Overnight – Fed Chair Powell says “Cuts aren’t coming anytime soon”

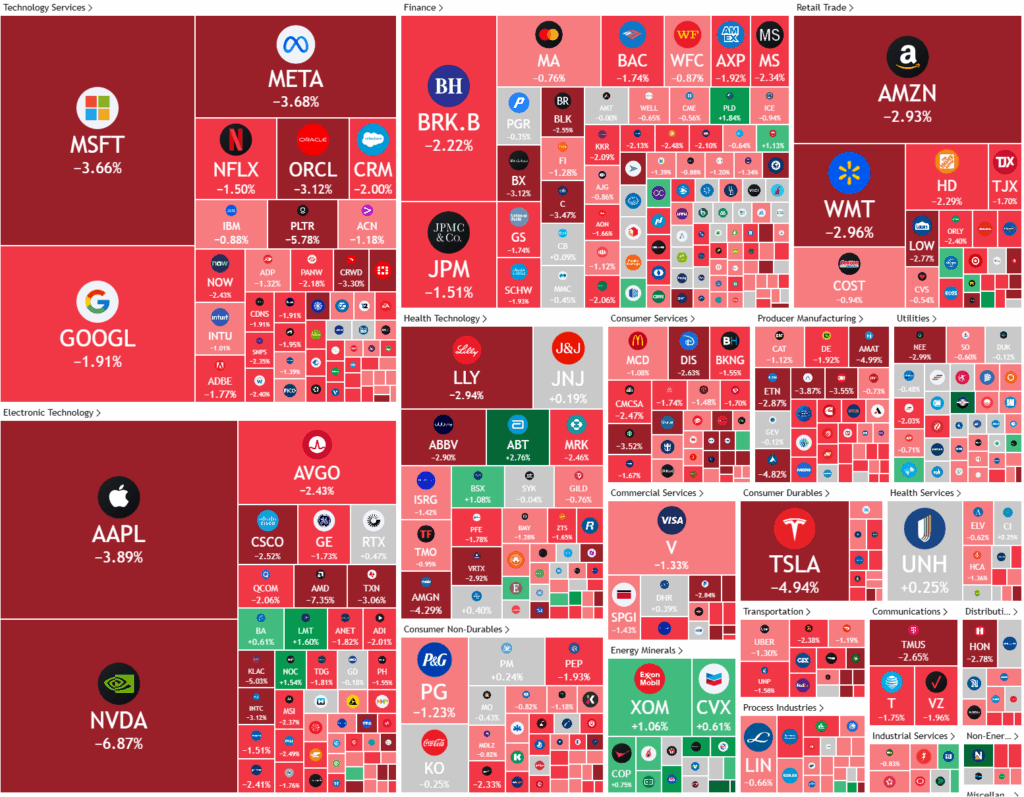

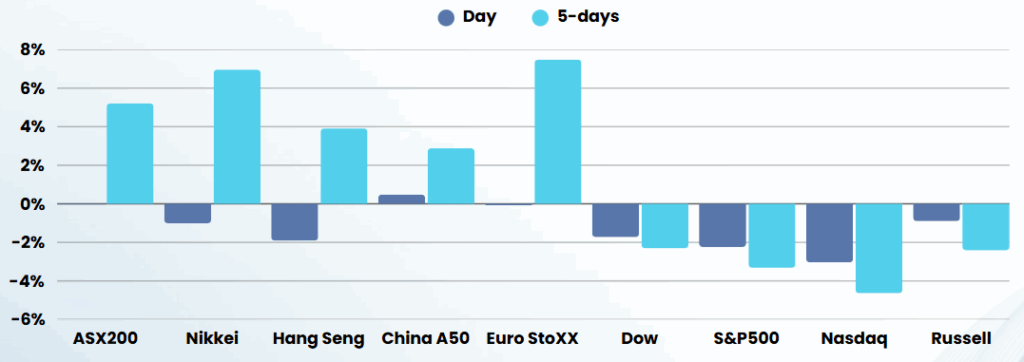

Stocks slumped again overnight, pressured by a Nvidia-led slump in tech and remarks from Federal Reserve Chairman Jerome Powell signaling that the Fed isn’t leaning toward cutting rates any time soon.

