Closing Bell

What's Affecting Markets Today

RBNZ’s Stance on Interest Rates

The Reserve Bank of New Zealand (RBNZ) has indicated that interest rates might need to remain elevated for a longer duration to bring inflation back to target. Despite this, the bank has not signaled any immediate further tightening. The RBNZ has kept its official cash rate steady at 5.5%. The bank’s comments suggest a reduced likelihood of a rate hike in November. The New Zealand dollar experienced a drop following the announcement.

US Credit Market Concerns

The US corporate credit market is showing signs of strain due to concerns about prolonged high interest rates. Yields on US blue-chip bonds have surpassed last year’s peak, and the speculative-grade bond market is also under pressure. Experts suggest that the market is adjusting to the possibility of sustained higher rates, which could impact smaller companies more than larger ones.

Wall Street’s Rising Anxiety

Wall Street’s indicators of market anxiety, such as the VIX, are reaching levels not seen in months. This comes after job data indicated a stronger labor market, leading to increased speculation about the Federal Reserve raising interest rates. The US 10- and 30-year bond yields have reached their highest levels since 2007, causing further market unrest.

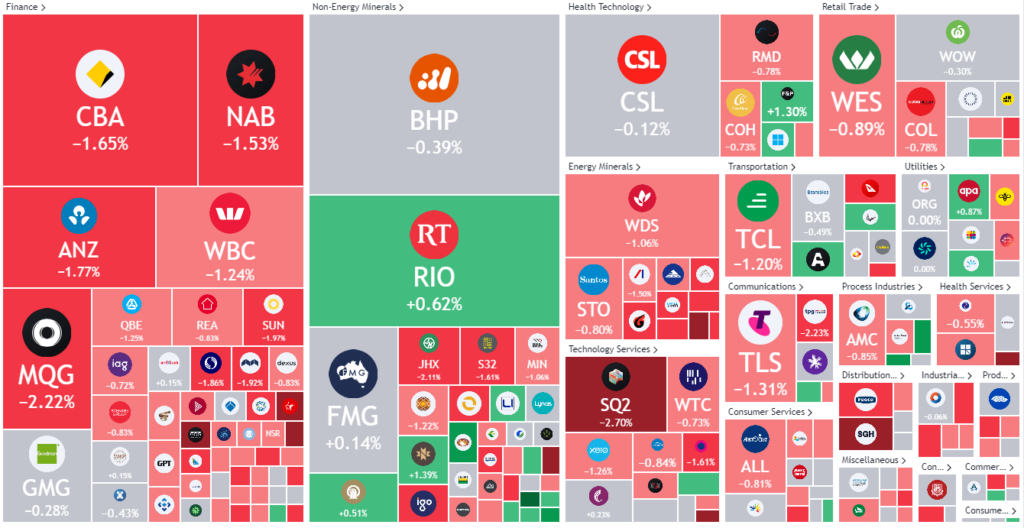

ASX Stocks

ASX 200 - 6890.2 -53.2 (-0.77%)

Key Highlights:

The Australian sharemarket is nearing its lowest point in 11 months, influenced by Wall Street’s reactions to the US job data and the associated interest rate concerns. The S&P/ASX 200 has seen significant drops, with tech, communication stocks, and major banks among the most affected. Global tech giants’ losses have also influenced the market downturn. The US labor market data, which showed an increase in available positions, has further fueled concerns about prolonged high interest rates.

Shares in IPH have risen after a positive rating from Goldman Sachs. Liontown Resources saw a slight increase after a major stakeholder expanded her holdings. Block Inc, the owner of After-pay, experienced a drop, and Mineral Resources saw a minor dip after finalizing a debt offer. The Star Entertainment Group remained stable, while TPG Telecom saw a decline amidst ongoing discussions with Vocus Group.

Leader

CTT-Cettire Ltd (+4.12%)

RMS-Ramelius Resources Ltd (+3.92%)

DTL-Data#3 Ltd (+3.54%)

SLR-Silver Lake Resources Ltd (+2.12%)

ORA-Orora Ltd (+2.06%)

Laggards

MAD-Mader Group Ltd (-8.33%)

A4N-Alpha Hpa Ltd (-7.90%)

EQT-EQT Holdings Ltd (-5.77%)

CXO-Core Lithium Ltd (-5.36%)

CRN-Coronado Global Resources Inc (-5.07%)