Overnight – Wall St ends mixed as long-term yields hit fresh 15-year highs

Equites ended mixed as the DOW was weighed down by new highs in long term treasuries, while the growth focused Nasdaq defied the elephant in the room, yet again, to finish slightly higher.

Treasury yields continue to hold sway on market direction after the US10Y swelled to 4.63%, marking fresh 15-high year high. The continued move higher in yields comes amid fresh concerns the Federal Reserve may be forced to hike interest rates again later this year as signs of a resilient economy threaten to keep inflation elevated. Supporting these fears were higher than expected Durable Goods numbers overnight, rising 0.5% (0.1% expected) Non-defense capital goods orders excluding aircraft, a closely watched proxy for business spending plans, rose 0.9 % last month, compared with expectations to remain steady at 0%

The resilience in the growth end of the market (when long term rates are high and rising) is completely at odds to the historical behaviour of stocks with growth profiles and it remains baffling that one segment of the market can be so ignorant of the central influence of financial markets. Even in the scenario of the internet was rolled out in the late 90’s – early 2000’s, one of the most significant leaps forward in technology in history, growth indexes couldn’t push through the headwinds of higher interest rates and it is highly unlikely this time will be different. To add some context of how extreme current valuations are, the push from the AI thematic has added around $4 Trillion to the market cap of the Nasdaq, almost double the annual contribution of online businesses to the US GDP, and more than the best expectations for AI’s contribution to the economy by 2030… all while long term rates have risen to 15 year highs

Ending the week, we have 2 Fed speakers from the hawkish (higher rates) end of the rates debate tonight and the Fed’s preferred inflation gauge, PCE on Friday night where a higher than expected number could be the trigger for a collapse in US Tech stocks. We remain defensive with healthcare stocks, energy and consumer staples providing great value given the market risks.

