Closing Bell

What's Affecting Markets Today

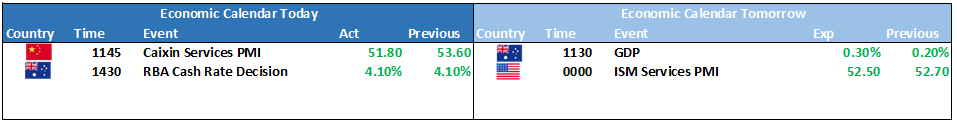

RBA Interest Rates Decision

The Reserve Bank of Australia (RBA) has kept the cash rate at 4.10%. Since May of the previous year, rates have risen by 4 percentage points. The RBA is holding rates to assess the impact of these hikes and the broader economic outlook. They hint at potential further tightening to manage inflation, with a focus on global economic trends and domestic spending.

China’s Services Sector

China’s services sector growth slowed in August, with the Caixin purchasing managers’ index dropping to 51.8 from 54.1 in July. This is its slowest pace since December. The decline is mainly due to a reduced increase in new work and a drop in new international business. Economic concerns have led to increased savings among the Chinese population.

Oil Market Update

Oil prices are stable, with West Texas Intermediate futures slightly above $US85 a barrel and the Brent benchmark at $US89. This stability is attributed to production cuts by OPEC+ leaders, especially Saudi Arabia and Russia. Analysts from the Bank of China International anticipate continued support for oil prices due to supply constraints, and potential price spikes are on the horizon.

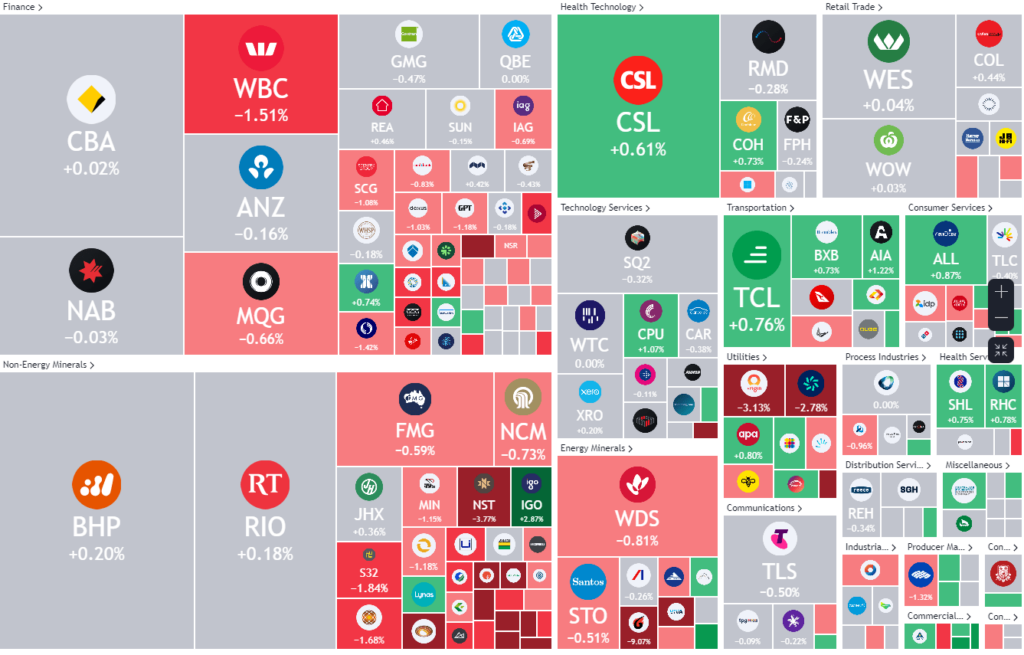

ASX Stocks

ASX 200 - 7314.3 -4.5 (-0.08%)

Key Highlights:

Leader

- RED – RED 5 Ltd (8%)

- GRX – Greenx Metals Ltd (7.49%)

- SWM – Seven West Media Ltd (6.56%)

- MAY – Melbana Energy Ltd (5.33%)

- LLL – Leo Lithium Ltd (4.91%)

Laggards

- TIE – Tietto Minerals Ltd (-20.43%)

- CHN – Chalice Mining Ltd (-13.43%)

- PDI – Predictive Discovery Ltd (-11.11%)

- YAL – Yancoal Australia Ltd (-9.07%)

- RSG – Resolute Mining Ltd (-6.85%)