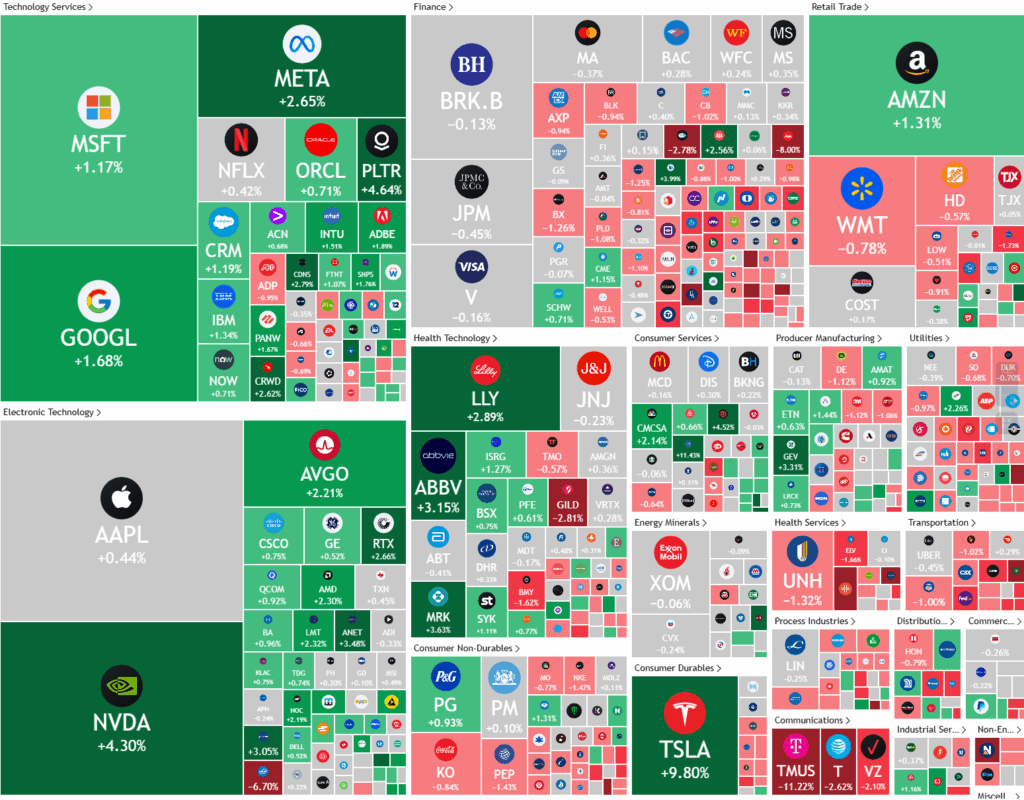

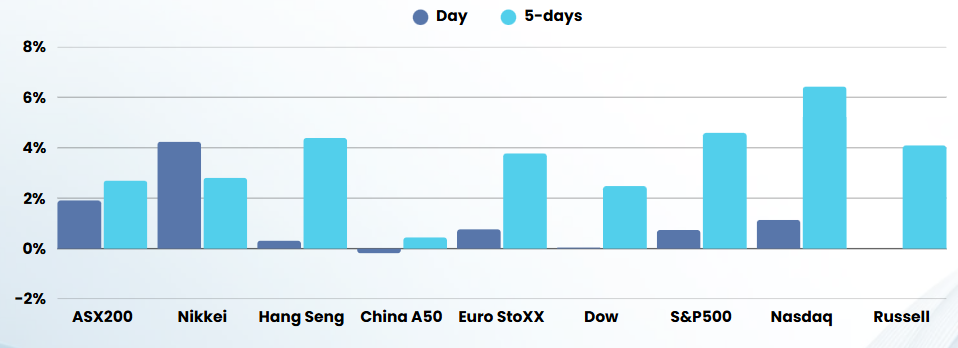

Thursday – The S&P 500 exited correction territory after a robust three-day rally, gaining 1.8% on Thursday and marking its longest winning streak since January. This surge was driven by strong performances in the technology sector, particularly from Amazon and Nvidia, whose executives dismissed fears of a slowdown in AI data center demand, citing continued robust growth prospects. The rally was further buoyed by President Donald Trump’s remarks that the U.S. and China had met regarding trade, although details remained vague and Beijing denied active negotiations. Despite lingering uncertainty over tariffs and mixed signals from Washington, investor sentiment improved, lifting the S&P 500 by 4.6% and the Nasdaq by 6.7% for the week, even as the Dow lagged behind.

