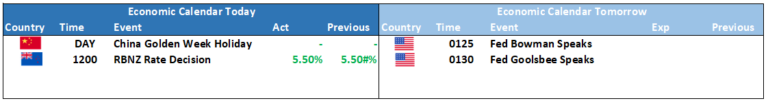

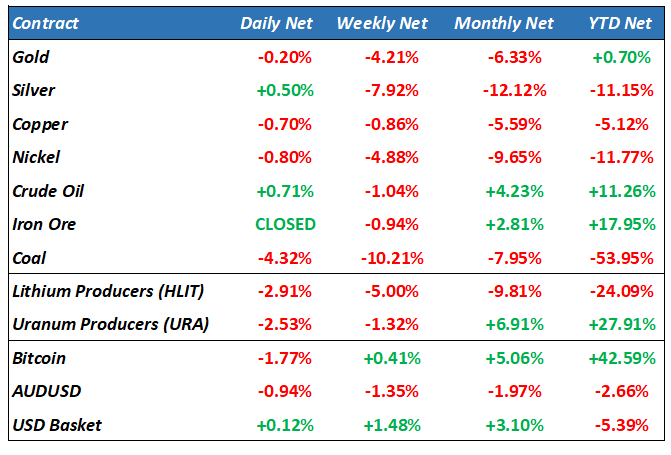

Overnight – DOW turns negative for 2023 as bond yields continue to march higher

The DOW turned negative for the year as data showing surprise strength in the labor market, stoked further concerns about higher Federal Reserve interest rates, pushing Treasury yields to multi-year highs. The latest US JOLT (job openings) report, a measure of labor demand, showed job openings in August unexpectedly increased by about 9.6 million, confounding expectations for drop to 8.8M.

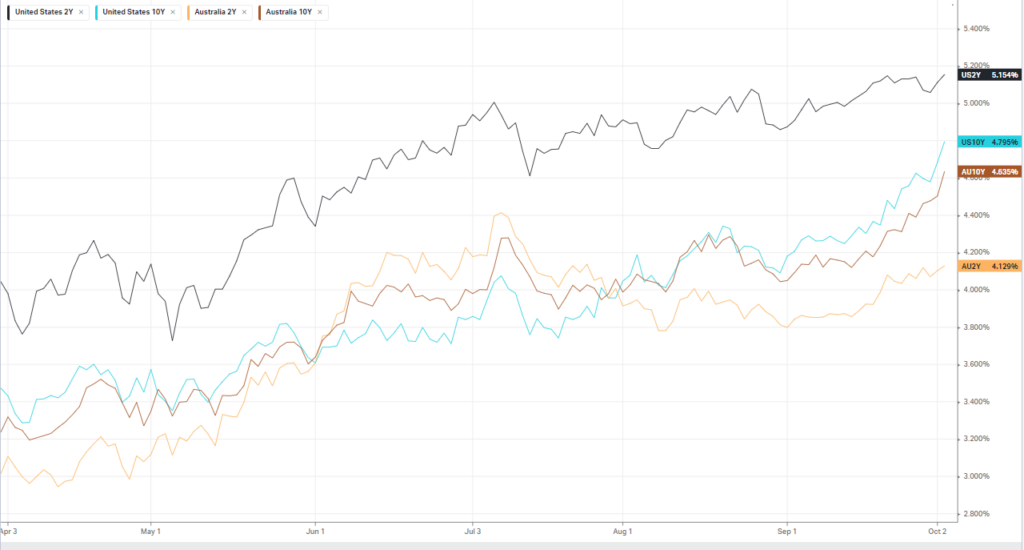

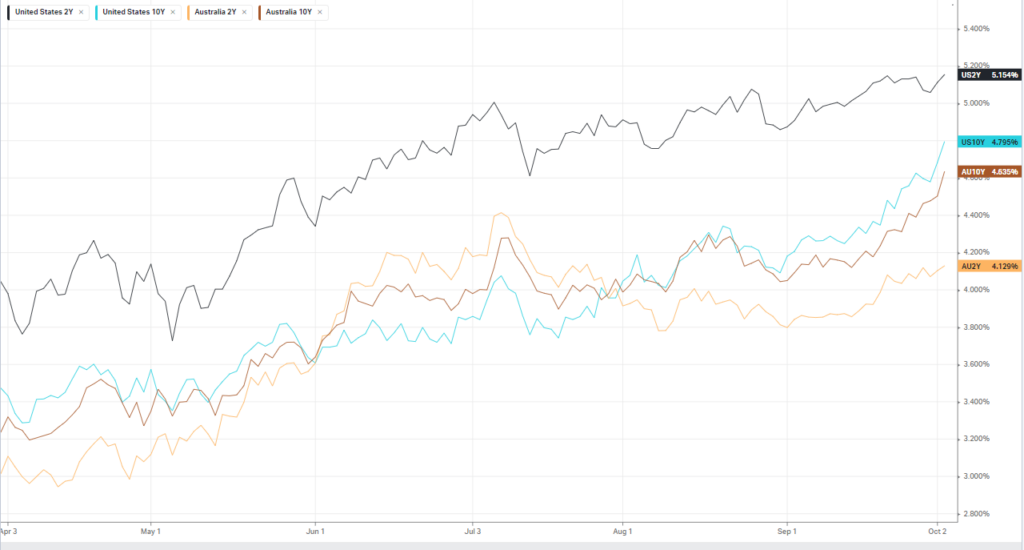

The signs of a still tight labor market added to fears that the Fed may need to hike again this year, pushing the US10Y and US30Y yields to their highest levels since 2007 in anticipation of a higher for longer rates. U.S. government bond prices, which trade inversely to yield, have also been pressured by a surge in the supply of Treasuries as the U.S. government stepped up the pace of borrowing amid growing deficit.

Tech, which staged a rebound a day earlier, was led lower by Microsoft and Meta, with the latter coming under added pressure after media reports that it is mulling whether to charge a $14 monthly fee to users who want to access an ad-free version of Facebook or Instragram. The moves comes as a European court ruling in July — stating that under the EU’s data protection rules, Meta must seek user consent first before showing personalized ads – threatens the tech giant’s advertising revenue, a major source of revenue. The broader malaise in tech, meanwhile, continued to be dominated by an ongoing rise in Treasury yields, which makes growth sectors of the market less attractive.

Energy stocks were less than 1% lower as a rise in oil prices following weakness a day earlier helped keep losses in check ahead of the meeting between Organization of the Petroleum Exporting Countries, or OPEC, and allies led by Russia, known as OPEC+, due Wednesday.

S&P 500 - Heatmap

The Day Ahead

ASX SPI 6929 (-0.50%)

The ASX will test year lows today as the sustained rally in treasury yields continues to make investors question the value of being fully allocated to equities. Defensive sectors like Consumer staples, utilities, communications and healthcare are likely to hold up best, while energy may remain bid in line with the crude and Nat Gas prices. Technology will deservedly wear the brunt of the selling as investors ignorance of the effect of higher yields on growth stocks can only last so long

Novonix is expected to release earnings. Shares of KMD Brands trade ex-dividend. CSL pays its dividend to investors. Mineral Resources has wound up its $US1.1 billion note offering.

Chinese markets are closed this week for the Mid-Autumn Festival and China’s National Day.