Overnight Equities – Scepticism emerges over the reality of AI targets

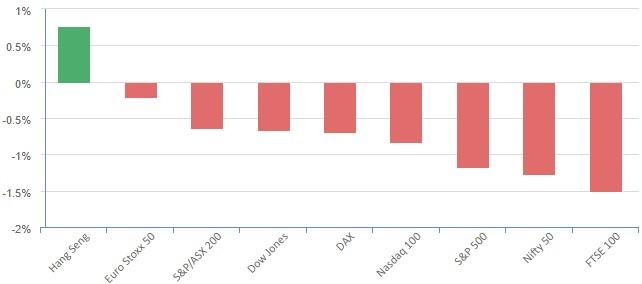

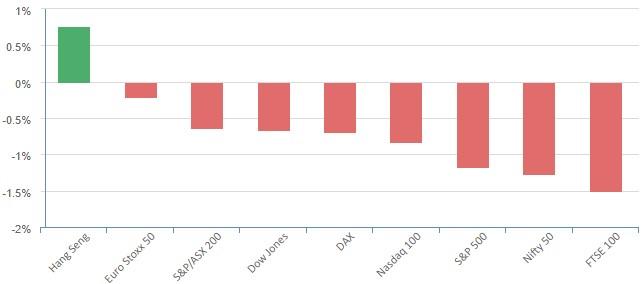

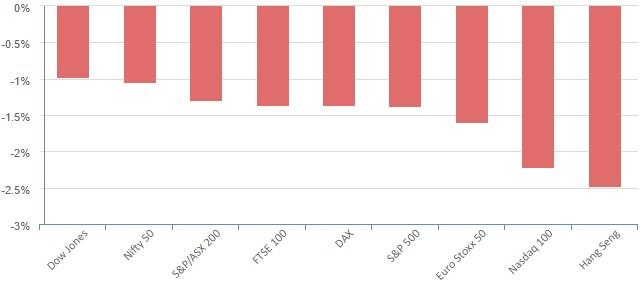

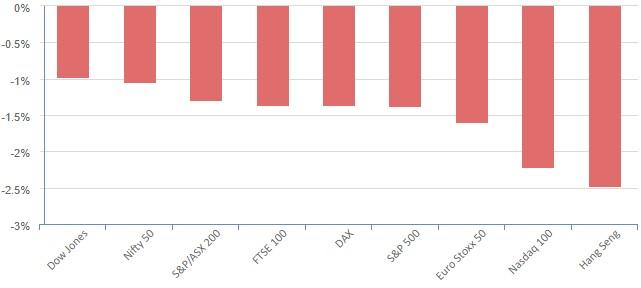

Wall Street finished lower on Wednesday, with the S&P 500 and Nasdaq Composite down for a second straight day as investors took profits on five months of gains a day after rating agency Fitch cut the U.S. government’s credit rating. Fitch downgraded the United States to AA+ from AAA late on Tuesday, citing expected fiscal deterioration over the next three years as well as growing government debt. Fitch was the second major agency to cut the country’s rating. In 2011 Standard & Poor’s stripped the country of its triple-A grade. Reaction to the news pushed major indexes lower, with the S&P 500 recording its biggest daily percentage drop since April 25. It was also the first session since May 23 in which the benchmark declined by more than 1%. Rate-sensitive megacap stocks, including Tesla, Nvidia, Meta Platforms and Apple tumbled, as the yield on U.S. 10-year Treasury notes rose to its highest in nearly nine months. Meanwhile, AMD, which started the day up 6% got a reality check over concerns its targets for an artificial intelligence (AI) ramp-up may be too ambitious, falling 13% to finish down 7% in one of the first signs that investors are rethinking valuations which are higher than the Tech Bubble of 2001. The technology index, dropping 2.6%, was also the worst performer of the 11 major S&P sectors, with nine in total ending the day lower. Despite lingering fears of a recession, corporate America has continued to perform well. With around two-thirds of the S&P 500 having already reported, 79.9% have posted earnings above analysts’ expectations.

