Closing Bell

What's Affecting Markets Today

PBOC Offers Unprecedented Cash Support Amid Surging Debt Sales

China’s central bank, PBOC, has infused a net 289 billion yuan into the financial system, marking the most significant medium-term liquidity injection since 2020. This move aims to bolster the nation’s economic recovery and facilitate increased debt sales amid a struggling economy and weak consumer demand.

Oil Markets Stabilize Amid Israel-Hamas Conflict

Oil prices steadied, trading near $US91 a barrel, as the world watches the unfolding Israel-Hamas conflict. The U.S. is actively engaging in diplomatic efforts, including back-channel talks with Iran, to prevent the crisis from escalating regionally, which could jeopardize global crude oil supply.

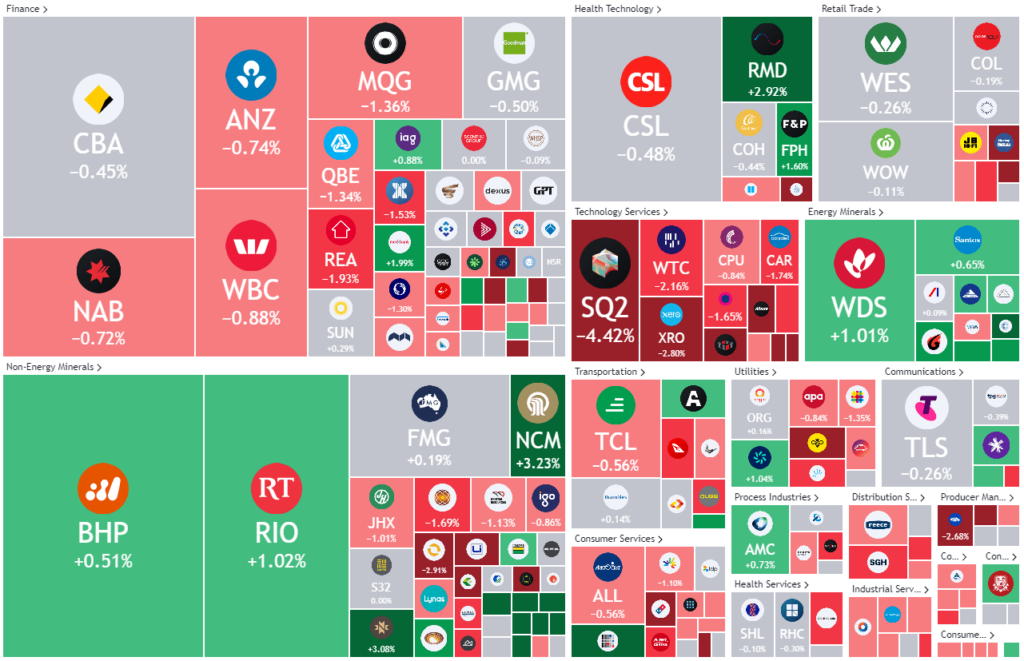

ASX Stocks

ASX 200 - 7026.5 -24.5 (-0.35%)

Key Highlights:

The ASX faced a turbulent session, influenced by escalating Middle East tensions and fluctuating global markets. The S&P/ASX 200 index declined by 0.3%, with technology stocks suffering a significant 2.6% contraction. Investors, seeking refuge from the prevailing geopolitical uncertainties, gravitated towards the relative safety of bonds and gold, causing a ripple effect across various market sectors.

Anticipation looms in the market, with upcoming communications from the Reserve Bank of Australia expected to provide crucial economic insights and directional cues. The Australian dollar, amidst these uncertainties, hovered near annual lows, reflecting the market’s cautious stance.

In the realm of individual stocks, there were notable movements. Fletcher Building experienced a sharp decline, emblematic of the market’s volatile nature. Tech giants like WiseTech and Xero also navigated through challenging trading waters, embodying the broader market’s cautious and risk-averse demeanor in the face of global unrest and economic unpredictability. The market also kept a close eye on oil prices, with Brent oil marking a significant position at $US91 a barrel, illustrating the market’s sensitivity to the ongoing geopolitical conflicts and their potential impact on global oil supplies.

Leader

FBU-Fletcher Building Ltd (-8.42%)

CTT-Cettire Ltd (-7.56%)

LRS-Latin Resources Ltd (-5.93%)

MP1-Megaport Ltd (-4.68%)

RWC-Reliance Worldwide Corporation Ltd (-4.62%)

Laggards

WGX-Westgold Resources Ltd (+8.13%)

LNW-Light & Wonder Inc (+6.11%)

WAF-West African Resources Ltd (+5.25%)

RRL-Regis Resources Ltd (+5.20%)

RSG-Resolute Mining Ltd (+4.80%)