Overnight – Equities positive despite higher producer inflation data

Investors shrugged off PPI (Producer Price Index) data pointing to an uptick in the pace of inflation as equities gained ahead of the key CPI (consumer Price Index) data for September that will likely seal the Federal Reserve’s decision on whether to stand pat on rate hikes next month.

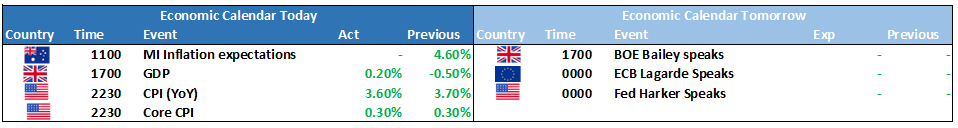

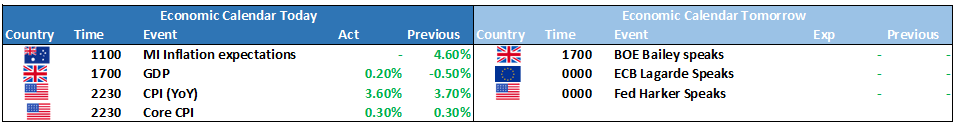

PPI surprised to upside, coming in at +0.5% (exp +0.3%) but in-line with recent market reaction, it was largely brushed aside with investors preferring to treat bearish news as white noise and only focus on data when it suits the bull case. September CPI being released tonight, which will be hard to ignore for the bulls if the recent string of strong numbers continues.

The consumer price index is expected to have slowed to 0.3% in September, while the core measure, which excludes food and energy and is more closely watched by the Fed, is forecast to have remained steady at a 0.3% pace.

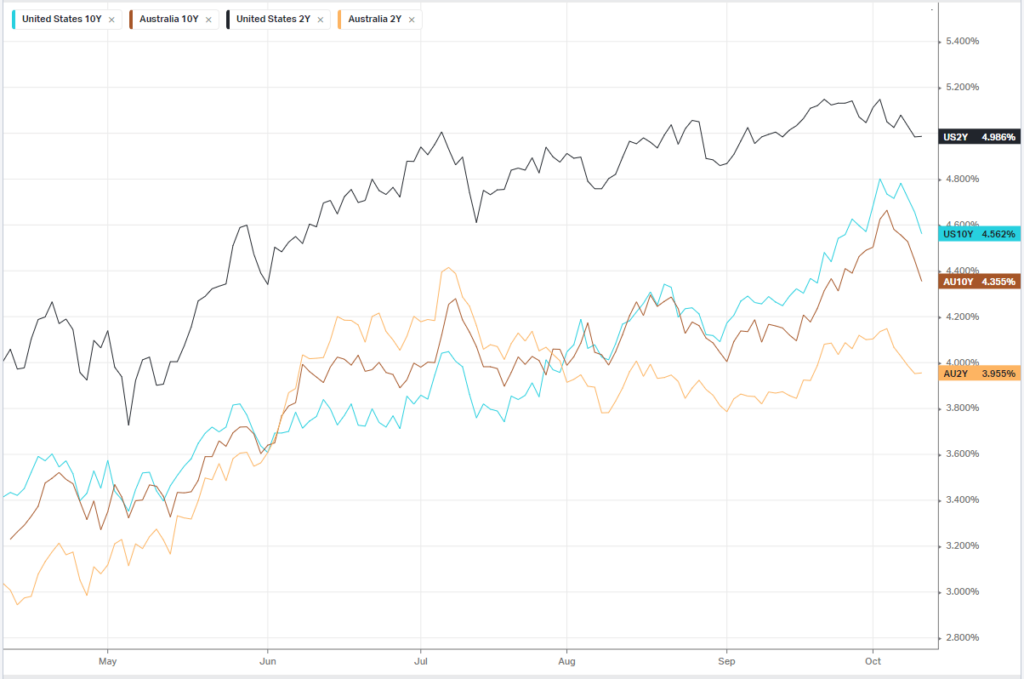

The Fed’s minutes from its September meeting, were also released, showing that most Fed members were backing one more rate hike. As this wasn’t what the market wanted to hear, investors deemed the minutes to be stale data as Fed jawboning has shifted to a dovish tone since September as the Fed attempts to reign in the recent surge in Treasury yields.

The widely touted IPO of Birkenstock disappointed, falling 12% on its first day of trading hinting that investors are still wary of new listings

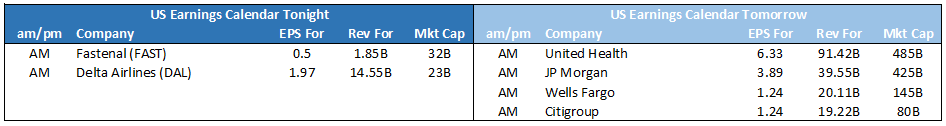

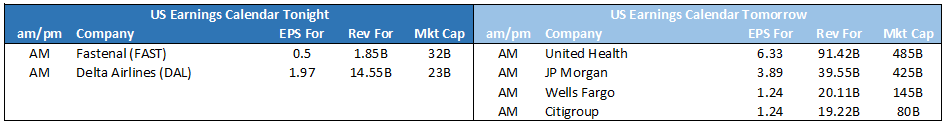

Earnings updates will kick off in the US tonight with industrial large-cap, Fastenal and Delta Airlines set to provide updates before the market open.

S&P 500 - Heatmap

The Day Ahead

ASX SPI 7124 (+0.08%)

The ASX is likely to edge higher, tracking a late the rally in the US as investors increased their bets that the Fed has reached the peak in the interest rate cycle.

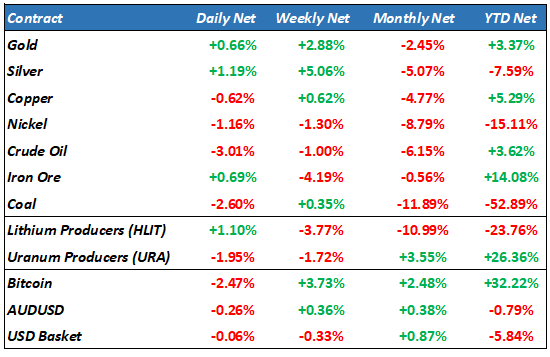

The risk premium on crude oil has been removed just days after the Gaza conflict erupted, which could see weakness in the energy sector

The technical bounce in the ASX200 off 6900 (called in our Alpha portfolio) may hit resistance around 7150 today, a trim of at least half the position is recommended