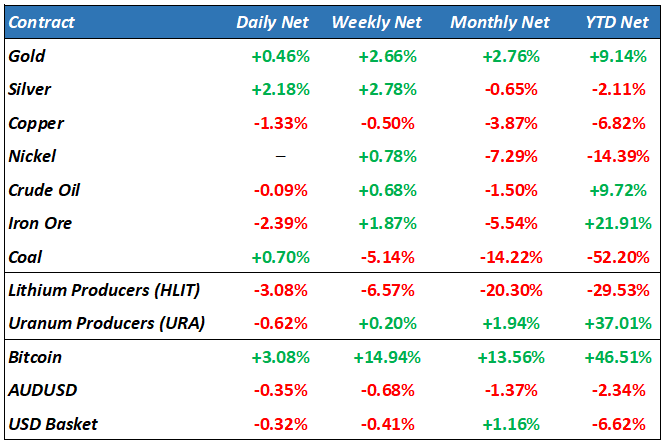

Overnight – Weekend Gaza worries and mixed earnings results weigh on equites

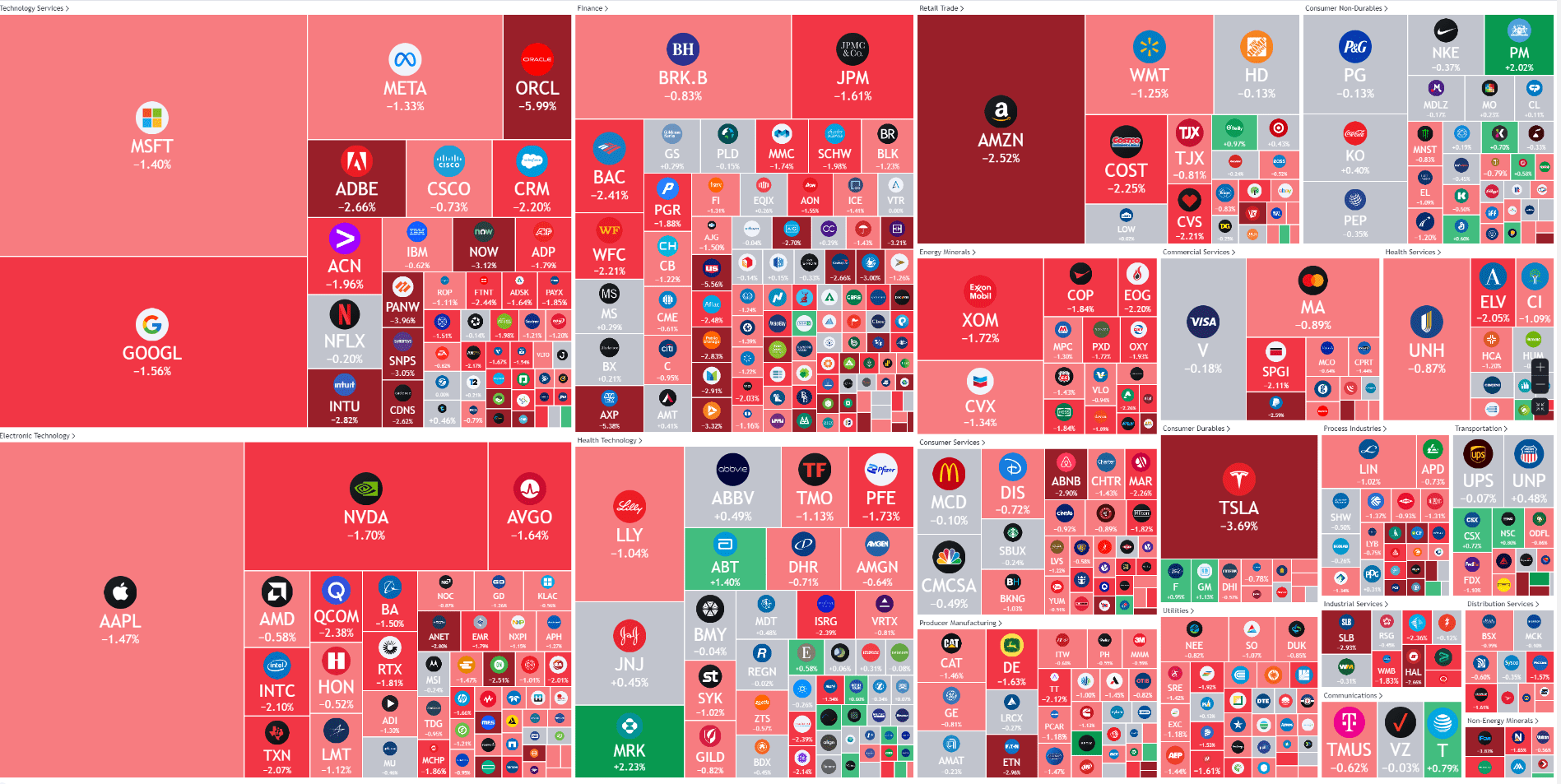

Equites closed out the week with a loss as worries about escalating conflict in the middle east, mixed earnings and the rally in treasury yields this week was too much for investors.

The US10Y hit another fresh 16-year high early in the day after Fed Chair Powell reiterated that rates would be higher for longer, and teed up the idea of a further hike should the economy continue to surprise to the upside. Safe haven Treasury buying into a weekend of middle east conflict saw yields drift lower late in the session.

Energy stocks including EQT, Halliburton and APA were pressured by a fall in oil prices despite ongoing tensions in the Middle East that threatened to disrupt oil production in the region. A mixed result from Schlumberger weighed down the sector.

The third-quarter U.S. earnings season is well under way, with 86 companies in the S&P 500 having reported. Results from some mid-sized banks have raised concerns that the boost to lenders from the Fed’s interest rate hikes was tapering off.

