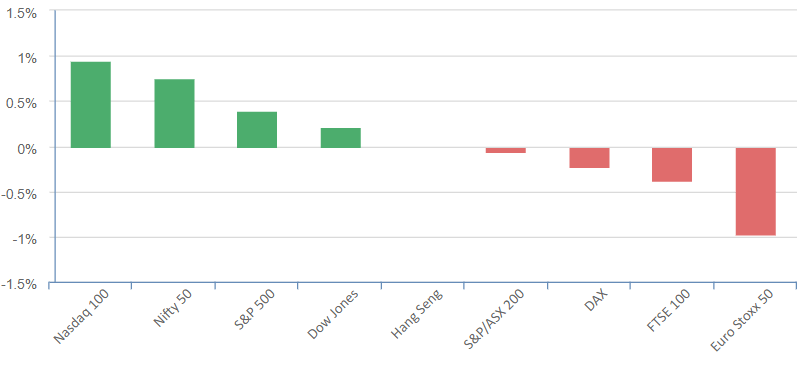

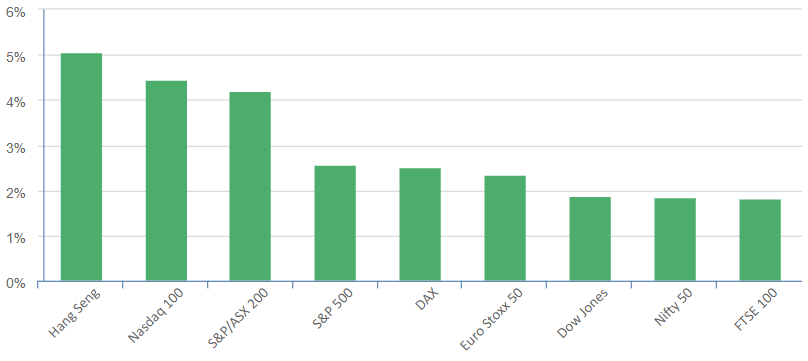

Equities experienced a slight increase on Monday, primarily led by the technology and financial sectors. Investors are eagerly anticipating more quarterly results from Wall Street banks and other major corporations later this week. However, it should be noted that broader market gains were slightly curtailed due to a stumble in the telecommunications sector.

Breaking this down further:

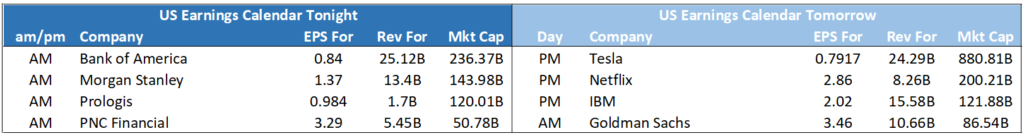

- The financial sector rallied by more than 1% as investors anticipate more indications of strength in banks. This is particularly in anticipation of quarterly results from Bank of America and Morgan Stanley due on Tuesday and Goldman Sachs due on Wednesday.

- Investor sentiment on major banks was enhanced last week following better-than-expected quarterly results from JPMorgan and Wells Fargo. However, Citigroup proved to be an exception, as its earnings fell short of analyst expectations.

- That being said, the broader expectation is that regional banks may deliver tougher results.

In the technology sector:

- Both Apple and NVIDIA played pivotal roles in pushing the broader tech sector higher by more than 1%.

- This was largely due to an AI-driven optimism, which continues to persist ahead of tech earnings.

S&P 500 - Heatmap

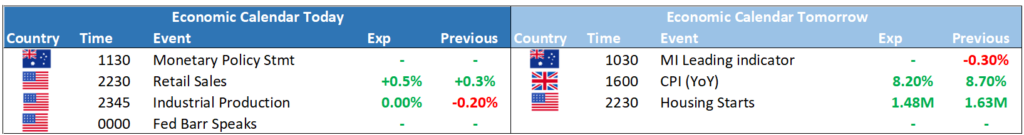

The Day Ahead

Today, the focus will be placed squarely on the RBA’s Monetary Policy Statement, set to be released at 11:30. With an incoming Governor, this serves as an opportunity for the RBA to potentially critique the previous management, akin to when new CEOs take charge at a company.

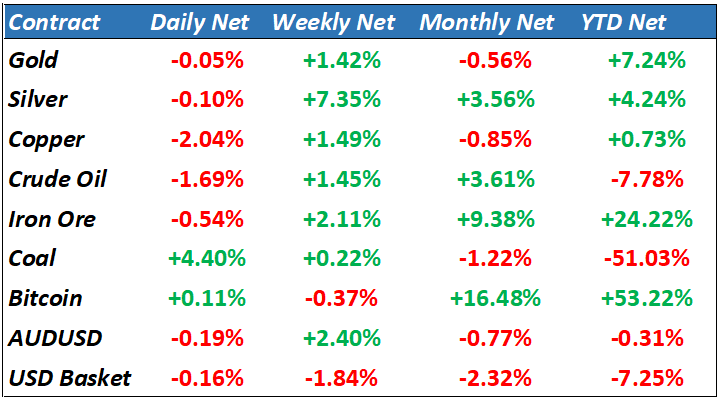

China’s economic health will also be closely monitored, particularly in light of yesterday’s lackluster GDP figures. On the sector front, banking stocks are expected to benefit from offshore lead, whereas the materials sector is anticipated to exert a downward pressure on the market.

As we venture further into the U.S. earnings season, caution prevails especially regarding tech earnings. The season kicks off with Tesla and Netflix, with their results set to be announced on Wednesday night.