Overnight – US10Y bond yields hit highest level since 2007, weighing on equities

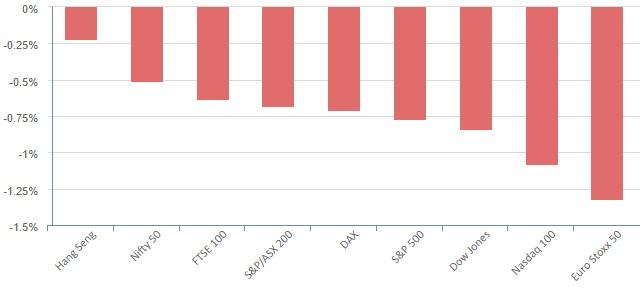

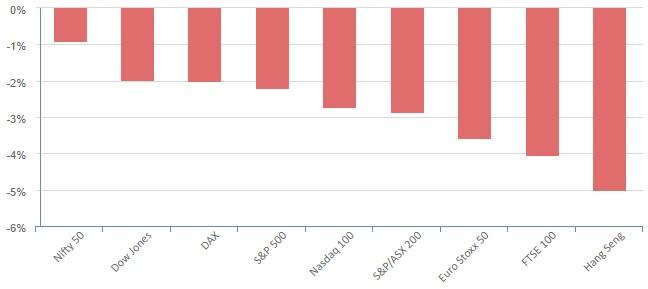

Equities closed lower buckling under the pressure of the highest long term bond yields in over 15 years. Treasury yields were in rally mode, with the 10-year Treasury yield threatening to make a dash for 16-year highs as investors digest the prospect of the Fed lifting rates again later this year.

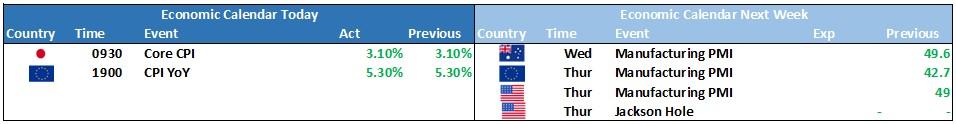

The minutes from the Fed’s July meeting, released yesterday, showed more members than expected were still leaning hawkish, as speculation grows that Fed chair Jerome Powell will deliver similar remarks at the annual Jackson Hole symposium next week. The speech is increasingly looking like a Fed seeing glimmers of hope in the recent CPI data but remaining concerned over restoring price stability. To put it plainly, the FOMC is not out of the inflation woods yet, and investors may have gotten ahead of themselves in predicting a “Goldilocks” scenario.

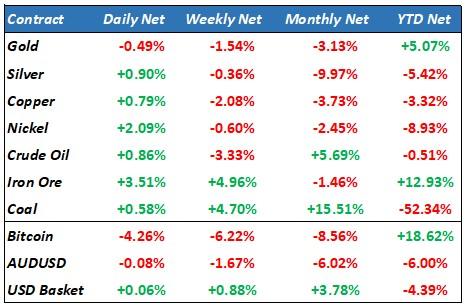

Commodities made a comeback after the PBoC vowed to get its economy moving, although markets are wary that the central bank has been full of jawboning and not much action over the last month

Economic bellwether, Walmart, fell nearly 2% despite lifting its annual guidance following second-quarter results that topped Wall Street estimates, driven by strong grocery and e-commerce performance.

S&P 500 - Heatmap

The Day Ahead

SPI Futures 7067 (-0.39%)

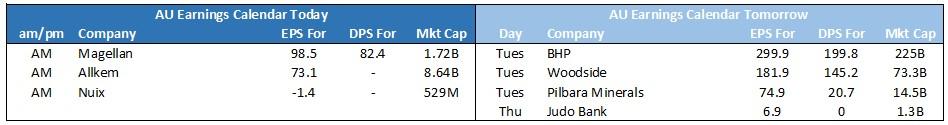

A recovery in commodities due to China central bank comments and yesterdays weaker than expected employment numbers should help the ASX200 “hang in there” today as the AU equity market closes in on its worst week since June. Earnings will be light today with AKE, MFG and LFS reporting before the open. However next week sees an “earnings flood” as 40% of the ASX200 delivers Annual or HY earnings reports