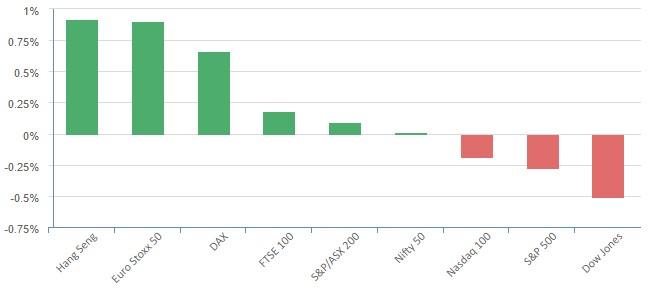

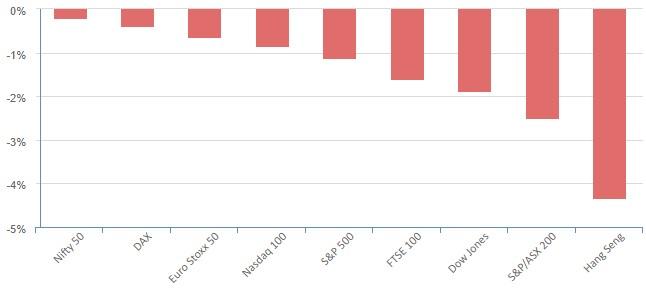

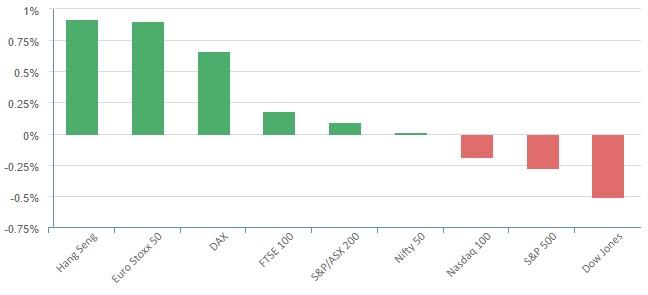

Overnight – Equites dragged down by poor retail results and bank downgrade

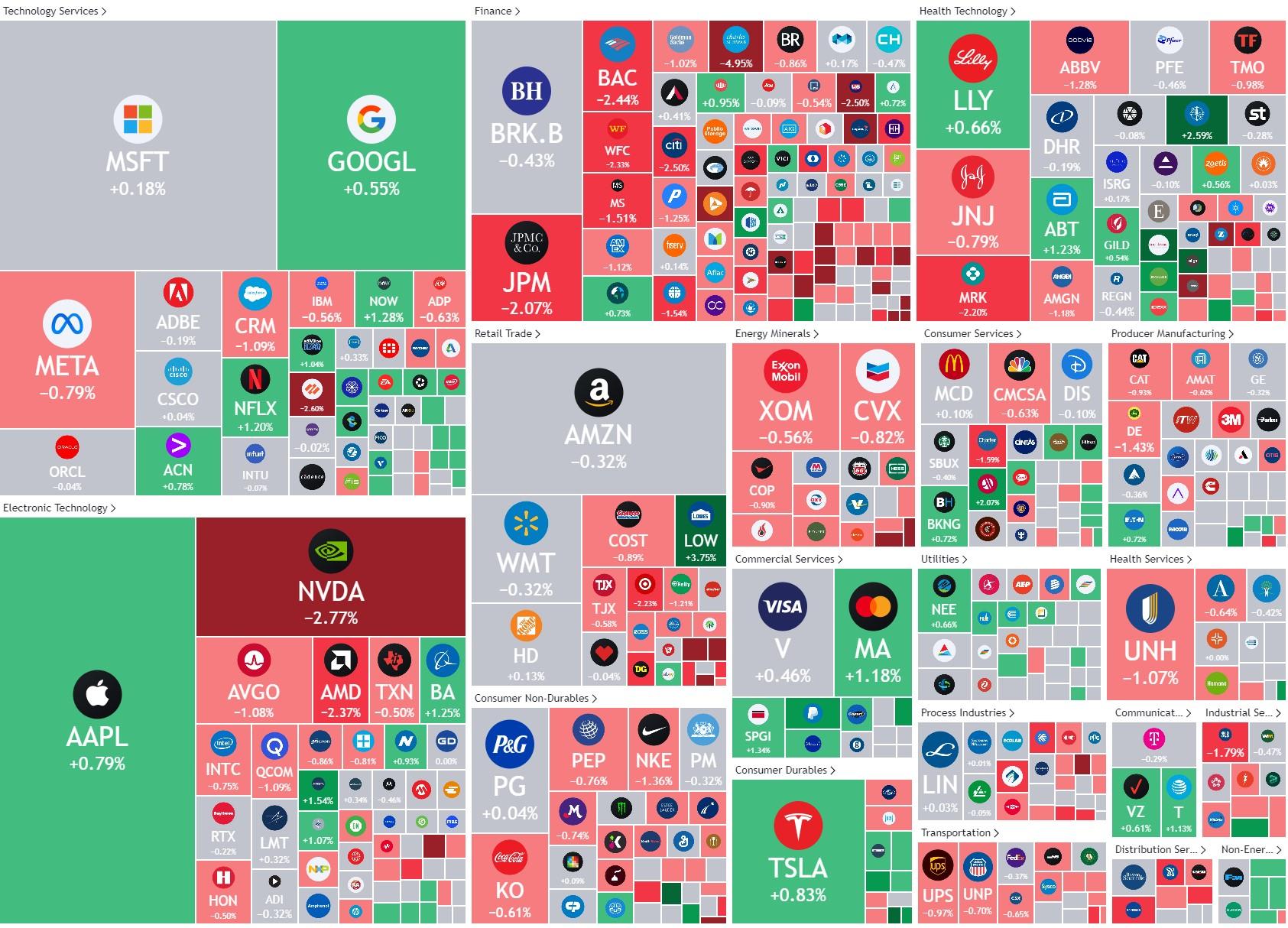

Equities closed lower Tuesday under pressure from regional banks and a tumble in retailers following disappointing quarterly results from Macy’s and Dick’s Sporting Goods.

Retail stocks fell more than 2%, pressured by a tumble in Macy’s and Dick’s Sporting Goods as the duo’s outlook rattled investor sentiment. Macy’s fell more than 14% after the department store said it was taking a “cautious approach on the consumer,” following a faster-than-expected rise in customer credit-card delinquencies. The somber outlook offset quarterly results that beat on both the top and bottom lines. Dick’s Sporting Goods, meanwhile, cut its guidance on the full-year profit after reporting weaker-than-expected quarterly results as inventory shrinkage, a loss in inventory not due to sales, weighed on margins. Its shares fell more than 24%

Regional banks including Regions Financial Corp, KeyCorp, and Zions Bancorporation fell sharply after credit ratings agency S&P Global downgraded its credit ratings on several regional banks, souring investor sentiment on the sector.

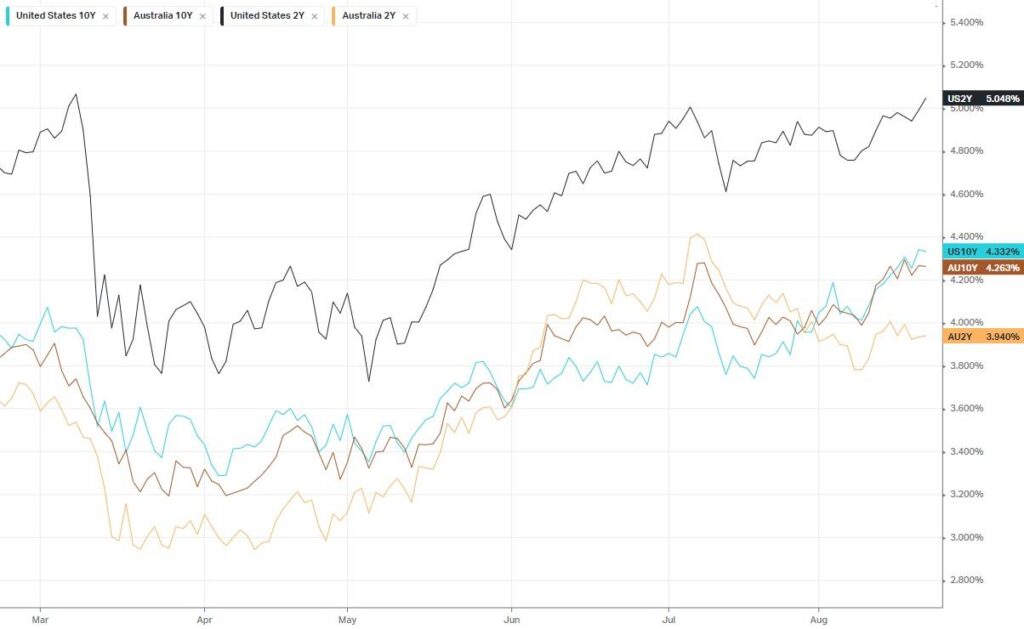

Tech stocks slipped as Treasury yields remain elevated, with the US2Y treasury yield, which is more sensitive to Fed rate hikes, topping 5% to hit its highest level since early July. The move lower in tech comes just a day ahead of Nvidia’s quarterly results that many see as a barometer of AI demand and another catalyst for tech should the chipmaker impress. The guidance from Nvidia might be that they can’t produce chips enough fast enough and that may be a concern at this eye watering level

S&P 500 - Heatmap

The Day Ahead

SPI Futures 7059 (-0.20%)

Earnings will remain the headliner today as key sector leaders Woolworths, Santos, Wisetech, Dominos and Corporate travel deliver FY results this morning. Despite a poor result yesterday from BHP, a sharp spike in the iron ore price overnight will help the materials sector, while on the economic front we get manufacturing data across the globe

(Earnings calendar click here)

Corporate Earnings

Corporate Travel (CTD) Balanced portfolio – CTD has delivered a bumper result with profits up 179% and returning to dividends with 22c (28.5c FY). Huge government contracts have begun pushing the July and August volumes higher by 40%+

With no debt, Government contracts and over 90%+ of their customers planning to increase business travel this FY, management is predicting a record year in FY24