Overnight – Stocks inch higher, in worst week since March

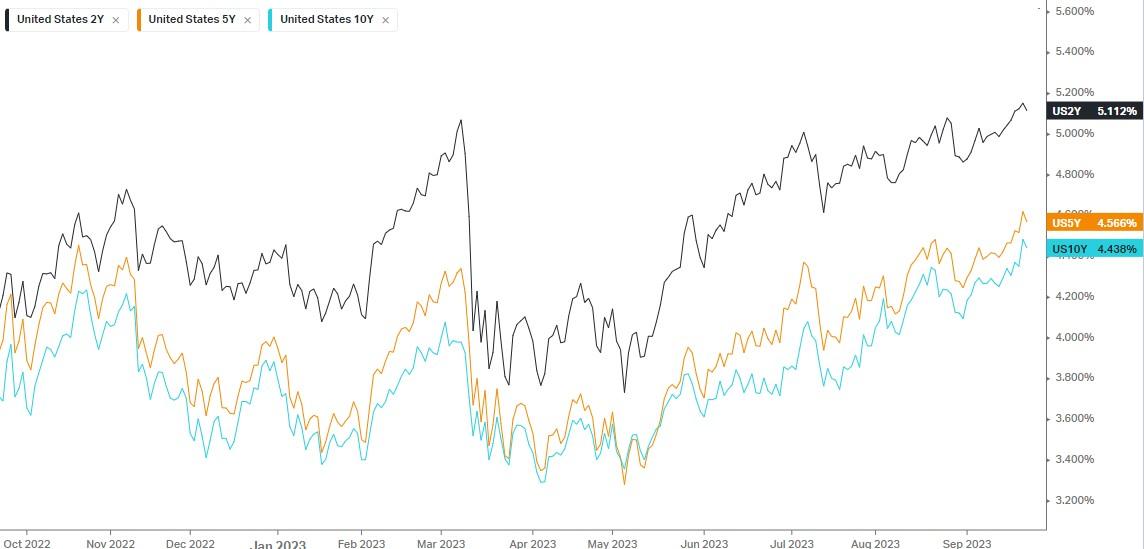

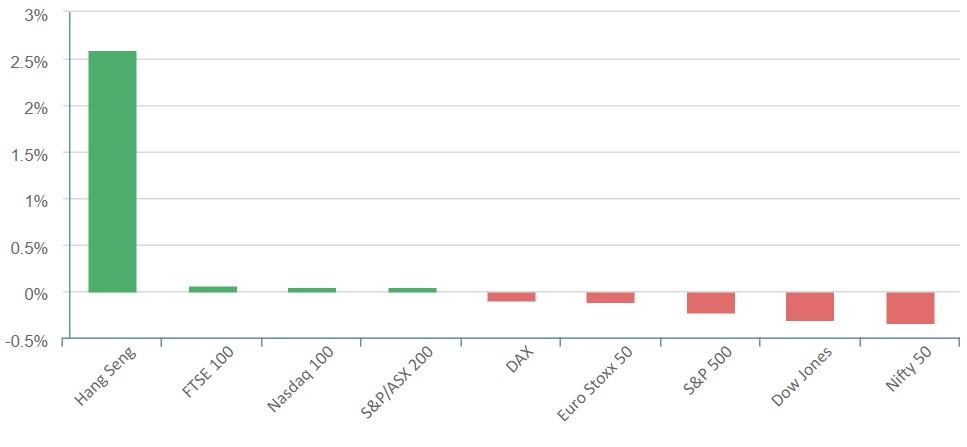

Equites finished mixed to unchanged on Friday, capping a tumultuous week during which benchmark Treasury yields hit 16-year highs and investors digested the Federal Reserve’s hawkish outlook revisions.

