Overnight – Oil Extends Slump to Lowest in a Month

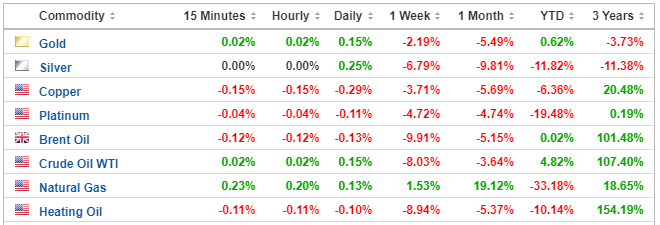

Oil prices have taken a hit amidst global financial market unrest, with recent data amplifying concerns about crude and gasoline demand. By 4.28pm in New York, Brent crude had fallen 5.3% to $US86.13 a barrel, while US oil mirrored this decline, settling at $US84.54 a barrel.

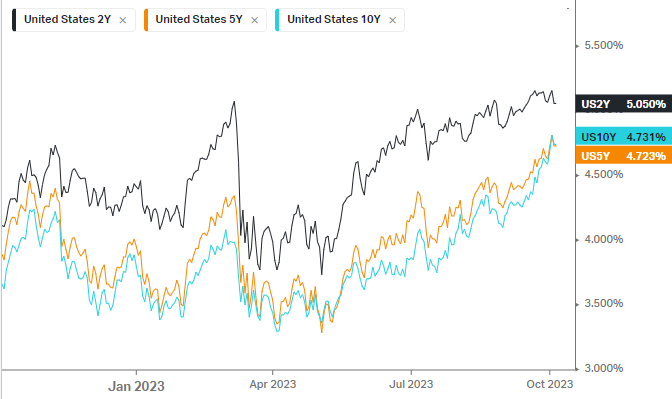

The anticipated persistence of high interest rates has stymied crude’s second-half rally. Concurrently, gasoline futures dipped as demand hit a 25-year seasonal low, hinting at potential economic slowdowns.

Despite this, OPEC+ leaders, Saudi Arabia and Russia, have committed to maintaining production curbs of over 1 million barrels daily until the year’s end. Both nations reiterated their dedication to stabilizing oil markets. Yet, a recent OPEC+ meeting yielded no policy change suggestions, with many members unable to join the Saudi-Russia initiative, limiting collective action.

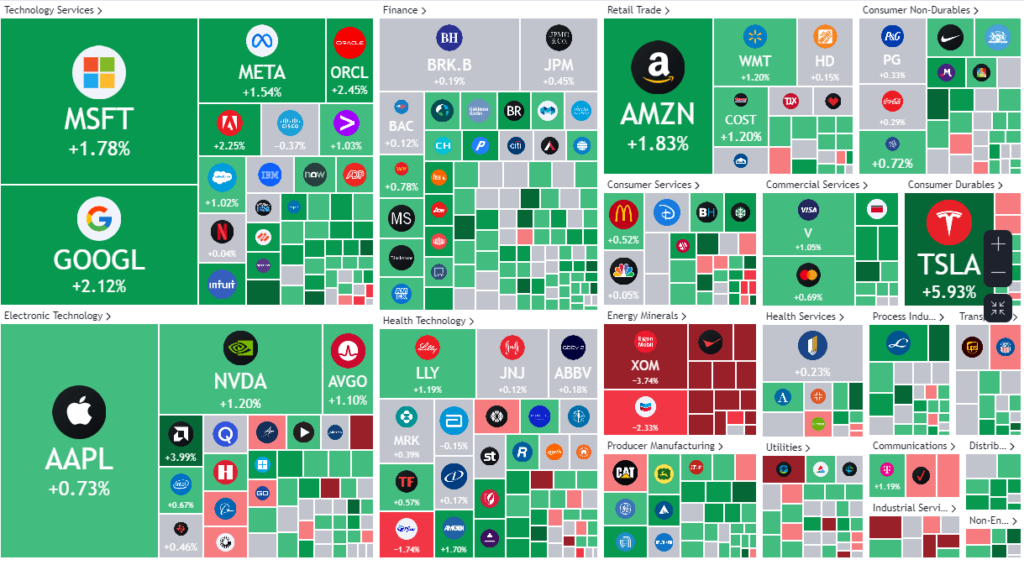

S&P 500 - Heatmap

The Day Ahead

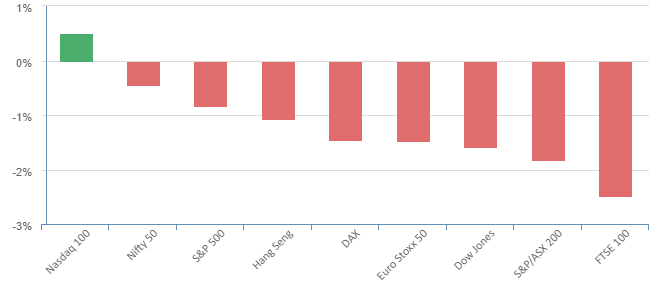

ASX SPI 6943 (-0.29%)

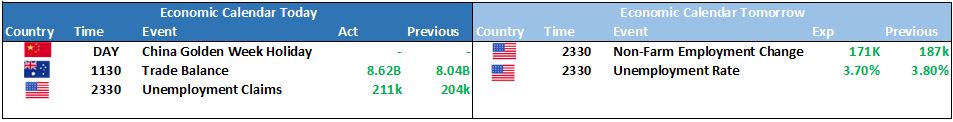

Today’s local agenda highlights the release of the trade balance for August at 11.30am. In overseas data, the US will also announce its trade balance for August. In stock movements, ARB shares dipped 0.6% trading ex-dividend, while gold producer Newcrest Mining saw a modest 0.3% rise after declaring a special dividend. Westgold Resources enjoyed a 1.9% surge after confirming its fiscal 2024 guidance, having achieved a notable milestone in the Australian dollar gold price recently. Meanwhile, Property Exchange Australia (PEXA) shares declined by 0.9% to $11 following their announcement of a planned acquisition of UK’s Smoove for £31 million ($59 million).

Chinese markets are closed this week for the Mid-Autumn Festival and China’s National Day.