Closing Bell

What's Affecting Markets Today

Gregory Crinum Coal Mine Expansion

The Albanese government has approved an extension for the Gregory Crinum coal mine located in Central Queensland’s Bowen Basin. This marks the third coal mine approval this year. The decision permits Sojitz Blue Pty Ltd to operate a coking coal operation at the site until 2073, ensuring employment for 230 mine workers. The coal extracted will be used for steel-making. The mine is both an open-cut and underground coking coal mine situated near the town of Emerald. However, this move has faced criticism from the Greens, who argue it contradicts the government’s commitment to achieving 43% of net zero emissions by 2030. The approval comes with environmental conditions, primarily concerning local water resources and the protection of certain vulnerable species. Environment Minister Tanya Plibersek emphasized the government’s dedication to transitioning to renewables and highlighted the increase in renewable energy approvals.

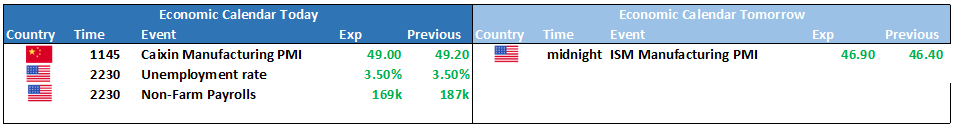

US Non-Farms Employment Tonight 10:30PM

Vanguard predicts that the US economy added 185,000 jobs in August, marking the third consecutive month of job gains below 200,000. The unemployment rate is projected to remain steady at 3.5%, with the labour force participation rate unchanged at 62.6%. Vanguard’s year-end forecast for the unemployment rate is 3.8%. Sevens Report suggests that the job report needs to strike a balance, indicating a strong economy but also allowing the Federal Reserve to halt rate hikes. Oxford Economics also anticipates a job increase of 185,000 for August. Jones Trading points out that the August payrolls report might not capture the actual number of jobs due to factors like vacations, strikes, and other disruptions.

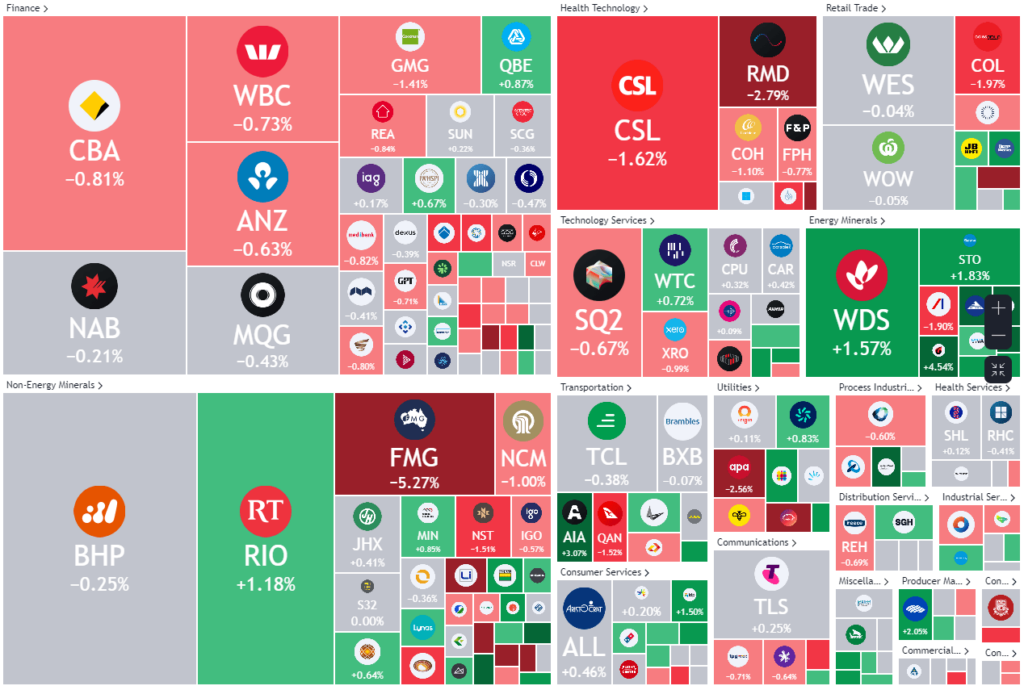

ASX Stocks

ASX 200 -7278.3 -27 (-0.37%)

Key Highlights:

Fortescue Metals Group Ltd (FMG:ASX)

Guy Debelle, previously a central banker and now a businessman-climate activist, has resigned from the board of Fortescue Future Industries (FFI), a green energy subsidiary of Andrew Forrest’s Fortescue Metals. This marks the third major exit from Forrest’s iron ore business within a week. Debelle’s departure was announced following a notice period, and he clarified that his decision was unrelated to other recent resignations at Fortescue. He has chosen to join the board of Tivan, an aspiring vanadium miner, due to its potential role in the green transition. Tivan’s ambition is to process vanadium flow battery precursors and assemble batteries. Debelle’s move to Tivan is seen as a significant endorsement for the critical minerals industry. However, his departure adds to the challenges faced by Forrest’s $66 billion empire, which has seen multiple high-profile exits recently.