Closing Bell

What's Affecting Markets Today

Zhongzhi’s Liquidity Crisis – Chinese asset manager Zhongzhi is facing a liquidity crisis amid China’s property downturn. The firm plans debt restructuring and is seeking strategic investors after its subsidiary, Zhongrong International Trust Co, missed payments since July’s end.

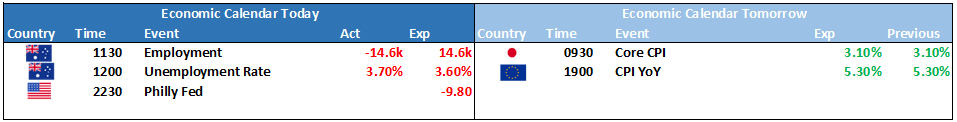

Australia’s Employment Shift – Australia’s unemployment rate rose to 3.7% in July, up by 0.2%. Despite a decrease of 15,000 in employment, the overall job count remains 387,000 higher than last year, indicating a generally strong job market.

US Inflation Concerns – The Federal Reserve continues to be wary of inflation, considering more interest rate hikes. The resilience of the US economy and a strong labor market were highlighted in their recent meeting.

Australian Dollar’s Decline – The Australian dollar, influenced by China’s economic challenges, is at risk of dropping below US60¢. This month saw a 5% decline, further impacted by the Reserve Bank’s policies affecting Australia’s labor dynamics.

RBA’s Rate Decision – HSBC has delayed its forecast for the RBA’s rate hike to late 2023 due to recent labor data and China’s economic indicators. Despite inflation concerns, HSBC expects a 0.25 percentage point rate increase later this year.

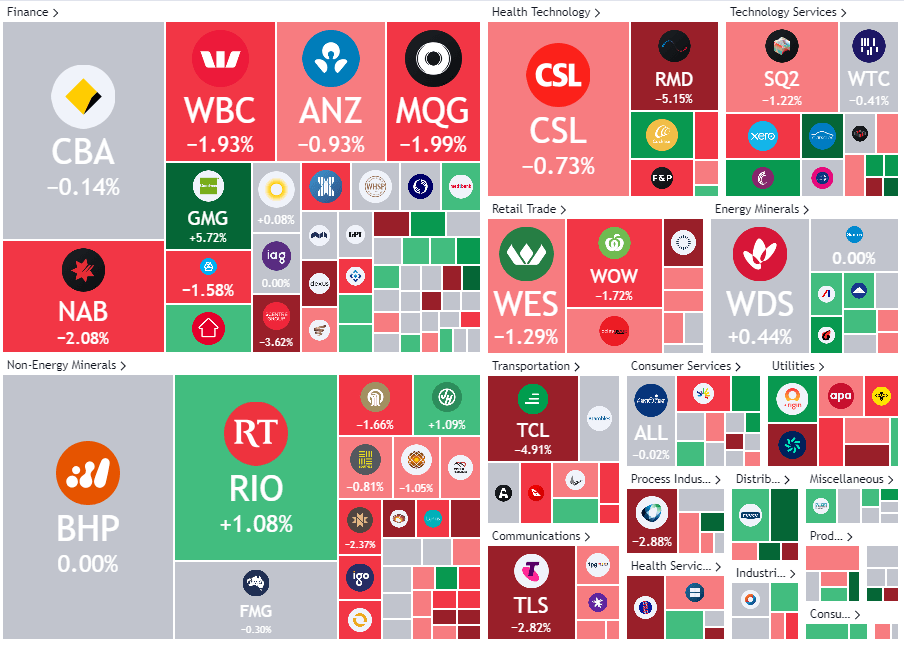

ASX Stocks

ASX 200 - 7,146 +49.2 (0.68%)

What’s happening in reporting season?

Asian shares dropped to a nine-month low due to concerns over China’s economic recovery and potential U.S. interest rate hikes. MSCI’s Asia-Pacific index declined, with China’s stocks underperforming amidst weak post-pandemic recovery data. Additionally, Zhongzhi Enterprise Group announced a liquidity crisis, further unsettling the market.

- Telstra (TLS: ASX) – The telecoms giant reported a 13% rise in annual net profit to $2.05 billion. It plans to retain its InfraCo Fixed business and announced a final dividend of 8.5¢ per share.

- Seven Group (SVM: ASX) – The conglomerate reported a 15% increase in EBITDA to $1.69 billion and a 36% rise in net profit to $604 million. The final dividend was set at 23¢ a share.

- HomeCo REIT (HDN: ASX) – The REIT reported a 70% drop in statutory profit due to an $87 million write-down. However, it delivered funds from operations of $177.1 million.

- Origin Energy (ORG: ASX) – The energy company reported an 83.5% increase in full-year core net profit to $747 million. A final dividend of 20¢ a share was declared.

- ASX Ltd (ASX: ASX) – The market operator’s net profit fell 38% to $317.3 million due to costs related to the failed CHESS project. A final dividend of $1.12 was announced.

- Goodman Group (GMG: ASX) – The property giant reported a 54% drop in statutory profit to $1.56 billion but saw a valuation gain of $800 million across its assets.

- Domain Holdings (DHG: ASX) – The company’s net profit fell over 28% to $38.6 million due to a drop in real estate listings. A final dividend of 4 cents a share was declared.

- Ingham Group (ING: ASX) – The poultry company reported a 72% jump in full-year net profit to $60.4 million. A final dividend of 10¢ was declared.

- Sonic Healthcare (SHL: ASX) – The company’s revenue rose 11% to $7.7 billion, but NPAT declined 53% to $685 million. The final dividend was increased to 62 cents per share.

Leader

Earnings release see above.

Earnings release see above.

Earnings release see above.

Earnings release see above.

No significant news.

Laggards

Announced the successful completion of a $100 million institutional placement.

Earnings release.

No Significant News.

Earnings release see above.

No Significant news.