What's Affecting Markets Today

Asia-Pacific markets were subdued on Monday as investors weighed China’s pledges of economic support and developments in regional trade negotiations. China’s Finance Minister Lan Fo’an pledged “more proactive macroeconomic policies” to achieve the country’s growth targets, according to a government statement. Investors await further details at a press conference scheduled later today.

Mainland China’s CSI 300 and Hong Kong’s Hang Seng Index were little changed amid choppy trading. Japan’s Nikkei 225 rose 0.37 per cent, while the Topix advanced 0.9 per cent. South Korea’s Kospi edged up 0.13 per cent, though the Kosdaq slid 1.04 per cent. In India, the Nifty 50 climbed 0.74 per cent and the BSE Sensex added 0.34 per cent. Australia’s S&P/ASX 200 gained 0.65 per cent.

Investors are closely monitoring U.S. trade policy developments after President Trump signaled a reduced likelihood of further pauses to reciprocal tariffs, according to Bloomberg.

Meanwhile, U.S. futures slipped ahead of a busy earnings week. On Friday, the S&P 500 rose 0.74 per cent, the Nasdaq gained 1.26 per cent, and the Dow inched up 0.05 per cent.

ASX Stocks

ASX 200 - 8,012.2 (+0.60%)

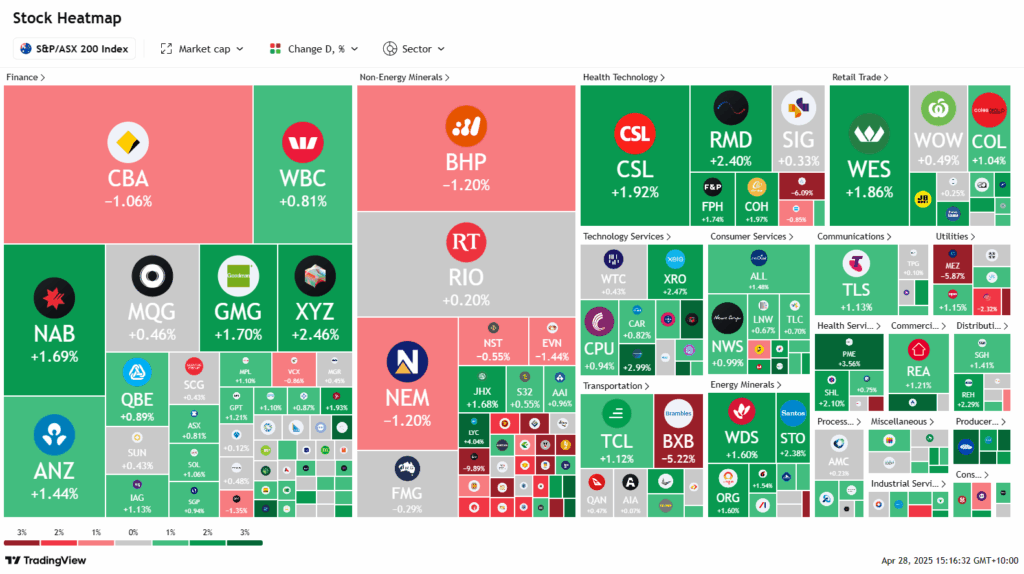

The Australian sharemarket advanced on Monday, buoyed by positive momentum from Wall Street and easing concerns over global trade tensions. The S&P/ASX 200 rose 0.7 per cent, or 56.1 points, to 8024.3 by 2pm AEST, while the All Ordinaries gained 0.7 per cent. Technology led gains, with 10 of 11 sectors trading higher.

On Wall Street, the S&P 500 climbed 0.7 per cent on Friday after the White House signaled plans to negotiate with trade partners. Tesla surged 9.8 per cent, and Alphabet rallied following strong earnings, pushing the Nasdaq more than 1 per cent higher.

Locally, tech stocks mirrored Nasdaq’s gains, with NextDC up 4 per cent and TechnologyOne 3.3 per cent higher. Banks also strengthened, led by ANZ’s 2 per cent rise after a Citi upgrade. Miners lagged as iron ore prices fell to near $US97 a tonne, dragging BHP down 1.4 per cent.

Key movers included Ainsworth, soaring 32.4 per cent on a takeover deal, while Brambles fell 5.3 per cent after revising guidance. Telix Pharmaceuticals and Bravura Solutions also posted notable declines.

Leaders

RSG Resolute Mining Ltd (+6.92%)

ILU Iluka Resources Ltd (+5.37%)

ALQ ALS Ltd (+4.44%)

MP1 Megaport Ltd (+4.20%)

AMP AMP Ltd (+4.13%)

Laggards

BVS Bravura Solutions Ltd (-10.43%)

PNR Pantoro Gold Ltd (-9.18%)

ADT Adriatic Metals Plc (-7.65%)

CU6 Clarity Pharma (-7.42%)

TLX TELIX Pharma (-6.51%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!