Corporate Earnings

Starbucks – Starbucks rose almost 1% after its Q2 earnings topped estimates, though weaker-than-expected revenue kept a lid on gains. The coffee giant’s same store sales growth in the U.S. of 7% missed Wall Street estimates.

AMD – tumbled more than 7% after the chipmaker reported better-than-expected quarterly results, but revenue and operating income fell in Q2 from a prior-year period, while current-quarter guidance missed Wall Street estimates.

CVS – rose almost 4% after reporting a beat on both the top and bottom lines. Concerns about the retail pharmacy’s long-term profit growth emerged. However, chief financial officer Shawn Guertin said its EPS targets for 2024 and 2025 were no longer “reasonable.”

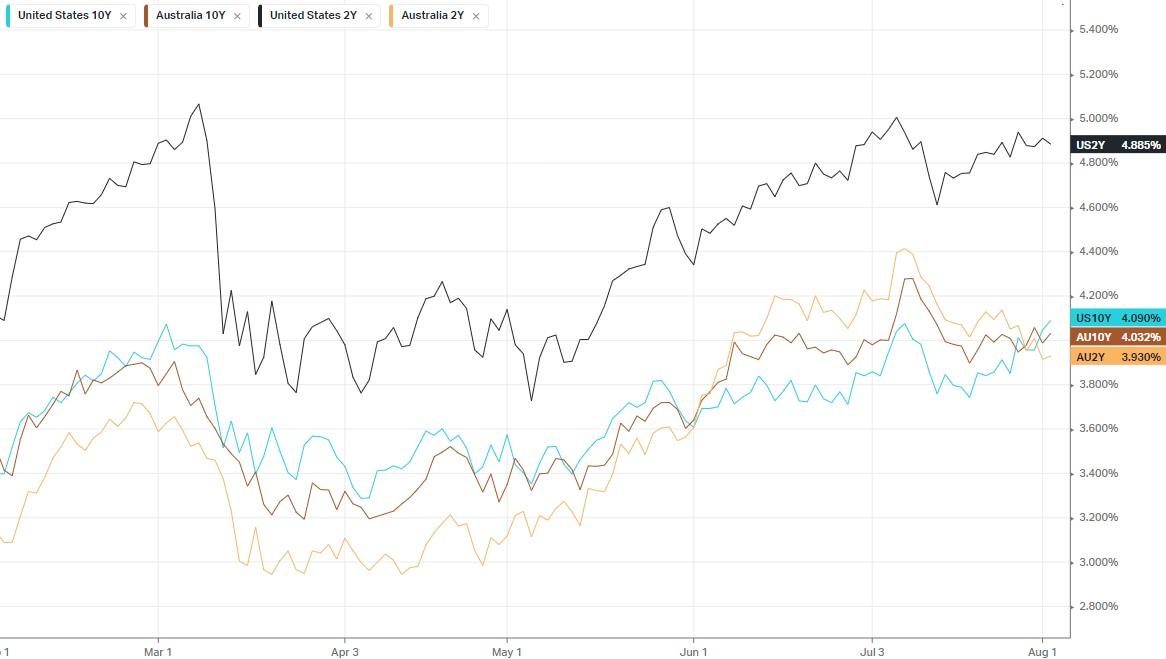

S&P 500 - Heatmap

The Day Ahead

SPI Futures 7241 (-0.79%)

The ASX will start the day lower as a weak lead from the US. The Fitch downgrade of the US and questions over the reality of the AI rally, offered perspective to just how much the market has rallied and if current levels are pricing in too much of a “goldilocks” scenario. This may begin to eat away at investor sentiment, which is key to holding current levels. Tonight sees 2 of the biggest companies in the world deliver earnings, which could reignite the bulls as over 79% of companies have beaten expectations so far in US earnings updates, a positive sign for the upcoming AU earnings season which kicks off next week with CBA, SUN, BLD, QBE and NCM delivering FY results