Closing Bell

3 Things Affecting Markets

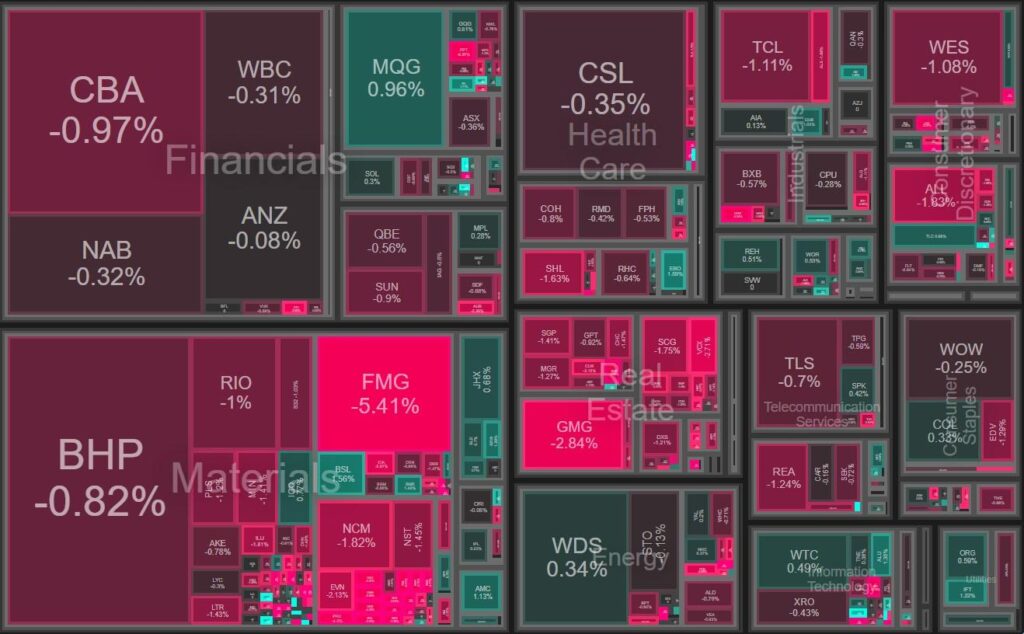

- Bank of Japan – the BOJ adjusted its YCC sending long term bond yields higher

- Australian Retail Sales – Fell 0.8%, well below expectations of flat, hurting retailers

- Iron ore – Fell for a third day in a row, down nearly 6% this week

ASX Today 7403.6 (-0.70%)

The ASX gave back yesterdays gains as optimism over a peak in the hiking cycle and China stimulus were dampened by economists reviewing the recent central bank statements. The rise in the USD hurt commodity prices and iron ore took a tumble on the “imminent” stimulus in China that hasn’t arrived. In Asia, stocks fell, with Japan’s Nikkei logging steep losses after somewhat hawkish messaging from the Bank of Japan, while Chinese shares outperformed on hopes of more stimulus measures. The Bank of Japan’s ultra-low interest rate policy was one of the few remaining forces anchoring long-term bond rates. So long as the trillions of Japanese capital could earn only 0.5 per cent on 10-year bonds, they were forced to venture to bond markets such as the United States and Australia for yield enhancement. If the BoJ is prepared to loosen that peg – the obvious implication is for other long-term bond rates to rise. And if long-term bond rates increase, higher yields mean higher discount rates on risk assets such as equities, and lower prices. Oil was headed for the longest run of weekly gains in more than a year on an improving macroeconomic outlook and signs of a tighter market.

Leader

SDR 21% rally was driven by the release of the hotel software company’s trading update. Siteminder revealed that it expects to report a 30.5% increase in revenue to $151.4 million for FY 2023

No news or updates

Livewire article

https://www.livewiremarkets.com/wires/patriot-s-imminent-lithium-resource-could-see-the-shorts-taken-down

No news or updates

No Significant News.

Laggards

Follow thru selling on Regis Resources softer cost and production guidance for the 2024 financial year.

Negative quarterly update

No significant news

5.5B in fund outflows and flagged higher costs

Falling Iron Ore prices