Overnight – Rising bond yields keep lid on equities

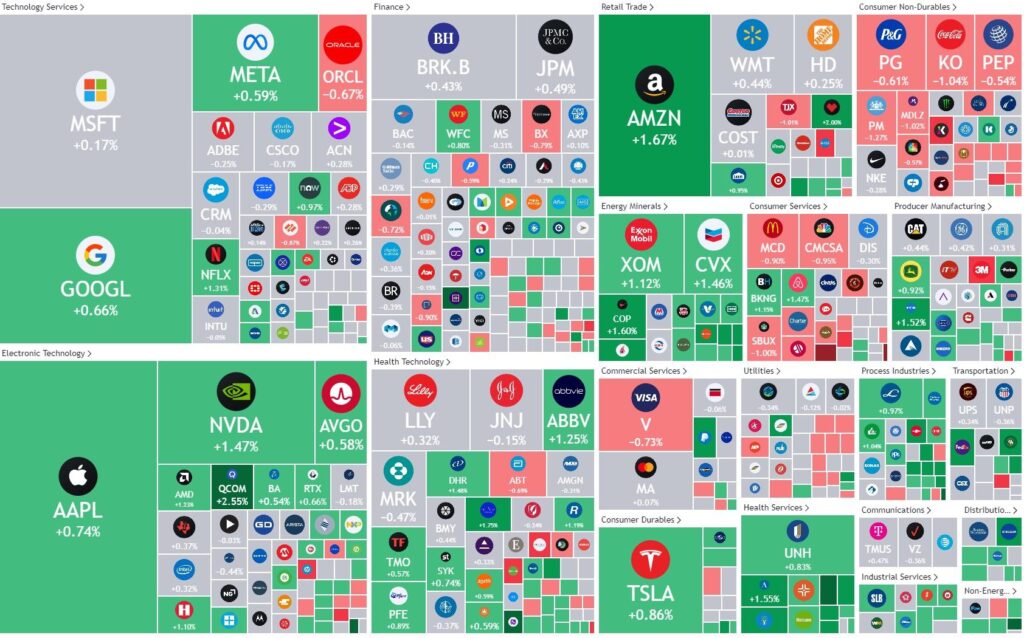

Equites edged slightly higher as Amazon fueled a rise in tech and a jump in energy stocks helped stocks wriggle away from the squeeze delivered by surging Treasury yields.

Amazon said it would invest up to $4 billion in the artificial intelligence start-up Anthropic –which develops generative AI technology including large language model-based chatbots like ChatGPT that will be to Amazon Web Services customers. The agreement has the potential to accelerate adoption and deployment of additional generative AI capabilities to AWS customers and should ease investor concerns that Amazon has been less proactive than its peers in its approach to generative AI.

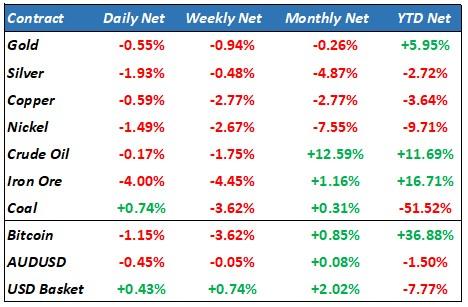

Energy stocks rose more than 1% to support the broader market even as oil prices stumbled as investors assessed the impact of the higher for longer rates on the economy and energy demand.

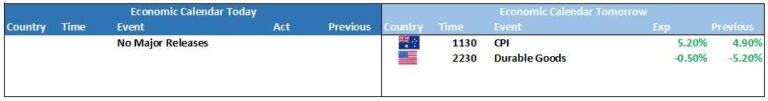

The US10y rose to highest level since 2007 as investors look ahead to remarks by Federal Reserve speakers and key economic reports this week including inflation and quarterly economic growth data that will play a role in Fed’s thinking on monetary policy. The calendar for the week includes various Fed speakers and the personal consumption expenditure price index data due Friday. Fed Chair Jerome Powell is scheduled to speak on Thursday and New York Fed President Williams on Friday.

Concerns about a U.S. government shutdown continue to grow as Congress has yet to pass any spending bills that are needed to fund the government beyond the Oct. 1. While there is still time to avert a shutdown, there is less than a week to pass a short-term spending bill needed to keep the government open past the new fiscal year beginning October 1, most are skeptical there is the will to negotiate. Credit rating agency Moody’s said that while a U.S. shutdown would have negative implications for the nation’s credit worthiness, the economic impact would be short-lived.

S&P 500 - Heatmap

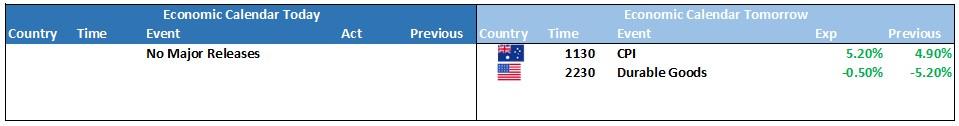

The Day Ahead

ASX SPI 7011 (-0.01%)

The fall in Iron ore overnight will weigh heavy on the materials sector which will make it hard for the index to gain ground today. AU CPI figures will be released tomorrow with higher oil prices the market will likely be wary of the numbers and see some profit taking.