Closing Bell

3 Things Affecting Markets

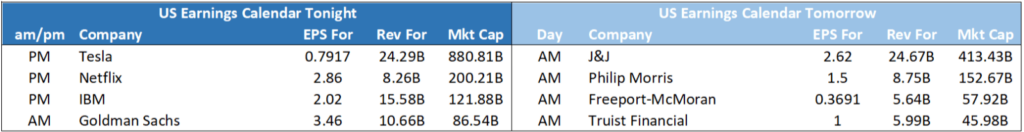

- US Bank earnings – Morgan Stanley and Bank of America beat Wall St estimates.

- China – Still no stimulus despite weakening economic numbers have investors concerned.

- US earnings – Tesla and Netflix tonight

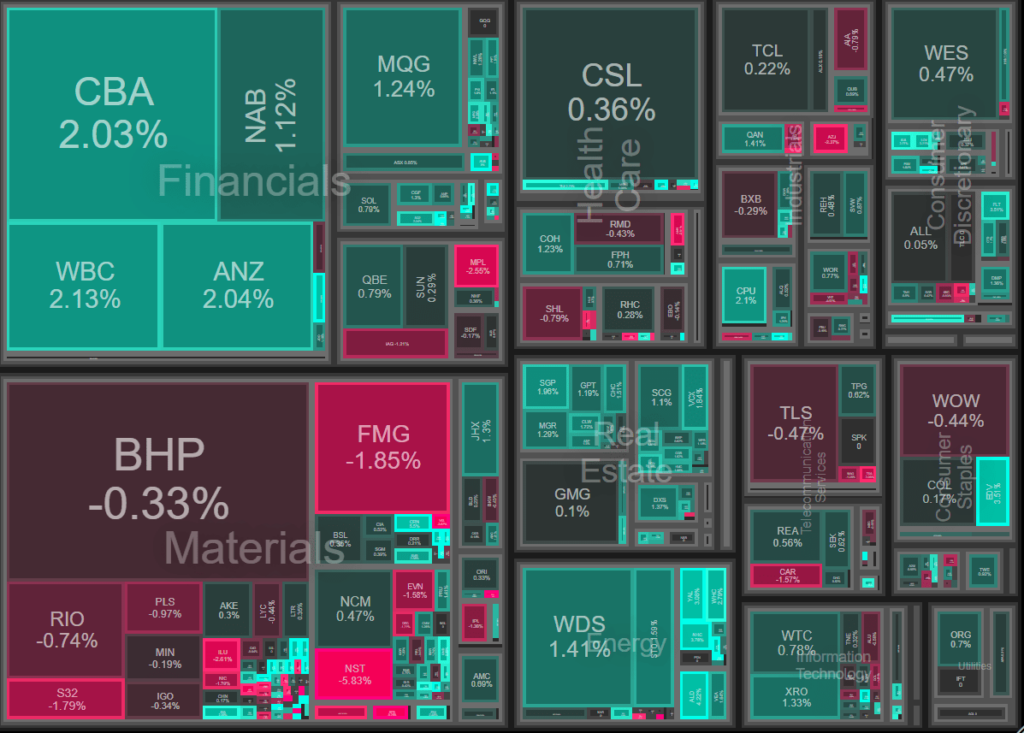

ASX Today

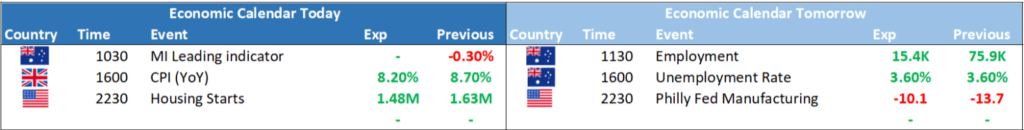

The ASX index experienced a rise today, absent of any new catalysts, propelled mainly by robust bank earnings in the US. Several elements influenced this upward movement:

US data that was released overnight stirred increased speculation that the Federal Reserve is on the brink of concluding its current rate hike cycle.

While this optimism boosted the market, Chinese markets continued to underperform due to the gloomy economic outlook.

Positive regional stock movements were inspired by an encouraging overnight session on Wall Street. The better-than-expected bank earnings and a lower-than-anticipated rise in retail sales suggested a slowdown in inflationary pressures.

This information sparked expectations that an upcoming 25 basis point hike by the Fed towards the end of July could be its final for the near future, encouraging investors towards risk-oriented assets.

However, it’s worth noting that larger mining companies posed a drag on the index. This was largely due to a 1.5% fall in iron, fueled by persistent concerns over the health of the Chinese economy.

Leader

No Significant News.

No Significant News.

No Significant News.

No Significant News.

No Significant News.

Laggards

Northern Star Resources tumbled 5.4 per cent. It expects 1600 to 1750 thousand ounces of gold to be sold with all in sustaining costs at $1730 to $1790 per ounce for financial 2024.

No Significant News.

No Significant News.

No Significant News.

No Significant News.