Overnight – Tech Investors “buy the dip” ahead of inflation data despite elevated bond yields

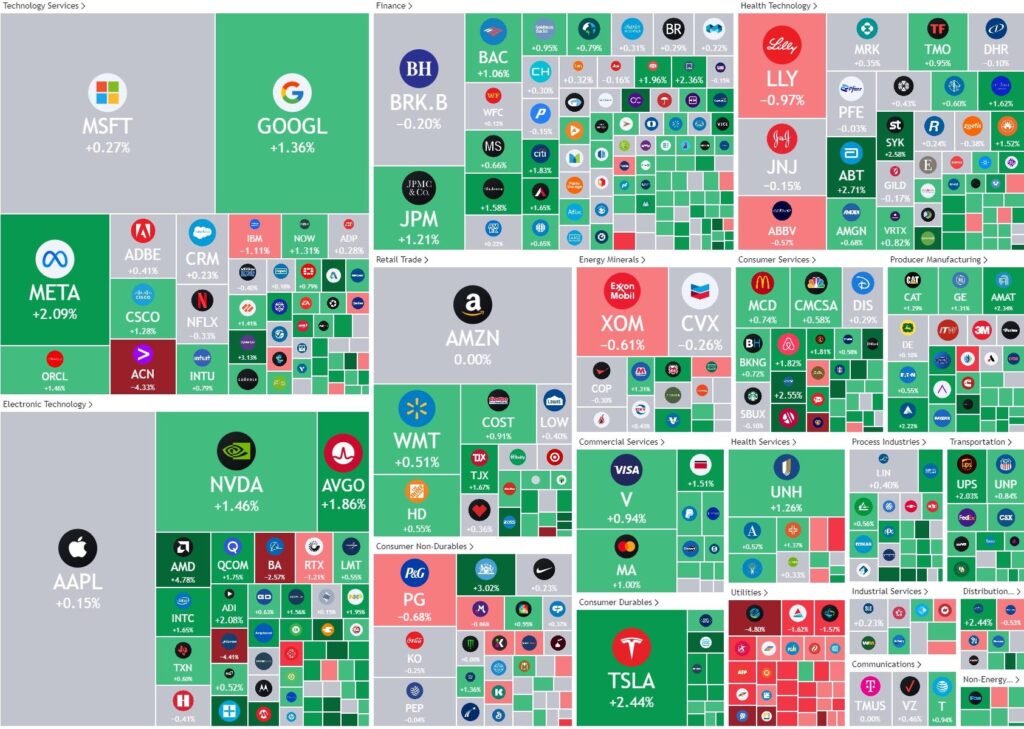

Equites bounced overnight as investors bought the dip after recent weakness in tech stocks just as the rally in Treasury yields paused ahead of key inflation data tonight .

Big tech including Google and Meta helped the broader market rebound from its recent malaise as Treasuries eased from fresh 15-year highs early in the session. Apple, meanwhile, ended the day marginally higher, as sentiment on the stock continues to be challenged by reports that users of its newly launched iPhone 15 are experiencing multiple issues including overheating.

Chip stocks also supported the broader move higher in tech following a rally in AMD that offset a slump in Micron. Micron fell more than 4% after its forecast for bigger losses for its fiscal first quarter overshadowed better-than-expected fourth-quarter results. Analysts, however, continued to back the memory chipmaker amid signs that the supply glut overhang is easing.

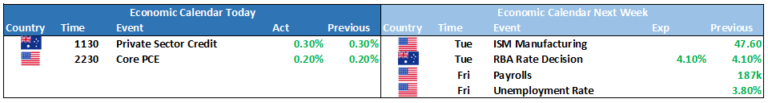

Fed Chair Jerome Powell is set to deliver a speech at a town hall meeting with educators at 4pm ET. The chief will be fielding questions from the audience, with investors eager to see whether he may walk back his hawkish comments from a week ago. Powell’s remarks will arrive just a day ahead of key inflation data, expected to show that core inflation remained steady last month, and continued to slow in the 12 months through August.

