Closing Bell

3 Things Affecting Markets

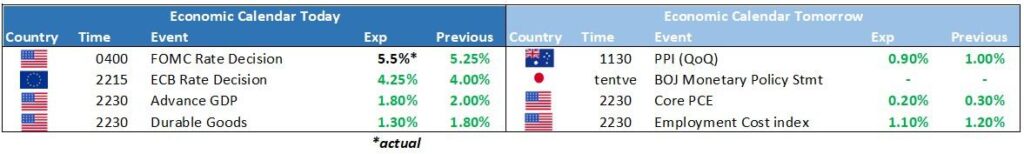

- Rate Cycle Optimism – Investors have seemingly decided the fight against inflation is done

- Asian tech – Korean and Chinese tech stocks rallied on speculation of the end of the hiking cycle

- ECB Decision – the meets tonight, widely expected to deliver another rate hike

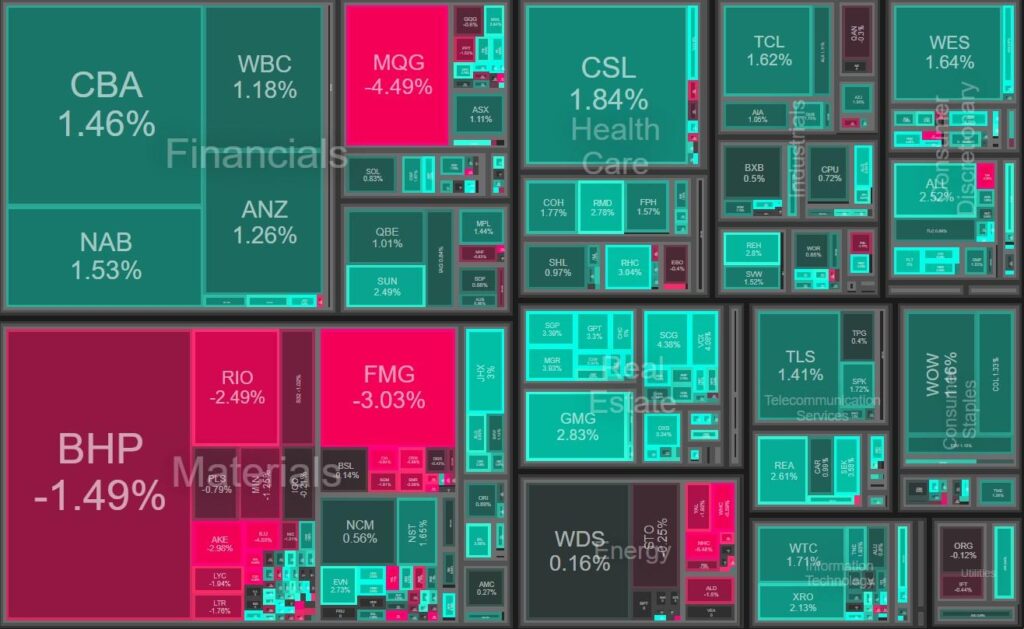

ASX Today 7455.9 (+0.73%)

The ASX had a positive day as optimism the RBA is close to done due to yesterday’s inflation data. The Index rose 0.73%, or 53.2 points, to 7455.9 buoyed by the technology, Financial and real estate sectors. The market seemed comfortable dismissing the Fed leaving the door open to more hikes. In our view this complacency will prove to be a mistake and likely add to a sell off if investors have jumped the gun on rates (for the 3rd time this year)

Technology stocks were among the best performers, up 2.7 per cent. WiseTech shares jumped 2 per cent, Xero added 2.8 per cent, Nextdc rose 3.2 per cent and Technology One climbed 2.4 per cent. Software company Megaport surged 10.5 per cent after it reached the top end of its earnings guidance. The real estate sector rallied 2.9 per cent and was led by gains in Goodman Group, advancing 2.8 per cent. Westfield parent Scentre rose 2.9 per cent and Mirvac jumped 3.3 per cent. Investment bank Macquarie tumbled 4.4 per cent following reports that its profit took a hit. Iron ore giant Fortescue Metals lost 1.3 per cent even as it beat analysts’ expectations and delivered at the top end of its target for the year to June 30.

Leader

Software company Megaport surged 10.5 per cent after it reached the top end of its earnings guidance.

Fund manager Perpetual increased its holding in healthcare provider Healius.

Sandfire Resources Produces 31,000 Tonnes of Copper Equivalent in Fiscal Q4; Shares Jump 7%

Positive quarterly update

No Significant News.

Laggards

Regis Resources flagged softer cost and production guidance for the 2024 financial year.

No Significant News.

Positive QTR update

No Significant News.

Lowered profit guidance at the AGM