Overnight Equities – Equities Edge lower, US Credit rating downgraded

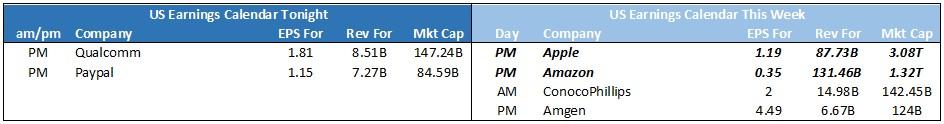

The S&P500 and Nasdaq closed weaker on Tuesday, the first day of seasonally slow August, ahead of U.S. jobs data and major companies’ earnings reports later this week. U.S. stocks ended July on a strong footing, as investors welcomed better-than-expected earnings. Support also came from hopes of a soft landing for the economy which has stayed resilient as inflation has cooled with rising interest rates. The benchmark S&P 500 hit a 16-month high on Monday, and is less than 5% away from breaching its record high closing level notched on Jan. 3, 2022. The DOW however, edged out a small gain as Caterpillar added 8.9% as the global economic bellwether reported a rise in second-quarter profit, though it warned of a sequential fall in current-quarter sales and margins. A string of better than expected earnings results has seen U.S. second-quarter earnings expectations to fall 5.9% from a year earlier, compared with a 7.9% decline estimated a week earlier. Shares of megacap growth companies such as Tesla and Amazon.com whose valuations drop when borrowing costs rise, fell as the benchmark 10-year U.S. Treasury note yield climbed over 4%. After the market closed AMD reported better than expected earnings, rallying 5% and credit agency, Fitch, Downgraded the US Governments credit rating due to its debt levels, market reaction was muted to the downgrade

Corporate Earnings

Caterpillar – Heavy machinery manufacturer and, Caterpillar added 8.9% reporting a rise in second-quarter profit. The stock, often regarded as an “economic bellwether” did warn of a sequential fall in current-quarter sales and margins.

Uber – Ridesharing app, Uber, fell 5.7% after its third-quarter guidance overshadowed second-quarter results, missing analyst estimates on both the top and bottom lines. The company also reported its first quarter of free cash flow of over $1 billion and its first operating profit.

Norwegian Cruise Lines – slumped 12% after the cruise company’s third-quarter guidance fell short of estimates and overshadowed its better-than-expected second-quarter earnings.

Pfizer – Pfizer reported mixed quarterly results as earnings topped, but revenue fell short of estimates. The company also cut its full-year revenue guidance warning of “near-term revenue challenges.”

Merck & Company – meanwhile, reported a narrower loss as second-quarter revenue topped analyst estimates, underpinned by the strength of its cancer drug Keytruda.

S&P 500 - Heatmap

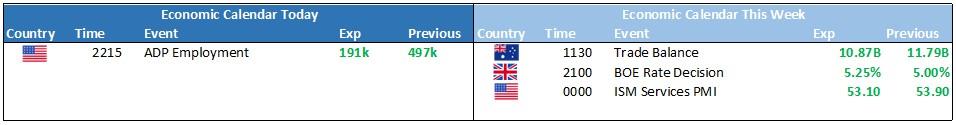

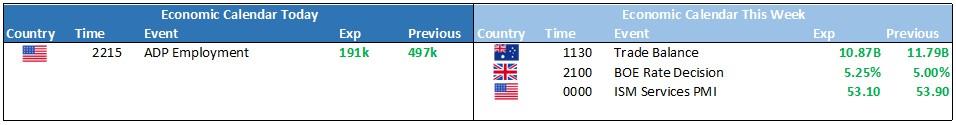

The Day Ahead

SPI Futures 7360 (-0.52%)

The ASX is likely to have a breather from its recent positive run as a weak offshore lead and a downgrade of the US Governments credit rating are likely to initially weigh on markets. Ratings agency Fitch on Tuesday downgraded the United States long-term foreign currency ratings to AA+ from AAA, reflecting expected fiscal deterioration over the next three years as well as a high and growing general government debt burden. On the positive side, many analysts have softened their peak rate expectations after yesterdays RBA pause which could see some buying in the financials