What's Affecting Markets Today

Asia-Pacific Markets Rally on Easing Trade Tensions and Fed Stability

Asia-Pacific equities advanced on Wednesday, buoyed by Wall Street’s strong overnight performance and renewed optimism over U.S.-China trade relations. U.S. President Donald Trump indicated that final tariffs on Chinese exports would not approach the previously stated 145%, though he confirmed they would not be eliminated entirely. His assurance that Federal Reserve Chair Jerome Powell will serve out his term further calmed investor nerves around central bank independence.

Hong Kong led regional gains, with the Hang Seng Index climbing 2.48% and the Hang Seng Tech Index rising 3.21%. Mainland China’s CSI 300 edged up 0.22%.

Japan’s Nikkei 225 rose 2.09%, while the broader Topix added 2.05%. South Korea’s Kospi gained 1.51% and the Kosdaq increased 0.93%. India’s Nifty 50 rose 0.64%, with the Sensex up 0.56%. Australia’s S&P/ASX 200 advanced 1.22%.

U.S. futures extended gains following Trump’s remarks on Powell. Overnight, the Dow surged 1,016.57 points (+2.66%) to 39,186.98. The S&P 500 added 2.51%, while the Nasdaq jumped 2.71% to 16,300.42.

ASX Stocks

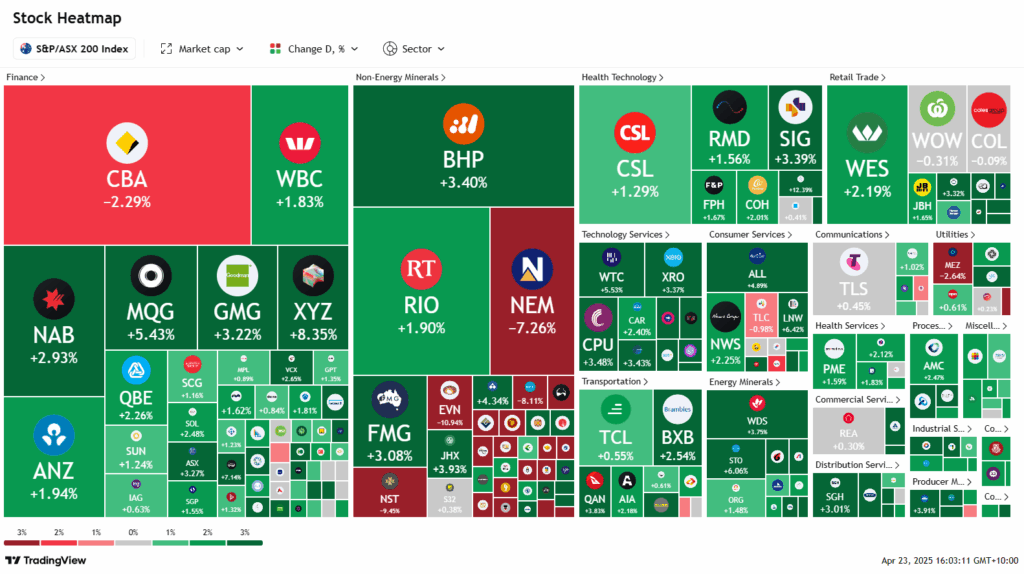

ASX 200 - 7,925.5 (+1.40%)

Australian Shares Surge as Tariff Relief Sparks Rally

Australian equities rallied on Wednesday, tracking a strong rebound on Wall Street after US President Donald Trump signaled a potential rollback of tariffs on China from the current 145 per cent. The S&P/ASX 200 jumped 1.3% to 7920.9 by 2pm, while the All Ordinaries gained 1.4%. Energy led gains across all 11 sectors, as iron ore and crude prices climbed on easing trade tensions.

BHP rose 3.1%, Woodside climbed 4%, and Santos advanced 5.7%. Technology shares also surged, with WiseTech up 4.8% and NextDC gaining 4%, mirroring a strong US tech rebound driven by Tesla’s 5% gain in after-hours trade.

Uranium miner Paladin Energy soared 26% on record output at its Langer Heinrich mine. Telix Pharmaceuticals jumped 9.8% on a 62% revenue increase. Conversely, gold stocks retreated as spot gold prices fell—Evolution Mining and Genesis Minerals dropped over 10%.

Cettire plunged 22.6% on weak US demand linked to tariffs. Capricorn Metals fell 11.8% after suspending its CEO over assault charges. Commonwealth Bank eased 1.6% after Tuesday’s rally.

Leaders

PDN Paladin Energy Ltd (+24.50%)

DYL Deep Yellow Ltd (+11.98%)

TLX TELIX Pharmaceuticals Ltd (+11.60%)

BOE Boss Energy Ltd (+8.82%)

A4N Alpha Hpa Ltd (+8.73%)

Laggards

OBM Ora Banda Mining Ltd (-14.85%)

RMS Ramelius Resources Ltd (-13.78%)

SPR Spartan Resources Ltd (-12.56%)

VAU Vault Minerals Ltd (-11.11%)

CMM Capricorn Metals Ltd (-10.77%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!