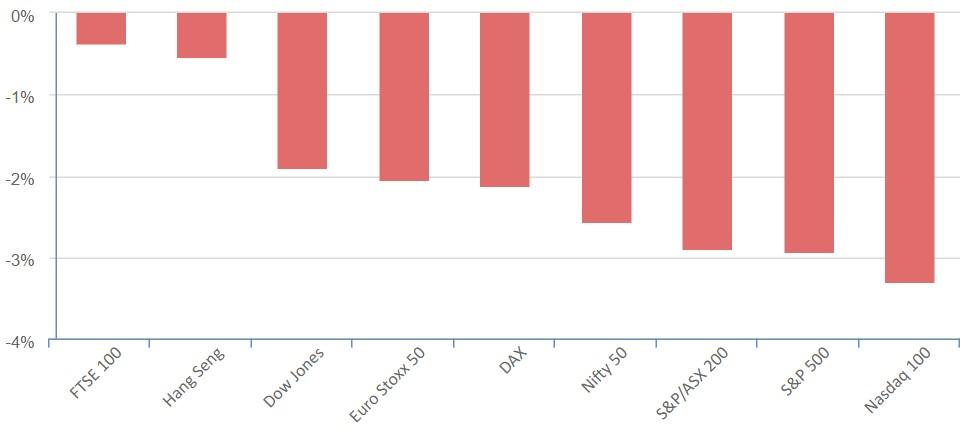

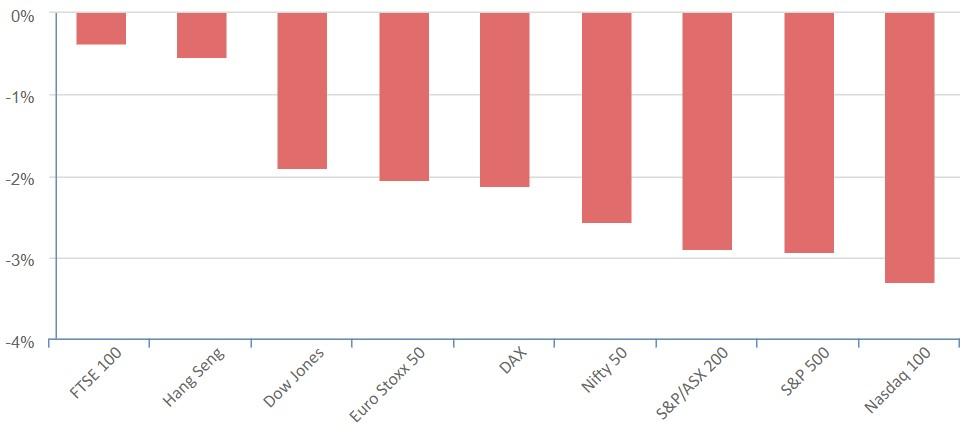

All three major U.S. stock indexes oscillated for much of the session but ended red. All three posted weekly losses, with the S&P 500 and the Nasdaq registering their largest Friday-to-Friday percentage drops since March.

On Thursday, the S&P 500 dipped below its 100-day moving average – a key support level – for the first time since March, Its failure to break above that level suggests the index is still under downward pressure.

Fed messaging colliding with overly optimistic equity investors who have wanted to trade peak interest rates for almost a year now, but it is clear in remarks this week by Fed Chair Jerome Powell and in the dot plot that the Fed doesn’t think we’re there yet.

Benchmark U.S. Treasury yields retreated from 16-year highs as investors turned their focus from hawkish Fed guidance to key economic data waiting in the wings.

On Friday, remarks from Fed Governor Michelle Bowman supported the FOMC hawks, suggesting the Fed funds target rate should be raised further and held “at a restrictive level for some time” to bring inflation down to the central bank’s 2% target.

There are a lot of factors working against a soft landing and that’s something the Fed needs to be reminded of, because pushing rates higher could push us into recession

Among the 11 major sectors of the S&P 500, consumer discretionary suffered the steepest percentage loss, while tech and energy were the only gainers.

S&P 500 - Heatmap

The Day Ahead

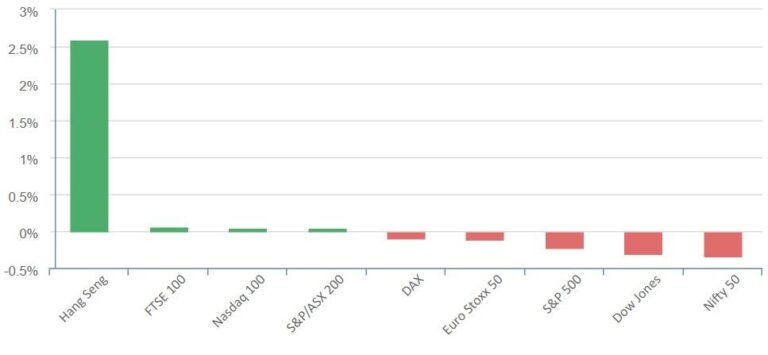

ASX SPI 7080 (-0.24%)

We are looking at another negative day as the buying into Friday afternoon is likely to be questioning a 1% bounce after a lackluster session on Wall St.

Defensive sectors like health and consumer staples may find some support as they present value due to being out of favour recently against the growth end of the market