Closing Bell

3 Things Affecting Markets

- Tech Nerves – Ahead of Amazon and Apple tonight, tech investors are taking profits

- Iron ore sinks – Promised stimulus from Chinese officials is failing to materialise

- US Yields rise – the glut of T-bill being issues and the Fitch downgrade are forcing yields higher

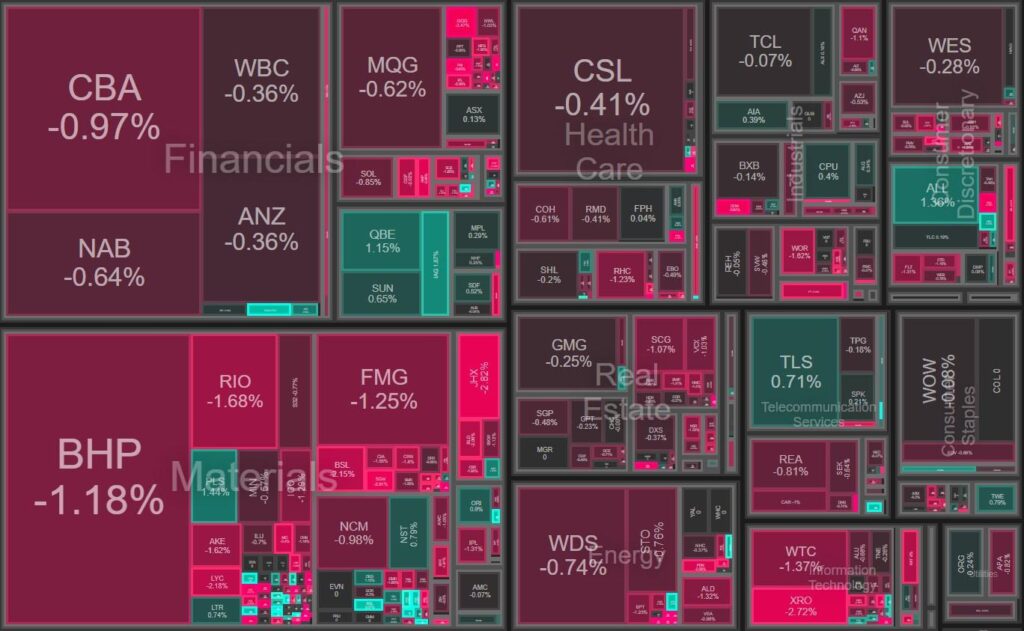

ASX Today 7311.8 (-0.58%)

The ASX we led lower today by the big miners as the Iron ore price sunk to its lowest level in nearly 2 months. Tech also weighed down the market as the Nasdaq continued to sell off as long-term treasury yields surged to their highest level in 9-months, coupled with profit taking from investors into Apple and Amazon results.

Amazon and Apple make up 11.5% of the S&P500 and positive updates from both companies will be critical in the tech rally holding its ground. Apple is expected to deliver its 3rd straight decline in revenue, but outlook will be key for the traditionally soft H2 as Apple fanatics wait for the September iPhone update. The focus for Amazon will be on their cloud service, AWS which delivers the lions share of the companies’ profits. The company has also aggressively cut costs recently, laying off 27,000 workers

There was a noticeable shift back into defensive stocks as insurance, consumer staples and communications were the only sightings of “green on the screen” as WOW, TLS and ELD edged out a small gain

The AUD continued to spiral towards 9-month lows as the rise in US yields and the optimism the RBA has finished hiking created the perfect storm for the currency.

Key US employment numbers are due this Friday as well and the leading indicators so far this week are pointing to yet another strong number, which will only fuel the rally in bond yields

Leader

No Significant updates

Positive production update

No significant news

No significant update

No Significant News.

Laggards

500m asset write off was announced

no significant updates

No significant updates

AGM was held

Announced US joint venture with DR Horton