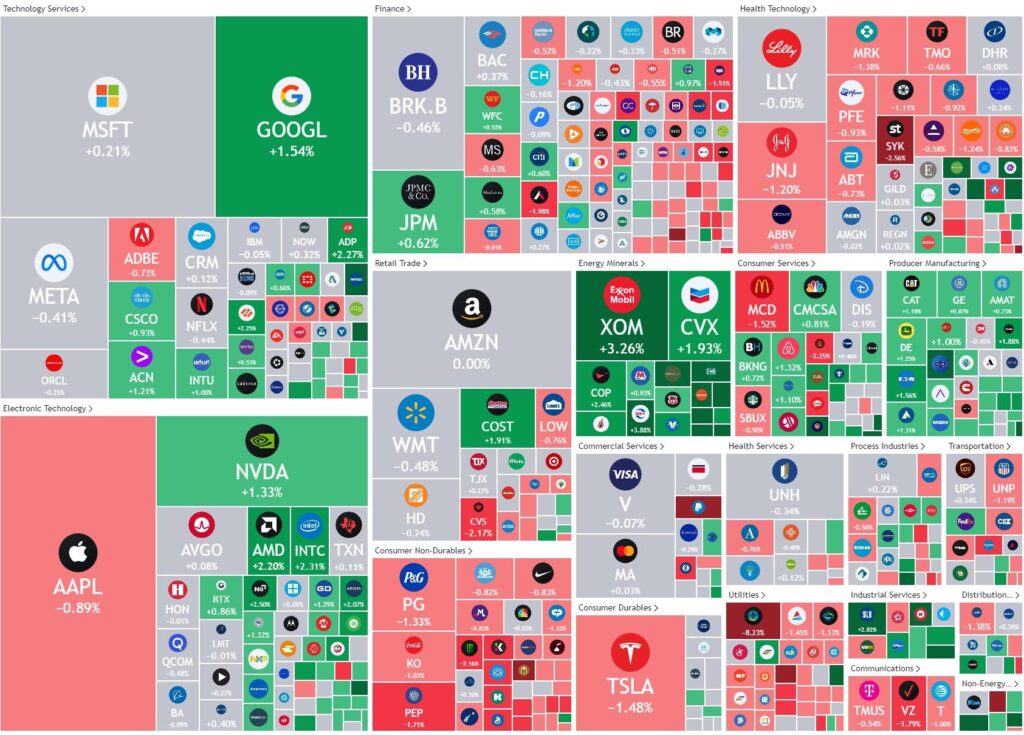

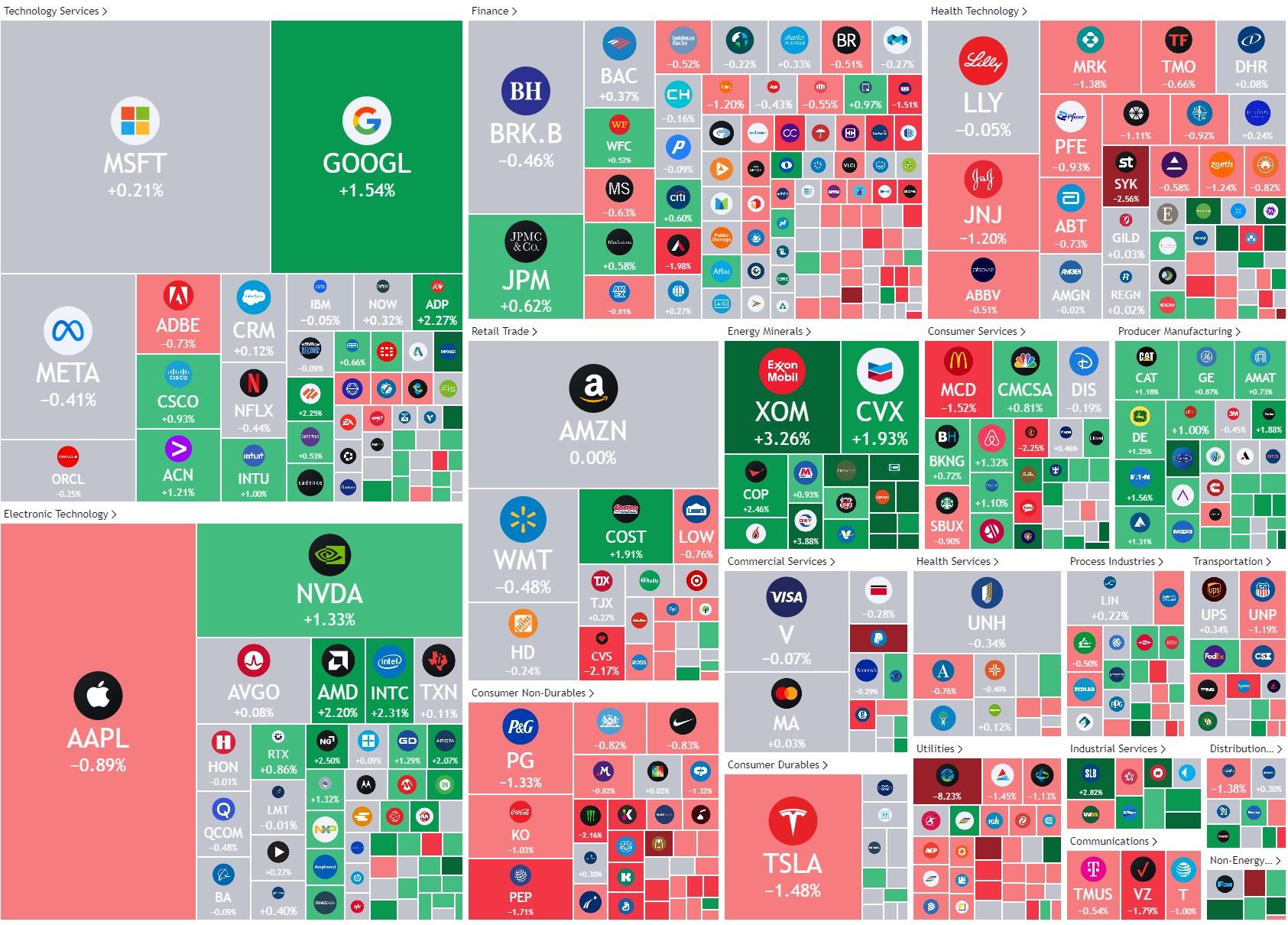

S&P 500 - Heatmap

The Day Ahead

ASX SPI 7055 (-0.18%)

The ASX is likely to be mixed today as a large amount of dividends get paid to investors while rising yields will almost certainly keep investors cautious.

Domestically, retail sales numbers may provide a small catalyst, expected at +0.30%

Of note, the Chinese property sector woes continue, dragging the Chinese stock markets down to 12-year lows. Chinese property giant, Country Garden has another debt payment looming in 4 days which if missed could trigger a default. While Evergrande founder, Hui Ka Yan has been placed in police supervision as fears of an imminent collapse grow.

Brickworks, Washington H Soul Pattinson and Premier Investments are set to release earnings today, while billions of dividends will hit bank accounts with BHP, Commonwealth Bank, Fortescue Metals, Santos, Woodside Energy and Telstra pay-date