Closing Bell

What's Affecting Markets Today

Global yields surge

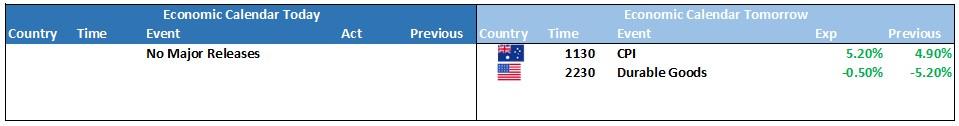

Long-term Treasury yields and the dollar rose, indicating a lengthy period of high US interest rates. The yield on 10-year US Treasuries reached a 16-year high. In Europe, 10-year German Bund yield also peaked since 2011. Central banks signal that high interest rates are necessary to control inflation. The US Federal Reserve maintained high interest rates and projected fewer rate cuts in 2024. Officials are open to further rate increases due to above-target inflation risks. The dollar index reached its strongest level since November last year.

Oil prices

Oil prices remained steady as Russia eased its fuel export ban. Brent crude and West Texas Intermediate crude showed little change. The Federal Reserve’s indication of sustained high interest rates affected oil demand. Saudi Arabia and Russia extended production cuts, impacting prices. An explosion occurred at Iran’s Bandar Abbas refinery.

$A and iron ore prices

The Australian dollar is near a 10-month low, affected by falling iron ore prices and concerns over China’s property market. Evergrande scrapped a debt restructuring plan. Iron ore demand is uncertain ahead of China’s Golden Week.

ASX Stocks

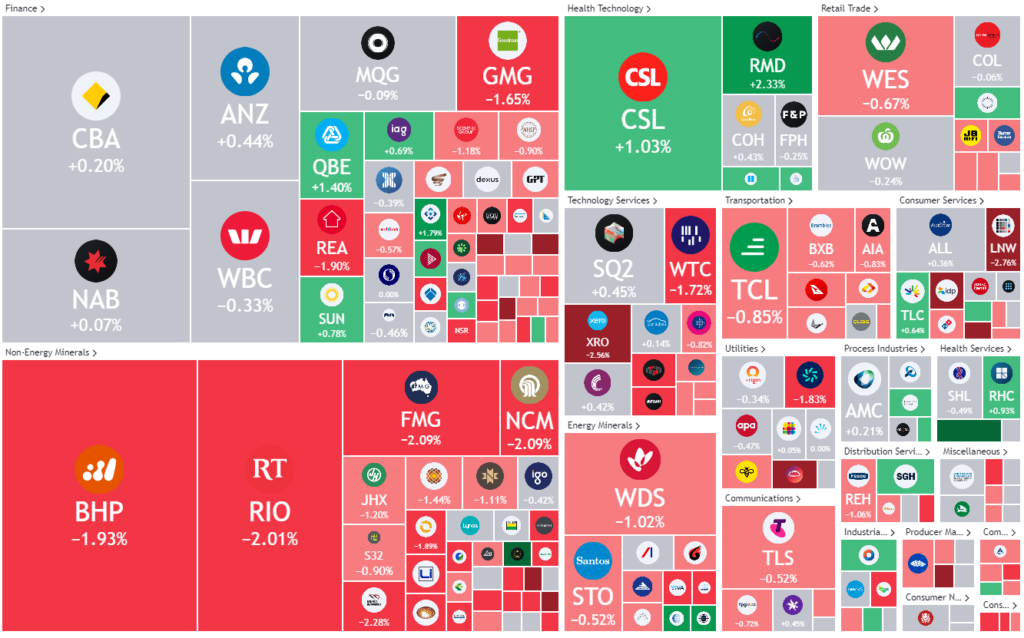

ASX 200 - 7041.6 -35.2 (-0.5%)

Key Highlights:

The Australian sharemarket faced notable losses, particularly impacting the technology and real estate sectors. This downturn is attributed to surging bond yields and the market’s repositioning in anticipation of a prolonged period of higher interest rates, causing the ASX 200 to trade near a 10-week low. Large cap tech stocks such as Xero and NextDC experienced significant losses, contributing to the overall decline. The property sector, including Goodman Group and Scentre Group, also faced setbacks. Additionally, the materials sector weighed on the ASX, with major companies like BHP, Rio Tinto, and Fortescue recording losses. Iron ore futures experienced a decline, further affecting the market. Despite the general downturn, Pro Medicus saw a surge after securing a substantial contract, and shares in Coronado Global Resources advanced following Sev.en Global Investments acquiring a majority stake. Conversely, Liontown Resources experienced a drop amidst a complex takeover scenario involving Albemarle and Gina Rinehart.

Leader

PME-Pro Medicus Ltd (+11.93%)

MAD-Mader Group Ltd (+7.90%)

BCB-Bowen Coking Coal Ltd (+6.90%)

PNV-Polynovo Ltd (+6.75%)

LOT-Lotus Resources Ltd (+6.25%)

Laggards

BOT-Botanix Pharmaceuticals Ltd (-19.44%)

AEF-Australian Ethical Investment Ltd (-8.78%)

IMU-Imugene Ltd (-8.49%)

LIN-Lindian Resources Ltd (-8.16%)

4DS-4DS Memory Ltd (-7.81%)