Overnight – Equites slump to worst monthly loss this year

Equites closed at their lowest level since June (March for the Dow), as weaker consumer confidence data fueled worry about the economy just as consumers face higher for longer interest rates and inflation that could rein in spending.

The consumer confidence index dropped by more than expected to a reading of 103.0, a four-month low, stoking concern the consumer is beginning to feel pressure from the double whammy of higher inflation and interest rates. Consumers — whose spending has surprised to upside for months and makes up the two-thirds of the economic growth – have been shaken by ongoing rises in prices and the potential of government shutdown.

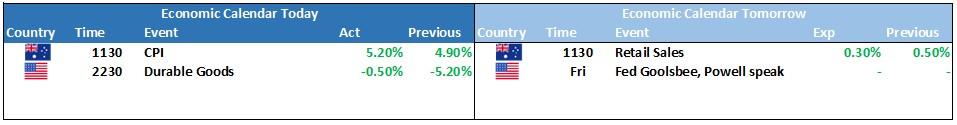

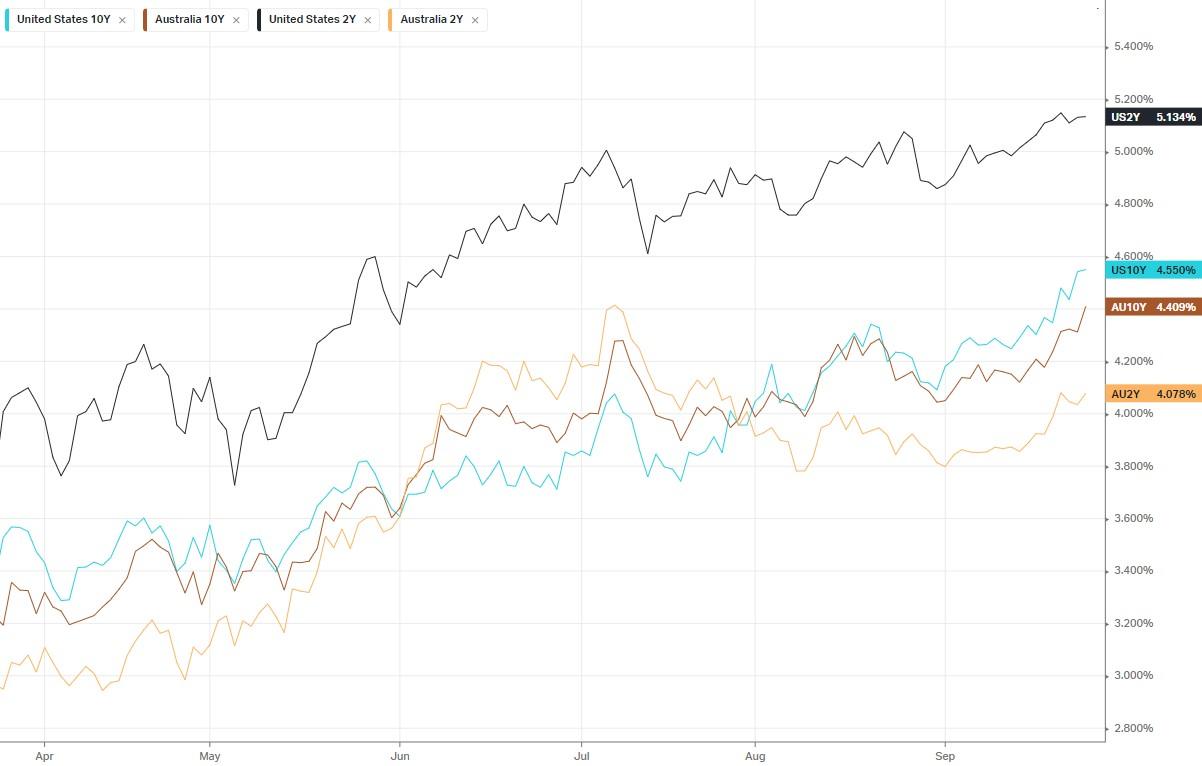

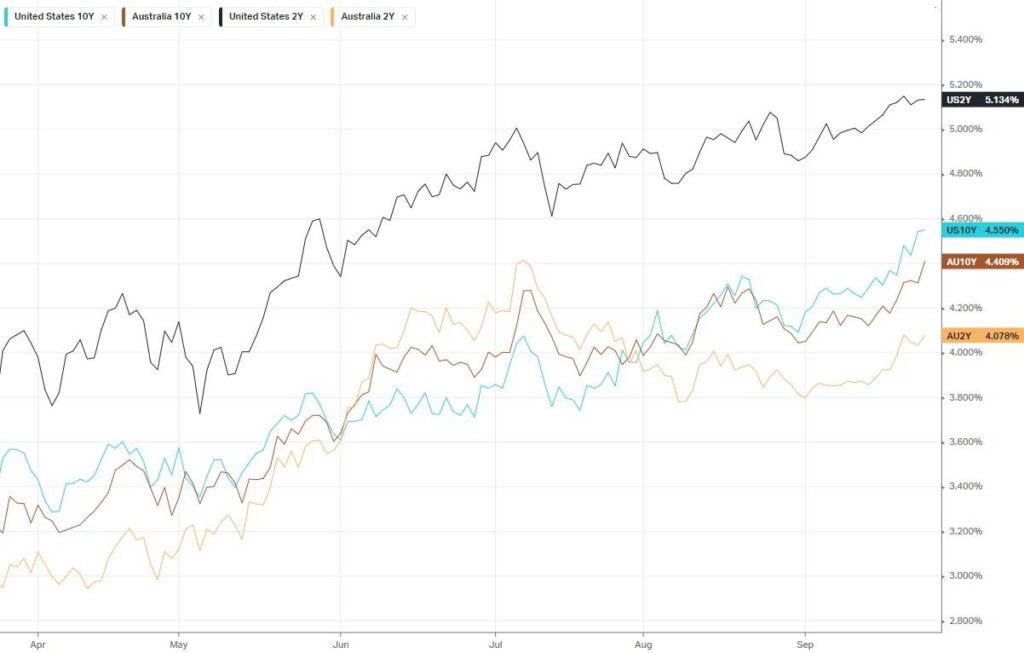

Treasury yields remained at their highest level in more than decade, with the 10-year yield at close to 4.55%, after JPMorgan’s Jamie Dimon warned that the Federal Reserve could lift rates to 7%. “I am not sure if the world is prepared for 7%,” Dimon told The Times of India in an interview. “I ask people in business, ‘Are you prepared for something like 7%?’ The worst case is 7% with stagflation. With the Fed funds rate at 5.4%, the extra 200 basis points to push rates to 7% would “be more painful than the 3% to 5%” move,”

With US lawmakers continuing to put their nations credit rating at risk, flirting with government shutdown deadline on Oct. 1. The dysfunction of US politics has become an issue for rating agencies and with government debt growing exponentially, they risk higher payments on their debt for the sake of “peacocking” in the media.

