Closing Bell

What's Affecting Markets Today

Bond traders re-evaluate RBA’s stance amid global cues

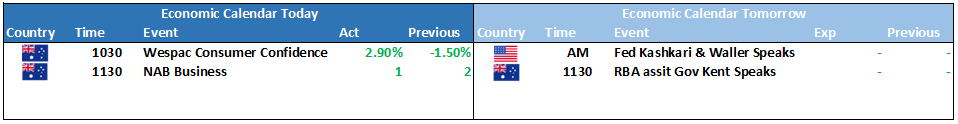

Dovish remarks from the US Federal Reserve and NAB’s recent business survey indicating easing price pressures have led bond traders to reconsider rate hike expectations, now leaning towards potential cuts. The survey revealed a decline in labour and purchase cost growth, reinforcing a market sentiment initially influenced by the Fed’s comments. As a result, the S&P/ASX 200 surged by over 1.3%. Current market predictions suggest a reduced likelihood of a rate hike by May next year, with a reintroduced possibility of a rate cut by year-end.

NAB survey: A softer inflation outlook

National Australia Bank’s latest business survey presents a promising picture for inflation. The findings showed a decline in price and cost growth for the month. NAB’s chief economist, Alan Oster, highlighted the survey’s positive signs for inflation, suggesting that some key cost pressures driving inflation might be receding. Despite expectations of strong inflation in the upcoming Q3 CPI release, the recent survey results hint at a more favourable broader inflation outlook.

Oil remains elevated amid Middle East tensions

The ongoing conflict between Hamas and Israel has kept oil prices elevated, with West Texas Intermediate maintaining its significant jump from Monday. The conflict, now in its fourth day, has heightened concerns about potential disruptions in the global oil supply chain, especially if the US and Iran become more deeply involved. While Israel’s direct role in global oil supply is minimal, the broader implications of the conflict, including potential threats to the crucial Strait of Hormuz, are significant.

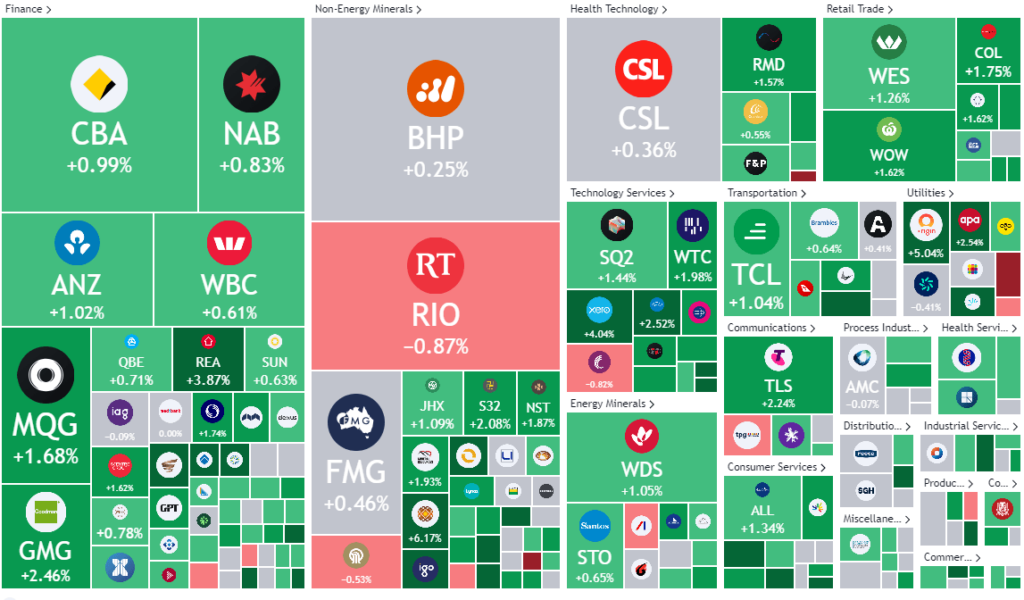

ASX Stocks

ASX 200 - 7043.6 +73.7 (1.06%)

Key Highlights:

The S&P/ASX 200 has shown resilience, rallying back above the 7000 mark. This surge is attributed to dovish comments from the US Federal Reserve and positive signs of easing inflation from NAB’s monthly business survey. All sectors on the ASX reported gains, with rate-sensitive tech and real estate stocks leading the charge, both registering over 2% growth. Utilities stocks emerged as the top performers, with a 3.9% increase, significantly influenced by Origin Energy’s 4.8% gain after the competition watchdog greenlit an $18.7 billion buyout offer. Energy stocks also saw a boost, with companies like Woodside and Santos registering gains, reflecting the heightened oil prices due to Middle East tensions. The market sentiment is further shaped by traders adjusting their RBA rate decisions, now leaning towards a potential rate cut by the end of next year. Key stocks to watch include Origin Energy, Weebit Nano, and Core Lithium. The overall market trajectory suggests a positive momentum, with traders and investors closely monitoring geopolitical events and domestic economic indicators.

Leader

LRS-Latin Resources Ltd (+8.49%)

SYA-Sayona Mining Ltd (+8.24%)

CHN-Chalice Mining Ltd (+8.15%)

CXO-Core Lithium Ltd (+7.35%)

PLS-Pilbara Minerals Ltd (+6.03%)

Laggards

BOE-Boss Energy Ltd (-4.62%)

TYR-Tyro Payments Ltd (-4.33%)

CEN-Contact Energy Ltd (-3.94%)

NEU-Neuren Pharmaceuticals Ltd (-3.23%)

JDO-Judo Capital Holdings Ltd (-2.94%)