Closing Bell

What's Affecting Markets Today

Bitcoin Extends Gains Above $US30,000

Bitcoin has surged past the $US30,000 mark, a first since July, without a clear catalyst driving its volatile trajectory. The cryptocurrency has almost doubled in value since the start of the year. The ongoing conflict in the Middle East, rising bond yields, and uncertainties regarding long-term interest rates have left investors on edge. A pending decision by the US Securities and Exchange Commission on a bitcoin ETF could potentially channel more capital into the asset.

Australian 10-Year Govt Bond Yield Peaks Since 2011

Australia’s 10-year bond yield has reached a peak of 4.81%, a height unseen since 2011. The market remains jittery following the Middle East conflicts, causing erratic bond movements. Despite no clear trigger for the rising yields, global bonds have faced significant sell-offs, driven by expectations of enduring high interest rates.

$A Under Pressure Amid Middle East Tensions

The Australian dollar is facing strains, influenced by fears of escalating conflicts in the Middle East, currently trading at US63.12¢. The currency has depreciated by US5¢ since the year’s commencement, primarily due to interest rate disparities between the US and Australia. Upcoming events, such as statements from the Reserve Bank of Australia and inflation reports, are anticipated to significantly impact the financial markets.

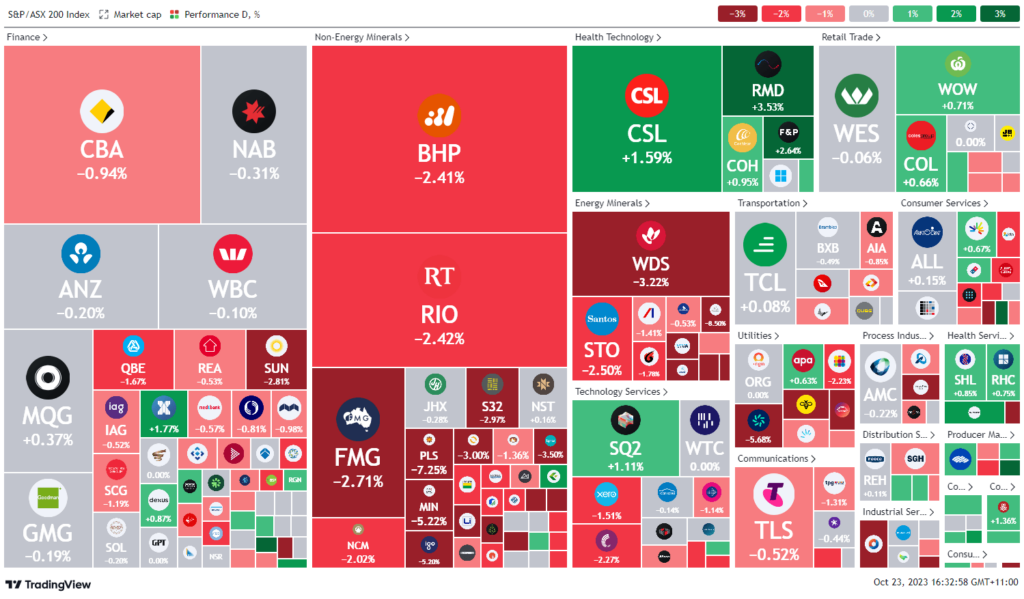

ASX Stocks

ASX 200 - 6844.1 (-0.82%)

Key Highlights:

The ASX hit a one-year low, reflecting global concerns about escalating Middle East conflicts. The S&P/ASX 200 dropped by 0.9%, with significant losses in materials and energy sectors. Major firms like Rio Tinto and BHP Group saw declines around 3%, and coal stocks also suffered, with New Hope falling 8.3%. South 32 flagged a 33% drop in coal production, causing its shares to fall by 2.8%. Conversely, oil prices and the Australian dollar remained subdued due to the ongoing geopolitical tensions. The upcoming consumer price index and potential monetary tightening also loom over the market, with bond futures suggesting possible interest rate hikes in the near future

Leader

WBT-Weebit Nano Ltd (+14.63%)

ARB-ARB Corporation Ltd (+4.76%)

COF-Centuria Office REIT (+3.57%)

RMD-Resmed Inc (+3.27%)

PNV-Polynovo Ltd (+3.13%)

Laggards

NHC-New Hope Corporation Ltd (-8.66%)

DYL-Deep Yellow Ltd (-7.61%)

LRS-Latin Resources Ltd (-7.55%)

PLS-Pilbara Minerals Ltd (-6.35%)

MEZ-Meridian Energy Ltd (-5.68%)