Overnight – Strong jobs numbers push both bonds and equities higher

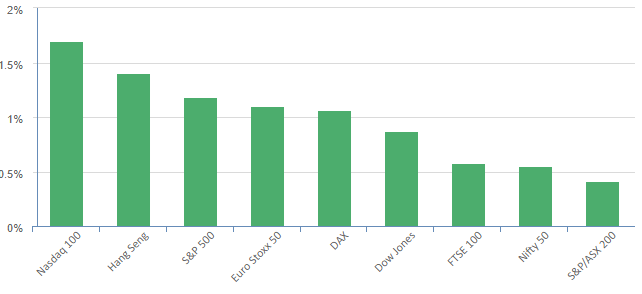

Equites jobs report on Friday sparked a delayed rally on Wall Street as the data revealed a strong economy with moderating inflation that helped set aside fears of higher interest rates that caused bond yields to soar. September’s job numbers were almost double the 170,000 forecast of economists polled by Reuters and shocked a market trying to understand how the U.S. Federal Reserve will address a strong economy and its mission to lower rates to its 2% target. Nonfarm payrolls increased by 336,000 jobs last month, the Labor Department said, while data for August was revised higher to show 227,000 jobs were added instead of the previously reported 187,000.

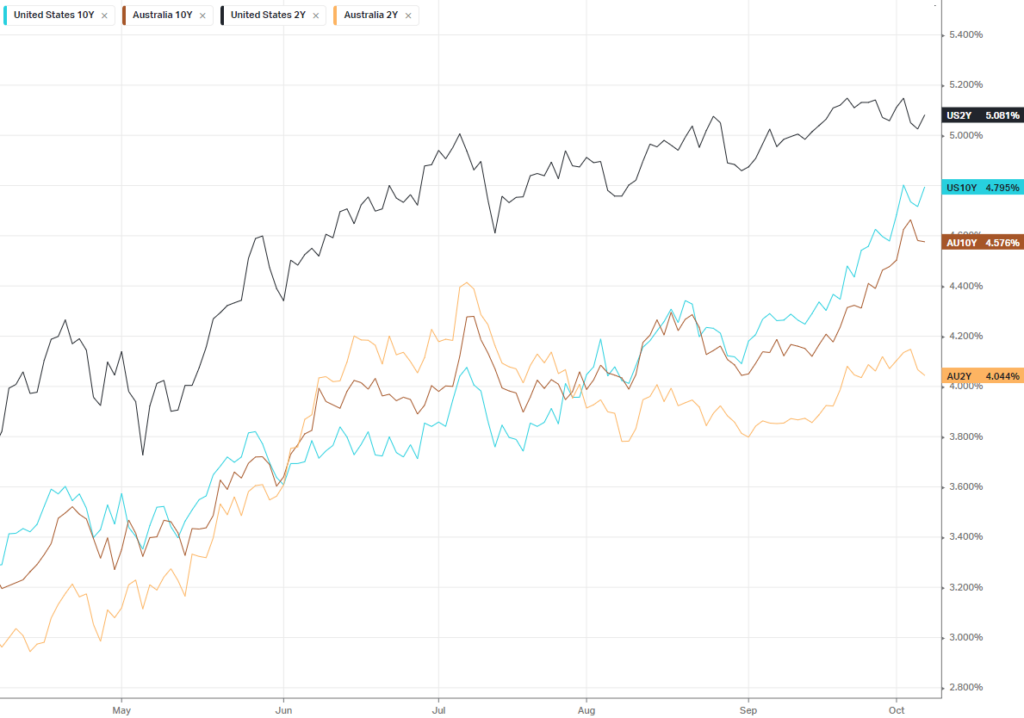

The yield on the benchmark 10-year Treasury note jumped more than 13 basis points within a half hour after the report’s release to a fresh 16-year high of 4.8874%, adding to this month’s steep sell-off. Bond yields move inversely to price.

Fiscal deficit-spending is working against the Fed’s rate hikes in helping the economy stay stronger, which may lead to the Fed having to push to a higher level for peak rates.

This week, the release of CPI and PPI data for September will be closely watched as investors continue to weigh the Fed’s ‘higher for longer’ rates mantra. Hot inflation figures could reinforce the Fed’s message that interest rates need to remain higher for longer

Israel Conflict

Over the weekend, Hamas troops attacked Israeli border towns, resulting in the deaths of 400 people prompting Prime Minister Benjamin Netanyahu to vow of “mighty vengeance”. The resulting retaliation has sent the death toll to over 1100 people

The violence in Israel will likely prompt a move into safe-haven assets as investors closely watch events in the Middle East to gauge geopolitical risk to markets. Gold and Oil stocks are likely to rally on any further deterioration of the conflict.

S&P 500 - Heatmap

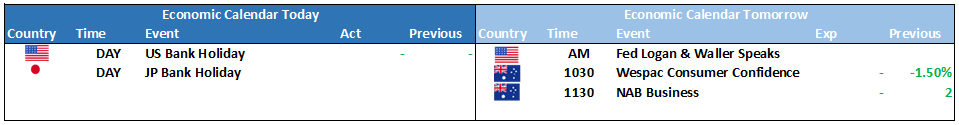

The Day Ahead

ASX SPI 6915 (+0.83%)

The ASX is likely to have a positive open with gold and oil stocks likely to open stronger on the middle east conflict in Gaza. The return of Chinese investors after golden week holiday may also see some higher volumes in the materials sector.

The higher employment numbers in the US may stoke fears of a higher inflation number later in the week which is likely to cap any significant gains