Monday morning may see a bounce if Gaza has not escalated

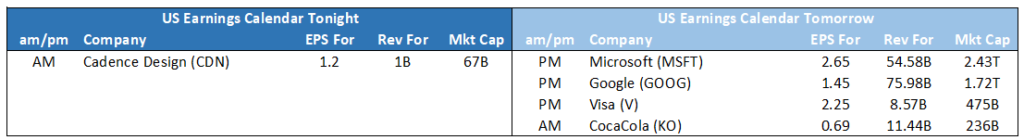

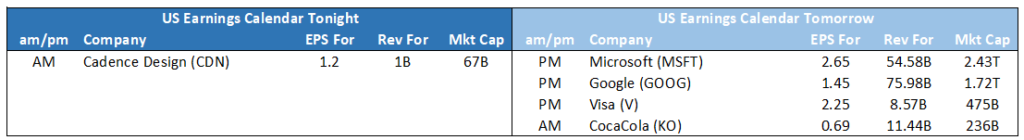

Earnings Results

Schlumberger – finished down 2%, reported mixed quarterly results as revenue missed analysts’ estimates.

American Express – reported quarterly results that beat on both the top and bottom lines, but its shares fall more than 5% amid concerns about tougher comps ahead.

Regions Financial – Q3 results fell short of Wall Street estimates, sending its shares down more than 12%.

Hewlett Packard – fell more than 6% after the company said it now expects adjusted EPS in 2024 of $1.82 to $2.02 a share, well short of analysts of $2.15.

S&P 500 - Heatmap

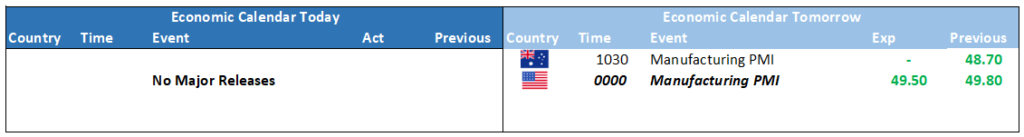

The Day Ahead

ASX SPI 6846 (-0.94%)

The ASX could see some index stop-losses hit as futures indicate a fresh 2023 low. The materials and financials will be hurt by falling iron ore prices and a weak lead from the US after worse than expected earnings results.

With little economic or company data today, all eyes will be firmly fixed on Gaza and US Treasury yields