What's Affecting Markets Today

Asia-Pacific markets traded cautiously on Tuesday, mirroring the sell-off on Wall Street after U.S. President Donald Trump escalated his pressure on Federal Reserve Chairman Jerome Powell, reigniting concerns over central bank independence.

Japan’s Nikkei 225 and Topix indexes were flat, while South Korea’s Kospi edged up 0.19% and the Kosdaq added 0.16%. Hong Kong’s Hang Seng Index slipped 0.25%, and China’s CSI 300 fell 0.17% at the open.

U.S. stock futures were steady in early Asia trade. Dow futures dipped 18 points, while S&P 500 and Nasdaq 100 futures hovered near unchanged levels.

The declines follow a sharp drop overnight in U.S. equities. The Dow Jones Industrial Average fell 971.82 points, or 2.48%, to close at 38,170.41. The S&P 500 declined 2.36% to 5,158.20, and the Nasdaq Composite lost 2.55% to 15,870.90.

Trump’s renewed criticism of Powell, calling for immediate rate cuts, has injected uncertainty into markets already rattled by a lack of progress in global trade negotiations. Powell reaffirmed last week that the Fed’s independence is legally protected.

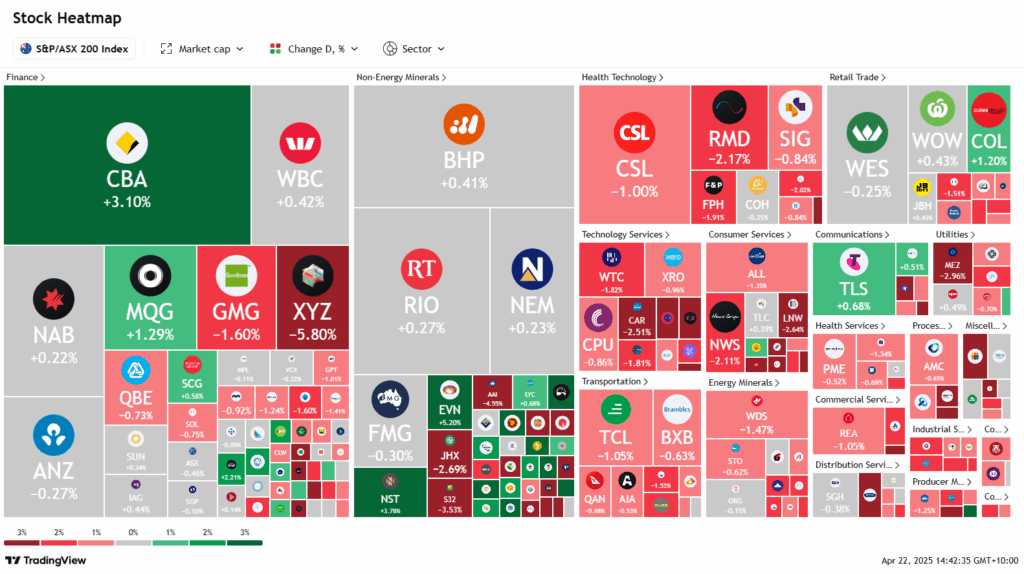

ASX Stocks

ASX 200 - 7,819.4 (+0.30%)

The Australian sharemarket was flat in afternoon trade as gains in Commonwealth Bank helped offset broader market weakness driven by fresh volatility in US markets. The S&P/ASX 200 Index edged down 1.3 points to 7817.8 near 2pm, paring a 1 per cent early decline. Technology led sector losses, while banks and miners provided some support.

Wall Street’s sharp sell-off, following criticism of the US Federal Reserve by President Trump, weighed on sentiment. Trump claimed there was “virtually no inflation” and urged the Fed to cut rates, calling Chair Jerome Powell a “loser”. The comments sent US equities, the dollar, and bond yields lower, while gold surged past US$3400 an ounce.

Locally, Commonwealth Bank climbed 2.3 per cent, helping lift the banking sector. Macquarie rose 2 per cent after selling its public asset management arm to Nomura for $2.8 billion. BHP and Rio Tinto advanced as iron ore prices rose. Meanwhile, Goodman Group and tech names including WiseTech and NextDC weighed on the index. Deep Yellow and Bellevue Gold fell sharply, while AMP gained 0.9 per cent on a Citi upgrade.

Leaders

RSG Resolute Mining Ltd (+9.14%)

WAF West African Resources Ltd (+7.65%)

VGL Vista Group International Ltd (+6.07%)

ADT Adriatic Metals Plc (+5.60%)

DRO Droneshield Ltd (+5.00%)

Laggards

PDN Paladin Energy Ltd (-10.44%)

ZIP ZIP Co Ltd (-7.98%)

DYL Deep Yellow Ltd (-6.04%)

XYZ Block, Inc (-5.87%)

NIC Nickel Industries Ltd (-5.83%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!