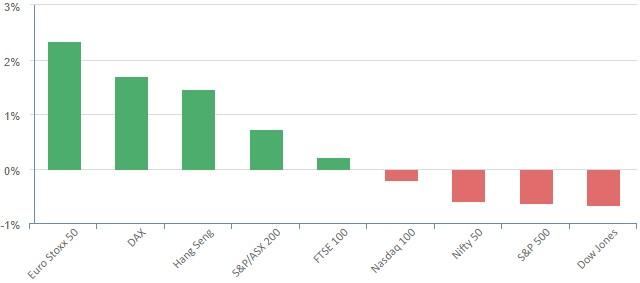

Overnight Equities – Dow snaps longest win streak since 1987

The Dow snapped a 13-day win streak Thursday as rally in Meta was offset by weakness in financials and airline stocks amid underwhelming quarterly results and resilient US GDP in the face of an aggressive bout of Federal Reserve policy tightening. The world’s biggest economy expanded by 2.4% on an annual basis in the April to June period, according to preliminary data from the Commerce Department on Thursday. Economists had called for growth of 1.8%. Fed Chair Jerome Powell left the door open for another increase in September saying the decision was “data dependant” but markets are only pricing in a 20% chance of a similarly sized jump at that meeting which poses a potential downside risk.

Corporate Earnings

Intel – shares surged more than 6% after-hours following the company’s reported Q2 results, with EPS of 13 cents coming in better than the consensus estimate of for a loss of 4 cents. Revenue fell 15% year-over-year to $12.9 billion, beating the consensus estimate of $12.09 billion

eBay – meanwhile, the online auction site slumped 10% after its earnings guidance for the current quarter missed analyst estimates and overshadowed better-than-expected second-quarterly results.

Meta – rallied more than 4% after the social media giant reported guidance and second-quarter results that topped Wall Street estimates, driven by strong advertising growth. UBS lifted its target on the stock to $400 from $335, on expectations that future earnings would likely be “supported by continued improvement in reels adoption and monetization, other new ad formats, solid engagement growth, a healthier macro environment.:”

Wills Tower Watson – the Insurance company, cut its outlook on 2024 earnings after reporting second-quarter earnings that fell short of estimates, sending its shares more than 8% lower and pushing the broader financials in the red. The company said the outlook included an “expected decline in pension income of approximately $1.65 per share.”

S&P Global – fell more than 7% failing to impress on the earnings stage as financial information and analytics firm reported quarterly earnings that missed analyst estimates.

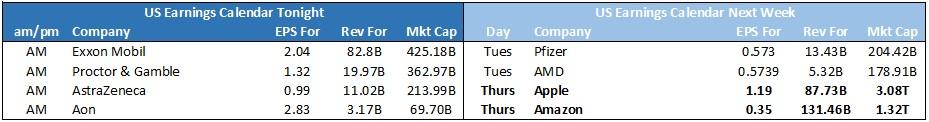

Tonight sees two of the major oil companies deliver updates and Healthcare giants P&G and AstraZeneca

S&P 500 - Heatmap

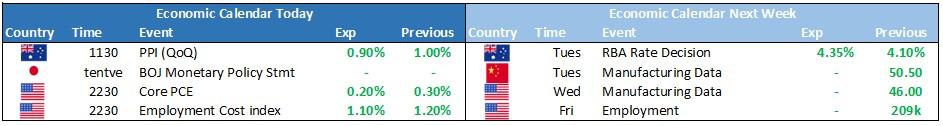

The Day Ahead

SPI Futures 7367 (-0.59%)

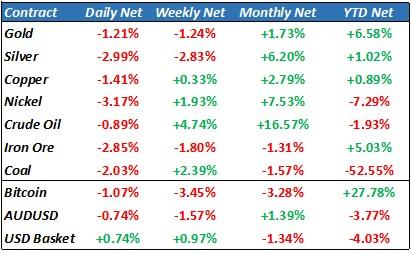

The ASX is in for a rough day with major commodities falling on a strong USD and the Financials one of the weaker sectors in the US. We currently sit at high levels of optimism with expectations of China stimulus and no more rate hikes, which are hugely presumptuous from investors. Big names like BHP and CBA are trading with 5% of record highs which flies in the face of even the companies own outlooks. We maintain caution is very warranted at these levels