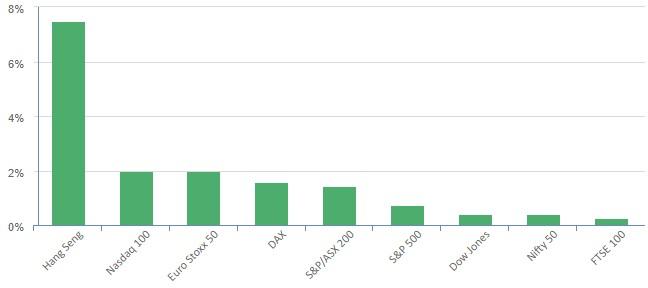

Overnight Equities – S&P500 Notches up 5th Consecutive Month of Gains

Equities closed higher Monday to wrap up a second-straight positive month for July after shrugging off a dip in health care as energy stocks racked up gains. Energy stocks were led higher by a more than 3% surge in Chevron after the oil major was upgraded by Goldman Sachs, citing potential for strong growth. Energy stocks were also led higher by climbing oil prices to multi-month highs on bets of tightening global supply and rising demand. Johnson & Johnson fell 4% after the judge on Friday rejected the company’s plan to place its subsidiary LTL Management into bankruptcy, known as a Texas two-step strategy, to deal with tens of thousands of legal claims alleging its talc caused cancer. DexCom was also a drag on health care, falling 6% giving up its recent gains despite raising its annual revenue forecast last week. Oil and gold rallied despite a rallying USD as investors continued to call the end of the Fed hiking cycle with only 19% of economists polled calling for a rate hike in September. The big test of this theory will be US employment numbers on Friday and the stock markets continued resilience which could lead to more hikes.

S&P 500 - Heatmap

The Day Ahead

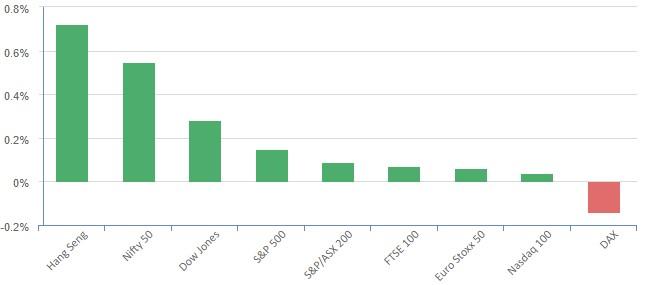

SPI Futures 7358 (+0.34%)

The ASX should have a positive morning with commodities, energy and financials offering a firm lead. the focus will then switch to the RBA rate decision at 1430 where traders and economist are split on whether the RBA will hike or leave rates unchanged. With optimism at euphoric levels, we expect this rally to continue for a least the next few weeks over AU earnings season, which should provide good opportunities.