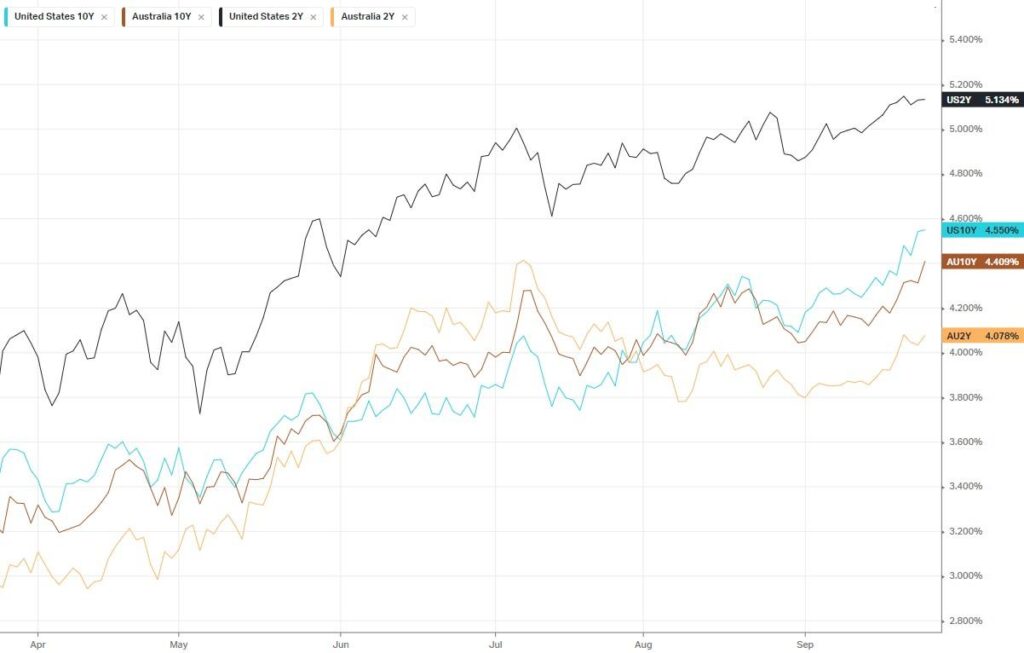

Big tech resumed its slide after brief respite on Monday as investors continue to price in the pain for growth stocks amid the prospect of higher for longer interest rate regime. Google fell 2% to lead big tech lower, followed by Microsoft Apple as higher rates make future profit appear less valuable, and the impact is particularly acute in higher-priced growth sectors including tech.

Currently we have bond yields at 16-22 year highs, Evergrande issues re-emerging in China, tech stocks dangerously sitting at the highest PEG valuations since the tech bubble and a dysfunctional US congress hurtling towards yet another likely shutdown, we strongly recommend caution over the next month

S&P 500 - Heatmap

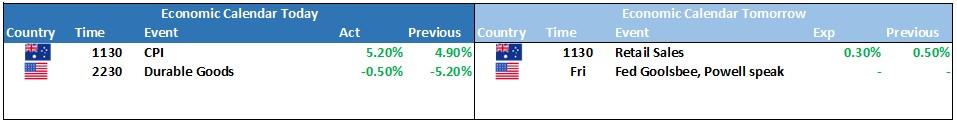

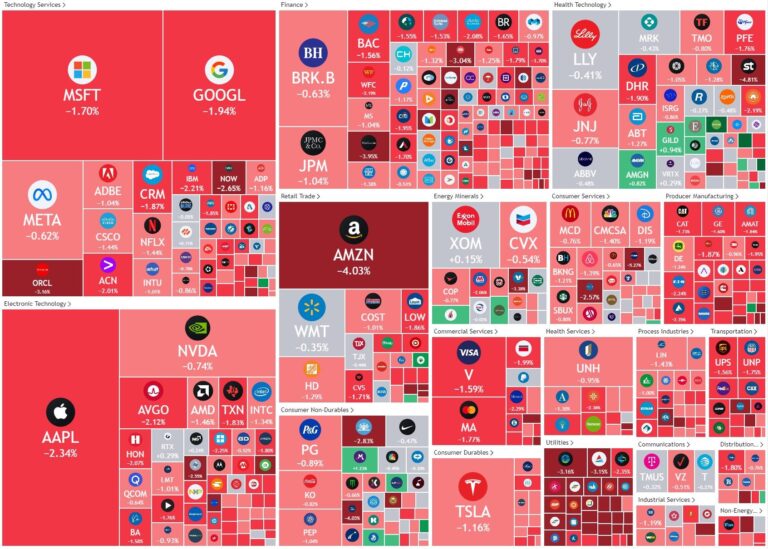

The Day Ahead

ASX SPI 7046 (-0.33%)

We are looking at broad weakness in the ASX today with the weight of high bond yields keeping a lid on investor optimism. A spike in volatility can be a pre-cursor to a break of the range and should be noted

Domestically, all eyes on the AU CPI number at 1130 which is expected to show Year-on-Year inflation push higher for only the second time this year at 5.3%. Any number higher than the expectation will likely deepen any selloff from the weak overnight lead

Core Lithium releases earnings, Myers goes ex-dividend and 11 ASX-listed companies pay dividends to investors today, including the ASX, Coles, Mineral Resources and Woolworths.