac and PointsBet.

Production results are issued by Ampol, Beach Energy and Mineral Resources.

AGMs on are the schedule for Codan, Corporate Travel Management, Dexus, Helloworld Travel, Liberty Financial, National Storage REIT, St Barbara, Super Retail Group and Tabcorp.