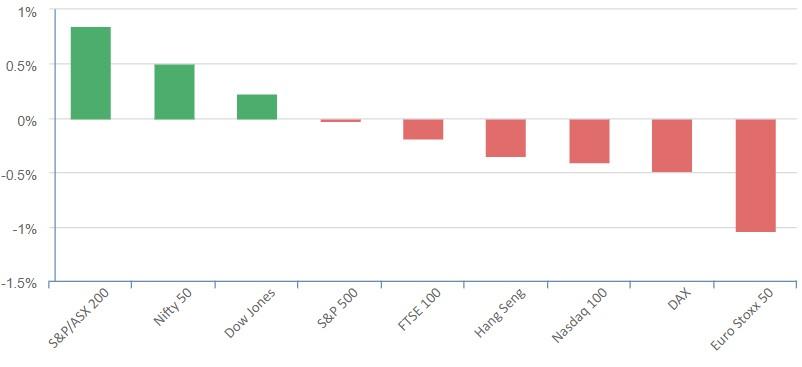

Overnight Equities – Investors bury their heads in the sand as Fed raises and doesn’t rule out more

The DOW extended its win streak to a 13th straight day, as investors buried their head in the sand as the Federal Reserve raising interest rates to the highest level in 22 years and a Microsoft-fuelled stumble in tech. The Federal Reserve raised interest rates by a quarter-point on Wednesday, and signalled a need to see further signs of slowing price pressures to declare victory on inflation. Powell acknowledged recent economic data showing slowing inflation in June was welcomed, but it was “only one report in one month’s data”, and didn’t rule out more hikes as the market was expecting saying “we’re going to need to see more data.”. He also added that the board does not see inflation back to the target band until 2025

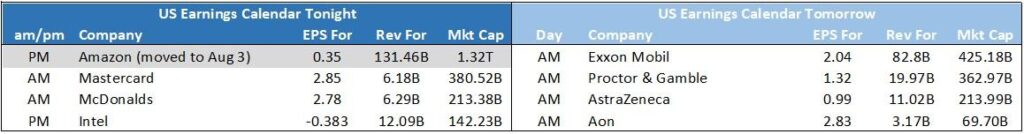

Corporate news – Meta was the focus for investors, delivering better than expected results after the bell. Boeing rallied more than 8% after reporting a smaller-than-expected loss in the second quarter and the aircraft maker detailed plans to ramp up projections. Snap also faltered on the earnings stage, falling more than 14% after its third-quarter guidance on sales missed Wall Street estimates. The social media company did, however, report better-than-feared quarterly results.

Meta +7.58%** – Meta Platforms reported better-than-expected guidance after the social media giant’s second-quarter results that topped Wall Street expectations, driven by a jump in advertising revenue. The better-than-expected results come as the company continued to make progress on its ‘year of efficiency’ pledge in 2022 and advertising revenue grew. Advertising revenue rose 12% to $31.50B year-on-year in Q2 from the prior-year earlier. Looking ahead, the company said it expects third quarter revenue to be in the range of $32B to 34.5B, beating estimates for $31.2B.

**at 730am in afterhours trade

Texas Instruments -5.42% – Texas Instruments, a semiconductor bellwether, fell more than 5% on fears about weak chip demand after forecasting revenue for the September quarter below Wall Street estimates, in line with Taiwan’s TMSC and Korea’s Hynix, the 2 largest chip manufacturers in the world who have both delivered dour outlooks.

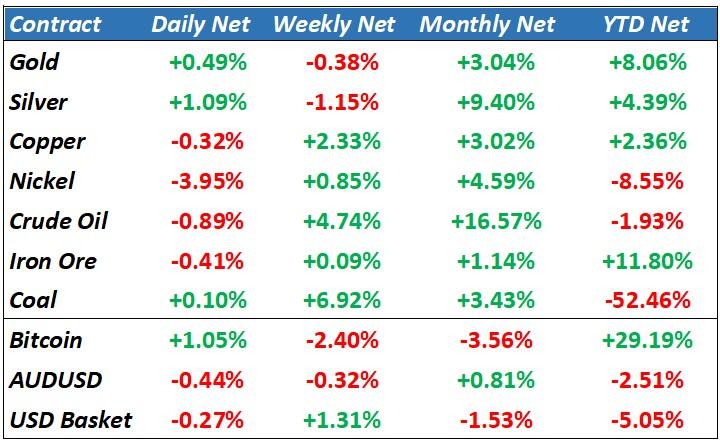

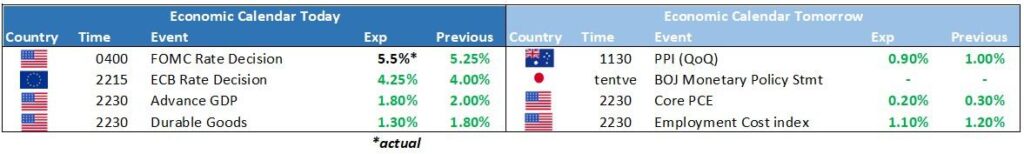

Looking ahead, the ECB will meet tonight and are expected to deliver another 25bp hike, while advance GDP numbers for the US will be released tonight and Core PCE, the Feds preferred measure of inflation released Friday night

S&P 500 - Heatmap

The Day Ahead

SPI Futures 7338 (+0.01%)

The ASX is likely to have an initial surge from the offshore lead and drift for the remainder of the day due to key Central Bank meetings and a huge amount of US earnings in the middle of the week. PLS and S32 give quarterly updates today which could see some action in both stocks. We remain cautious due to possible hawkishness from the Fed and the unlikelihood that earnings from the Mega-caps can justify their current high valuations