Closing Bell

3 Things Affecting Markets

European Gas – Worker strikes in Australia push European gas prices up.

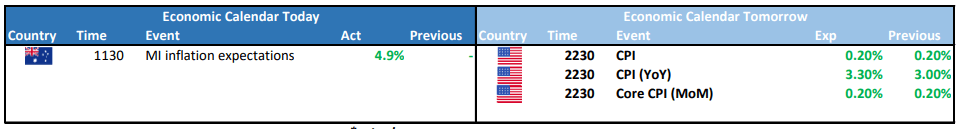

US CPI – July report expects 3.3% annual inflation increase.

ASX Earnings – Boral and Cettire report gains; Downer and AGL face losses.

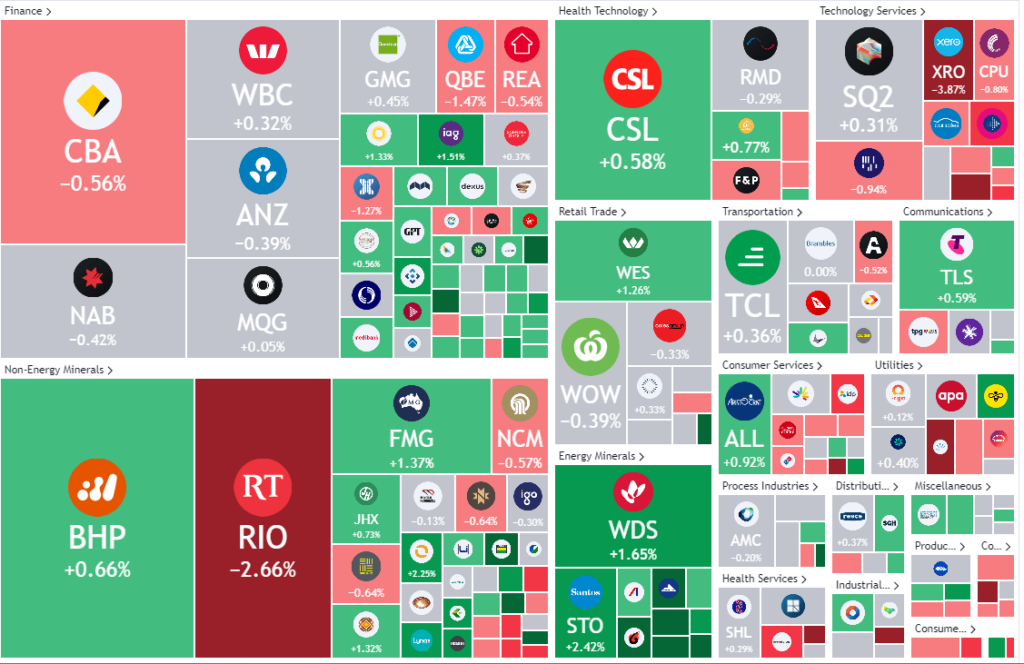

ASX Today

ASX 200 - 7,357.40 +19.40 (0.26%)

European Gas Price Surge:

European natural gas prices experienced a sharp surge of 40%, primarily driven by the potential worker strikes at Chevron and Woodside facilities in Australia. This has stirred concerns over potential supply disruptions, notably as the Asian market is likely to raise LNG imports bids in response.

Apart from the strike concerns, other factors such as a decline in LNG imports to Europe, possible delays in Norway’s maintenance, and position-covering by investors have influenced the market.

Concerns over supply disruptions have driven US oil prices above $US84 a barrel, reaching a nine-month high. This rise intensifies inflation worries and suggests potential central bank interest rate hikes. HSBC’s chief economist, Paul Bloxham, emphasized the energy market’s sensitivity to supply shocks.

Earnings Releases & Corporate News Highlights:

- Cettire’s shares skyrocketed over 12% following a near doubling of its full-year sales revenue.

- Boral observed a 8.47% stock increase after announcing a 17.1% annual revenue increase to $3.46 billion.

- Zip Co’s stocks grew by 1.2% as Cynthia Scott, the current CEO for Australia and New Zealand, was elevated to the position of group CEO.

- Downer’s shares plummeted by 6.39% in the wake of the company’s reported annual net loss of $386 million and anticipated market challenges in the coming half-year.

- AGL’s stock dipped 3.37% due to a full-year bottom-line loss of $1.3 billion attributed to prior write-downs.

- QBE’s shares decreased by 1.47% despite a 10.2% increase in premiums, shedding light on the ongoing pricing pressures in the insurance sector.

All Eyes on US CPI

The US Consumer Price Index (CPI) for July is set to be released today. Analyst expect a 3.3% annual inflation rise, highlighting the first surge since June 2022. While the overall inflation might accelerate, the core CPI, excluding food and energy costs, is predicted to decrease marginally to 4.7%.

Leader

Full year sales revenue almost doubled.

No Significant News.

Reporting a 17.1 per cent rise in full year revenue to $3.46 billion.

No Significant News.

No Significant News.

Laggards

No Significant News.

No Significant News.

Construction engineering company posted an annual net loss of $386 million and warned of “challenging” market conditions over the next six months.

No Significant News.

No Significant News.