Investors were also watching developments in Washington to see whether U.S. lawmakers could avert a government shutdown. Political posturing from both parties has further delayed the process and it appears that the government will shut down for 2-3 weeks minimum, stopping salary payments to many public servants

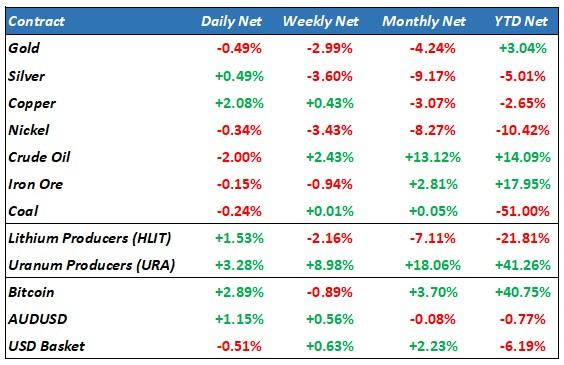

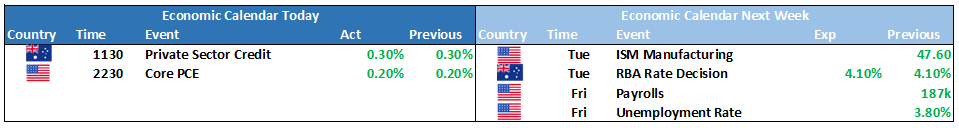

Data showed the U.S. economy maintained a fairly solid pace of growth in the second quarter. Separate readings showed initial jobless claims rose slightly last week and a higher-than-expected fall in contracts to buy existing homes in August. Investors are now firmly focused on the Federal Reserves preferred measure of inflation, personal consumption expenditures price index (PCE) for clues on if there is a second wave of inflation emerging

S&P 500 - Heatmap

The Day Ahead

ASX SPI 7097 (+0.63%)

The ASX should bounce today, following the offshore lead. With Chinese markets closed today and all of next week which will likely lead to low volume and quiet markets in the materials sector, although developments in Evergrande and the looming debt payment deadline for Country Garden on Monday will be closely monitored

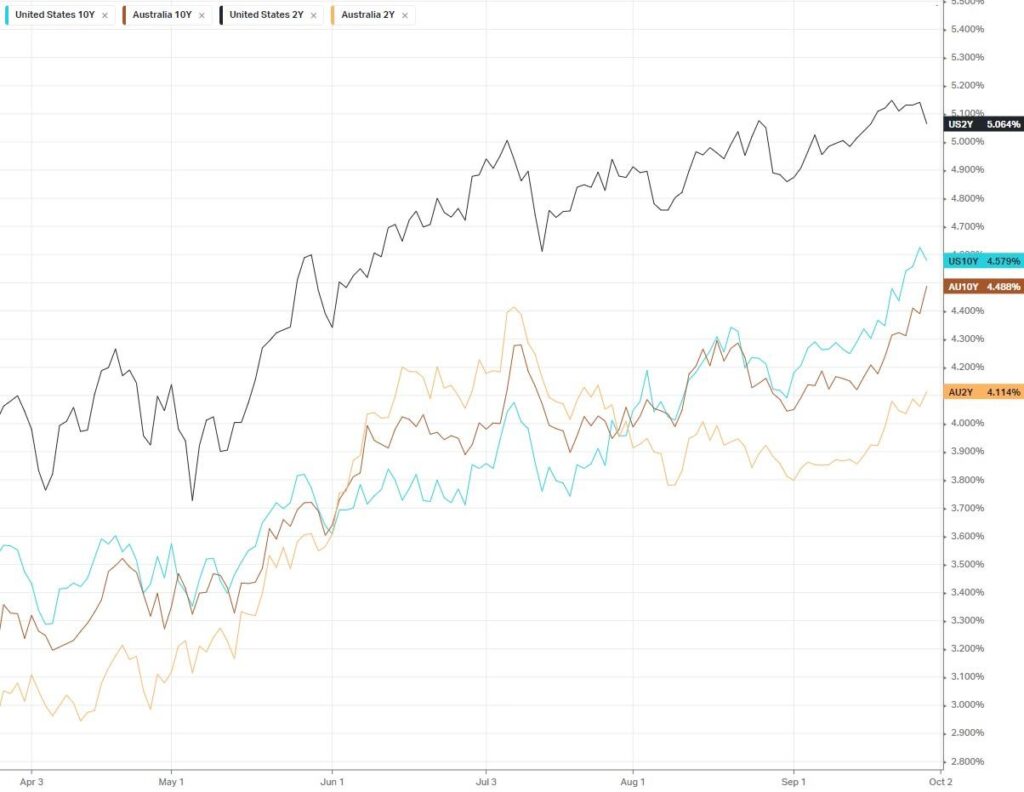

Tonight’s US inflation data will be the focus for global markets as yields linger at 15 to 22 year highs

Chalice Mining and Liontown Resources release earnings.

AMP, Bendigo & Adelaide Bank (BEN), Origin Energy (ORG), Perpetual (PPT) and Ramsay (RHC) all pay dividends.

Chinese markets are closed as of Friday through next week for the Mid-Autumn Festival and China’s National Day.