Closing Bell

What's Affecting Markets Today

- Bitcoin’s Rocky Ride – Cryptocurrencies are facing a downturn, with Bitcoin experiencing a 4.5% drop, marking its most significant weekly decline in three months. Factors contributing to this include rising global bond yields and a report of SpaceX liquidating its Bitcoin assets, resulting in a $US373 million write-down.

$A’s Unexpected Dive – The Australian dollar’s swift drop to a nine-month low has taken the market by surprise. With a 1.3% decrease this week, hitting US63.63¢ after disappointing job data, this marks its fifth consecutive week of decline. Commonwealth Bank’s predictions indicate a potential dip below US60¢ by year-end, primarily due to the deteriorating Chinese economy.

Oil’s Slippery Slope – Oil prices are on a downward trajectory, with West Texas Intermediate nearing $US80 a barrel. Despite US stockpiles being at their lowest since January, poor economic data from China and the potential for stricter US monetary policies have overshadowed any positive indicators. The rising US dollar, set for its fifth weekly gain, further diminishes the appeal of commodities for global buyers.

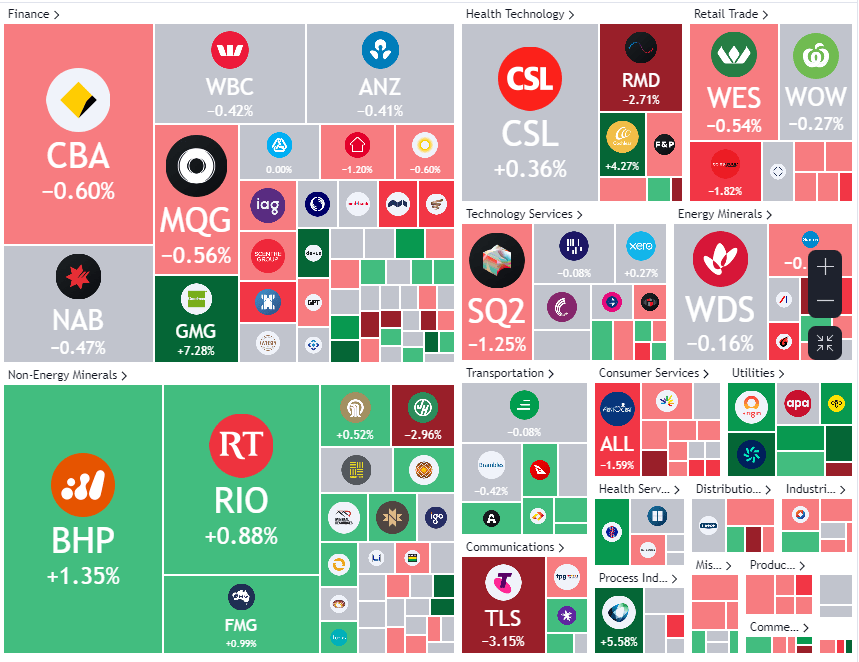

ASX Stocks

ASX 200 - 7,148.1 +2.1 (0.03%)

What’s happening in reporting season?

In the Asian trading session, the day began with a notable dip but eventually stabilized, ending on a neutral note. Despite Wall Street’s lackluster performance the previous night, the stock market rallied by midday, primarily driven by gains in materials stocks.

- Magellan Financial Group (MFG: ASX) – The international equities manager reported a 52% drop in net profit to $182.6 million and a decrease in revenue by 22% to $431.7 million. Total funds under management decreased from $61.3 billion to $39.7 billion. The company declared a final dividend of 39.8¢ and a special dividend of 30¢, bringing the full-year dividends to $1.167. The Magellan Global Fund returned 20.6% over the year, while the Airlie Australian Share Fund returned 18.1%.

- Abacus (ABP: ASX) – The property investment firm recorded a property write-down of $248 million due to a rise in interest rates. The trust’s statutory profit fell by 95% to $25.5 million. Operating earnings increased by 8.8% to $175.0 million. The company paid a full-year distribution of 18.4¢ per security and reconfirmed its FY24 guidance.

- Spark New Zealand (SPK: NZX) – The telecom company’s sale of its TowerCo business resulted in a 20.7% increase in revenues to $4.5 billion and a 49.7% increase in earnings to $1.7 billion. Excluding the sale, revenues rose by 5.1% to $3.9 billion. The company announced a full dividend of 27¢, an increase from the previous year.

- Latitude (LFS: ASX) – The lender reported an 88% decrease in cash profit for the first half of 2023 to $7 million and removed its interim dividend. The company faced challenges, including a significant data breach discovered in March. The company has allocated $76 million for pre-tax costs and provisions related to the cyberattack.

Leader

Earnings release see above.

Earnings release see above.

No Significant news.

No Significant news.

No significant news.

Laggards

Capital Raising

No Significant news.

No Significant News.

No Significant news.

No Significant news.