Closing Bell

What's Affecting Markets Today

Oil Surges Amid Middle East Tensions

Oil prices spiked by over 4% due to Hamas’ unexpected attack on Israel, raising concerns about the stability of the Middle East, a crucial region for global energy supplies. While the immediate threat to oil supply remains uncertain, potential retaliation against Iran could heighten tensions around the Strait of Hormuz, a critical shipping route. Market analysts anticipate heightened volatility, especially if the conflict spreads to other regions like Saudi Arabia.

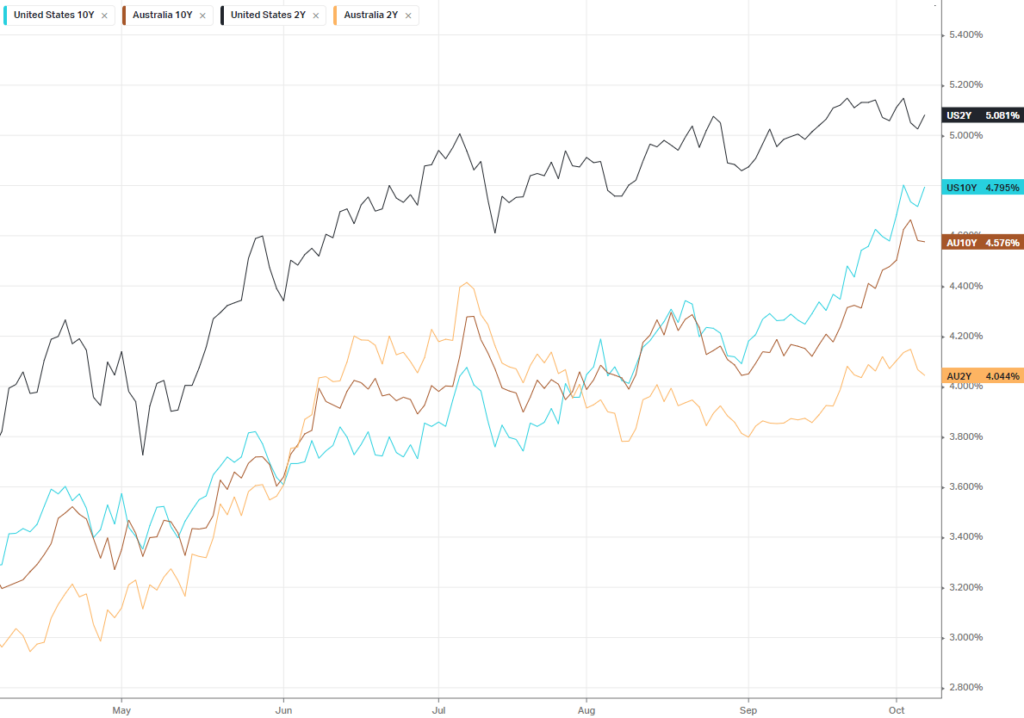

Dollar Strengthens Following Israel Attack

The US dollar rose against major currencies as traders reacted to the sudden attack by Hamas on Israel. Recognized as a safe haven during crises, the greenback’s surge also impacted other currencies, with the Australian dollar declining. The dollar’s rally continues its impressive performance, further influenced by the Federal Reserve’s aggressive interest rate hikes and the US economy’s resilience.

Chinese Stocks Dip Post-Golden Week

Chinese stocks witnessed a decline as traders resumed after the Golden Week holidays. External factors, including global market turbulence due to the Treasuries selloff and the oil price surge following the Israel attacks, influenced the drop. Despite tourism revenue surpassing pre-COVID-19 levels during the Golden Week, it failed to meet government expectations. The ongoing property market crisis and other economic challenges contribute to the prevailing market pessimism.

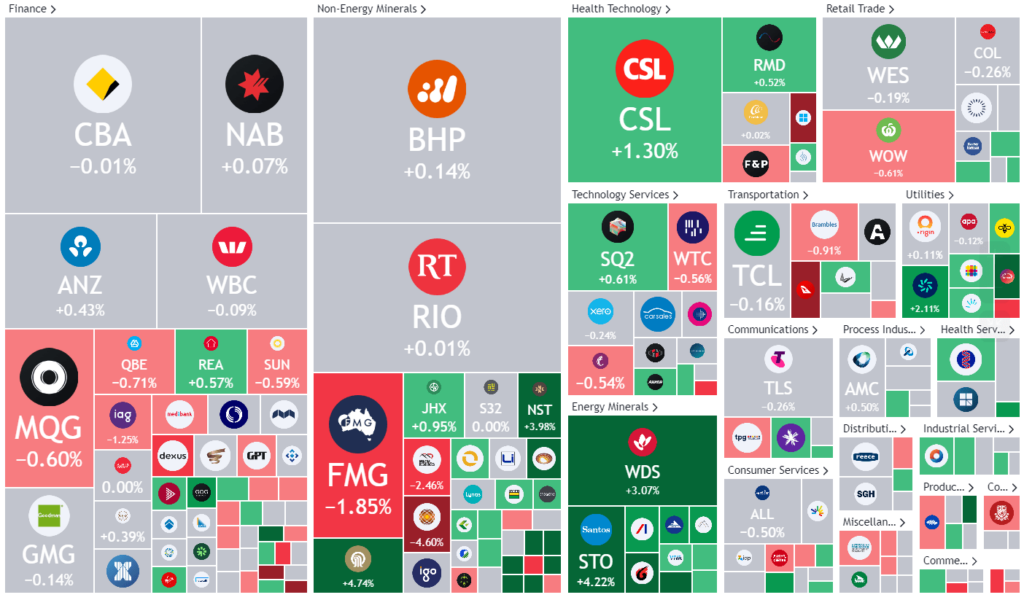

ASX Stocks

ASX 200 - 6970.2 +16 (0.23%)

Key Highlights:

The Australian sharemarket experienced a boost, primarily driven by the surge in oil prices following the Israel attacks. The S&P/ASX 200 saw a 0.5% increase, with energy and mining stocks leading the rally. Wall Street’s rally also positively influenced the ASX. The US dollar’s rise impacted the Australian dollar, which declined by 0.3%. Local energy stocks, including Woodside Energy and Santos, witnessed significant gains. In contrast, Magellan Financial Group’s shares dropped, continuing its decline from the previous week due to a decrease in funds under management.

Leader

DEG-De Grey Mining Ltd (+9.64%)

WGX-Westgold Resources Ltd (+7.49%)

RSG-Resolute Mining Ltd (+7.46%)

ERA-Energy Resources of Australia Ltd (+6.25%)

EVN-Evolution Mining Ltd (+6.14%)

Laggards

AZS-AZURE Minerals Ltd (-15.63%)

MFG-Magellan Financial Group Ltd (-7.80%)

PLS-Pilbara Minerals Ltd (-3.96%)

QAN-Qantas Airways Ltd (-3.58%)

SYA-Sayona Mining Ltd (-3.41%)