Closing Bell

What's Affecting Markets Today

Oil Prices Waver Amid US Diplomacy in Middle East and Venezuela

Oil prices slightly declined as the US intensifies diplomatic efforts to prevent the Israel-Hamas conflict from escalating and is nearing a deal to increase Venezuela’s crude exports. Despite these diplomatic moves, the market remains on edge due to the ongoing conflict and potential disruptions in oil supply.

Iron Ore Miners Ascend with Prices Holding at $US120/t

Iron ore miners are experiencing gains as the commodity’s price sustains above $US120 per tonne. Influenced by China’s liquidity injection into its financial system, major mining companies like BHP, Fortescue Metals Group, and Rio Tinto are witnessing stock increases, reflecting the market’s positive response.

New Zealand’s CPI Moderates

New Zealand’s consumer price index (CPI) saw a 5.6% annual increase in the September quarter, slightly below economists’ expectations. Despite this, the inflation rate remains high, primarily driven by rising food prices, and continues to be a focal point of economic attention and policy decision-making.

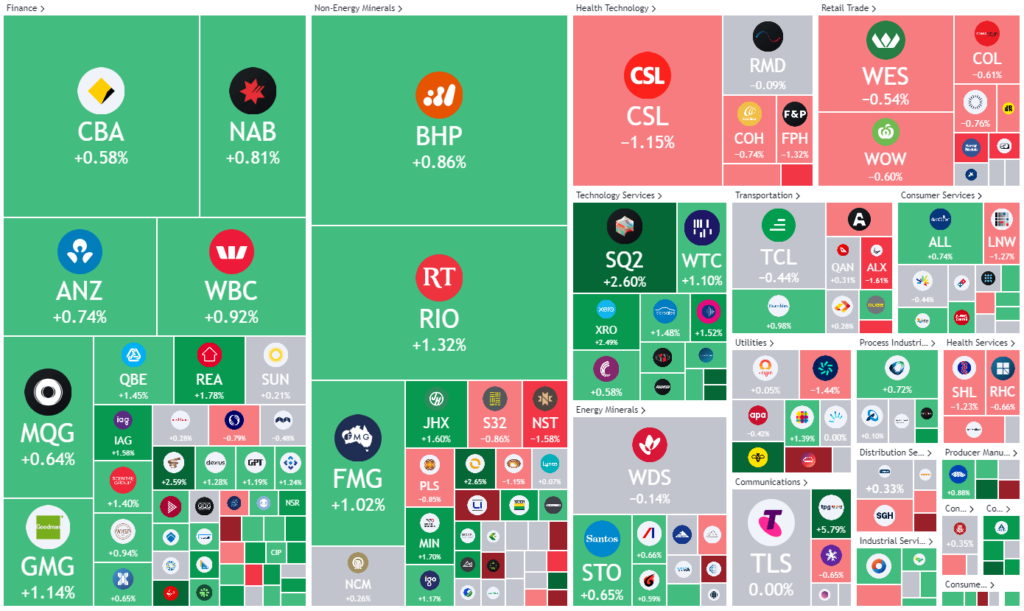

ASX Stocks

ASX 200 - 7056.1 +29.6 (0.42%)

Key Highlights:

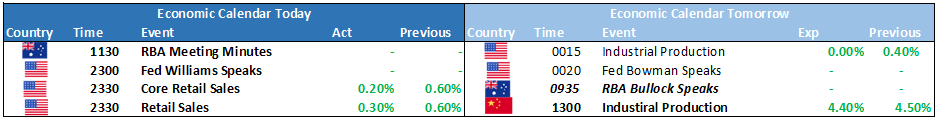

The Australian Securities Exchange (ASX) exhibited a resilient performance, subtly navigating through a landscape marked by the Reserve Bank of Australia’s (RBA) hawkish monetary policy minutes and global geopolitical tremors. The S&P/ASX 200 managed to carve out gains, reflecting a market that is cautiously optimistic yet sensitive to macroeconomic cues and policy narratives.

The RBA’s deliberations, marked by considerations of rate adjustments, cast a nuanced influence, steering market sectors in varied directions. Technology stocks found favor, riding on a wave of positivity, while consumer staples felt the weight of the central bank’s policy discourse. The broader market also absorbed global influences, particularly the oscillations in oil prices and the unfolding geopolitical tableau in the Middle East, integrating them into its adaptive response mechanisms.

In this multifaceted environment, the ASX became a theater of diverse sectoral plays, reflecting a spectrum of reactions to domestic policy dialogues and international events. The market’s ability to carve out a space of resilience amidst these dynamic influences underscores its nuanced navigational strategies in responding to a confluence of global and domestic economic currents.

Leader

CMW-Cromwell Property Group (+11.11%)

TPG-TPG Telecom Ltd (+5.79%)

VUK-Virgin Money Uk Plc (+4.73%)

NWS-News Corporation (+3.92%)

LFG-Liberty Financial Group (+3.74%)

Laggards

BAP-Bapcor Ltd (-11.75%)

WAM-WAM Capital Ltd (-6.49%)

RSG-Resolute Mining Ltd (-5.92%)

CEN-Contact Energy Ltd (-4.70%)

SDR-Siteminder Ltd (-4.56%)