Corporate earnings presented a mixed picture: Nvidia and Amazon both saw shares rise over 3% on optimism about AI infrastructure, while IBM fell more than 6% despite posting better-than-expected results. Other notable moves included Southwest Airlines rising 3.7% after announcing schedule cuts, Hasbro jumping 14% on strong digital gaming revenues, and Texas Instruments climbing 6.5% following an upbeat outlook. Meanwhile, PepsiCo dropped over 4% after cutting its profit forecast due to supply chain issues, and Chipotle edged up 1.6% despite missing revenue estimates and lowering its sales outlook. Economic data showed jobless claims rising modestly but remaining within expectations, underscoring persistent concerns about the broader impact of ongoing tariff uncertainty

Overnight – Stocks finish with best week of the year so far, led by Google earnings

Friday – Stocks closed sharply higher for the week Friday as Alphabet’s better-than-expected quarterly results stoked fresh optimism on artificial intelligence, extending the recent rally in tech.

Despite these robust results, Alphabet faces ongoing challenges. The company reaffirmed its ambitious $75 billion capital expenditure plan for 2025, aimed at expanding data center and AI infrastructure, even as global trade tensions and new U.S. tariffs threaten to increase costs. While investors welcomed the commitment to AI, some remain cautious about the immediate financial returns and the impact of higher equipment prices due to tariffs. Legal risks also linger, with a federal judge set to evaluate remedies in an ongoing antitrust case over Alphabet’s dominance in ad-tech, which could affect the company’s future operations and market position.

Broader market sentiment was mixed amid Alphabet’s strong showing. While the tech sector rallied on renewed optimism for AI-driven demand, other corporate earnings painted a more cautious picture, with Intel and T-Mobile both posting disappointing results. Meanwhile, President Donald Trump’s comments about maintaining high tariffs on foreign goods injected fresh uncertainty into the market, even as China signaled possible exemptions for some U.S. products. Economic data showed consumer sentiment dipping less than expected, but the focus for investors remains on how companies like Alphabet will navigate ongoing macroeconomic and regulatory headwinds while sustaining their growth in AI and cloud computing

Company Earnings

- Google – Alphabet reported a standout first quarter in 2025, with revenue rising 12% year-over-year to $90.2 billion and net income soaring 46% to $34.5 billion, both figures surpassing Wall Street expectations. Earnings per share hit $2.81, well above the anticipated $2.01, while the company also announced a $70 billion stock buyback and a 5% increase in its quarterly dividend. Alphabet’s core businesses-Google Search, YouTube, and Google Cloud-all delivered double-digit growth, with advertising revenue up 8% and cloud revenue jumping 28%. CEO Sundar Pichai credited the strong performance to Alphabet’s “full-stack approach to AI,” highlighting the rollout of Gemini 2.5, the firm’s most advanced AI model, and the rapid adoption of AI-powered features like AI Overviews, now used by 1.5 billion people monthly.

- T-Mobile – stock dropped 11% after the telecommunications company added fewer wireless subscribers than expected in the first quarter, as rivals dialed up promotions in a saturating U.S. telecom market.

- Colgate-Palmolive – stock was 1% higher after the consumer goods company slashed its full-year guidance for organic sales, becoming the latest company to cite possible headwinds from aggressive U.S. tariffs, although it still delivered better-than-anticipated first-quarter earnings.

ASX SPI 8078 (+0.02%)

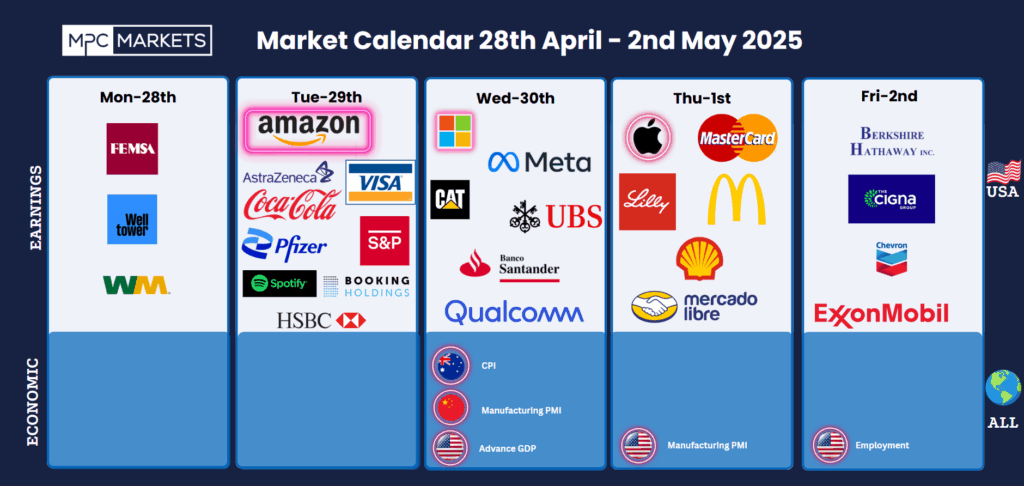

After 2 solid days of gains in the US, we will see the some catch up played in the AU market. There is a full calendar ahead this week with Amazon, Apple, Meta and Microsoft, along with AU CPI and election, Manufacturing PMI’s from multiple countries, Advance GDPO from the US and finally US payrolls