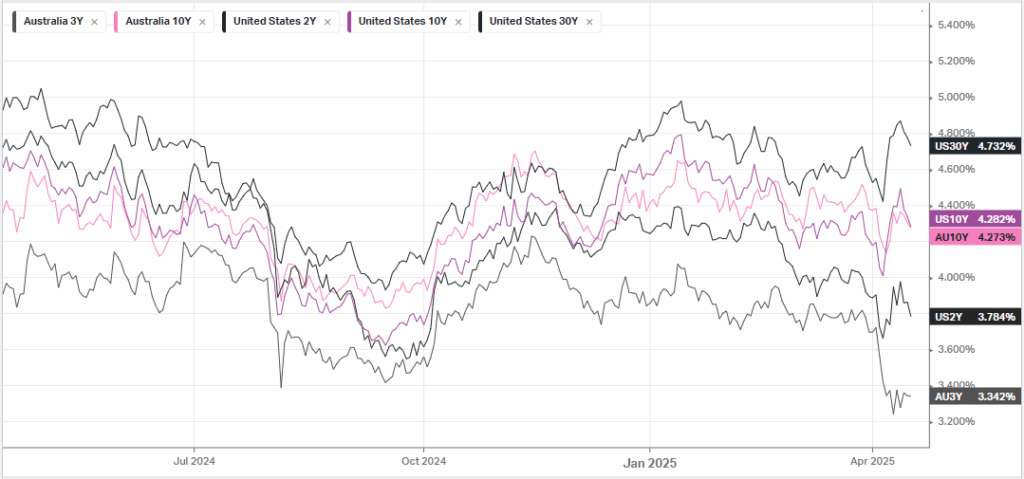

Federal Reserve Chairman Jerome Powell said Wednesday that the Fed was focused on ensuring the impact of tariffs only has a one-time boost to inflation, dashing investor hopes that the central bank could lean toward rate cuts to cushion the potential blow to the economy.

“Our obligation is to keep longer-term inflation expectations well anchored and to make certain that a one-time increase in the price level does not become an ongoing inflation problem,” Powell said in prepared remarks at the Economic Club of Chicago. When asked directly if he would cut rates to support the stock market, “No, with an exclamation point” the bluntest reply from any Fed Chair I’ve ever seen in nearly 30 years watching Central Banks

Nvidia stock fell over 6% after the AI darling said it would be hit by $5.5 billion in charges following a Commerce Department decision to limit exports of its H20 AI chip to its key Chinese market. The H20 is the main AI chip Nvidia is permitted to sell in China under restrictions originally imposed by the Biden administration, as the U.S. sought to close off Beijing’s access to cutting-edge advancements in AI tech. Nvidia’s announcement spooked other chipmakers and technology stocks, amid concerns over even more export restrictions on China, which is embroiled in a bitter trade war with Washington.

Chip-rival, AMD also warned of hit to profit from the China export curbs, forecasting a write off of $800M, sending its shares more than 7% lower. The warnings from the duo of chipmakers come on the heels of Dutch semiconductor equipment ASML warning of softer demand from China after reporting net bookings for Q1 that fell short of estimates. Other chipmakers and AI stocks, including Intel and Broadcom also fell, while major Nvidia supplier TSMC retreated.

U.S. retail sales surged in March, increasing 1.4% last month after an unrevised 0.2% gain in February, as households boosted purchases of motor vehicles ahead of tariffs. Motor vehicle manufacturers reported a big jump in auto sales in March, attributed by some to a rush by buyers “to try and beat the tariffs.” The stronger retail sales data encouraged some economists to boost their estimates of economic growth, which is foolish and naïve.

In short, China needs grain, meat, gas & oil and consumers, most of which can be done by diverting a few ships. The US needs electronics, textiles, battery minerals, construction materials, semiconductors & steel….. and build the factories, source the manufacturing expertise, then find the workers willing to take $6 and hour.

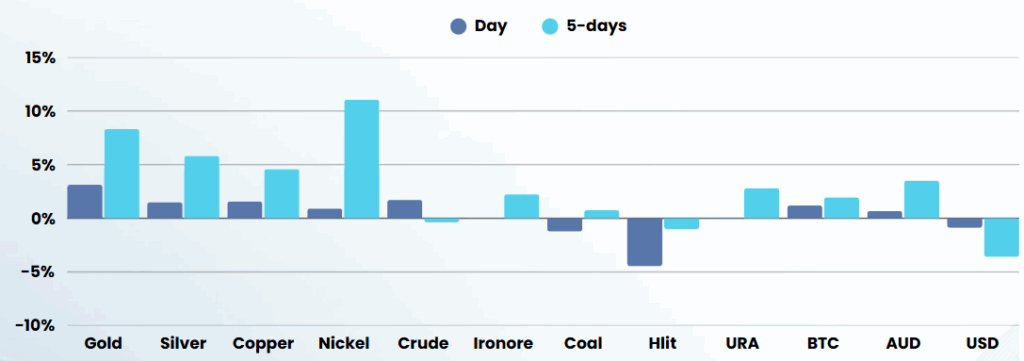

This was further emphasized to markets overnight as China struck a deal with Canada overnight to import oil to replace US supply.

ASX SPI 7760 (-0.33%)

Overnight weakness in the US market and a looming 4-day weekend will mean Investors will be looking for the exit today as they won’t want to risk 4 days of what Trump could possibly do over the easter weekend (who would?!?!)

Encouragingly, the deal between China and Canada on oil overnight, might be a positive for our mining and energy sector as the Chinese are looking far more willing to deal than the US. It won’t make a difference today, but I had to find a silver lining somewhere

Gold miners will rally again, as the plummeting trust in the USD has investors clambering for an alternative.