Ask the Committee a Question!

Turning Trump Tariff Volatility into Opportunity: Insights from the Investment Committee

Summary

The committee delves into the recent volatility in the markets, discussing the implications of AI valuations, cash management strategies, and historical market analysis. The committee share insights on their profitable trading decisions made during periods of high volatility, particularly in the gold market, and provide predictions for future market movements. Emphasis is placed on the importance of having a strategic plan in place to navigate the uncertainties ahead.

Takeaways

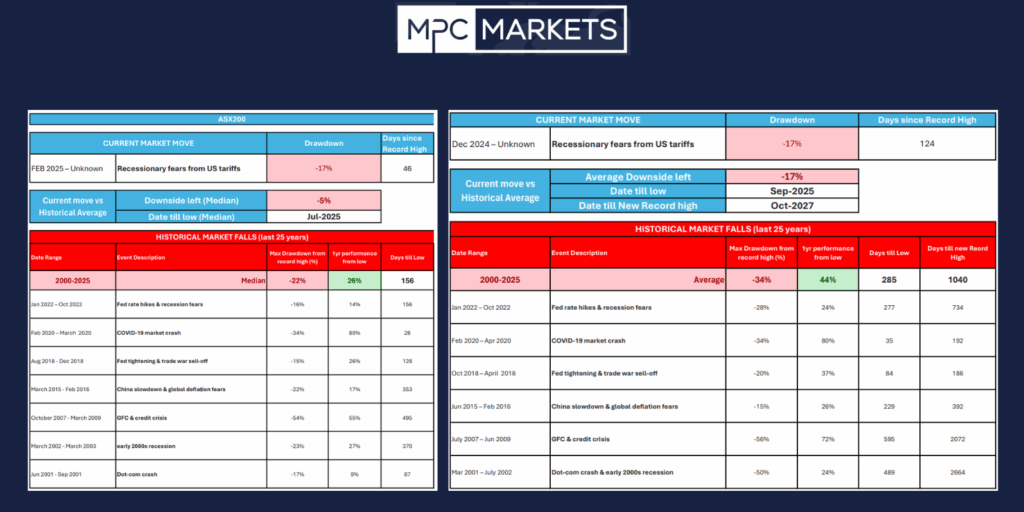

- The recent market volatility felt like a year’s worth of action in a short time.

- Concerns about AI valuations and revenue are prevalent in the market.

- The market has not seen a correction since October 2023.

- Buffett’s cash position provided confidence in investment strategies.

- Trusting historical averages is crucial during market downturns.

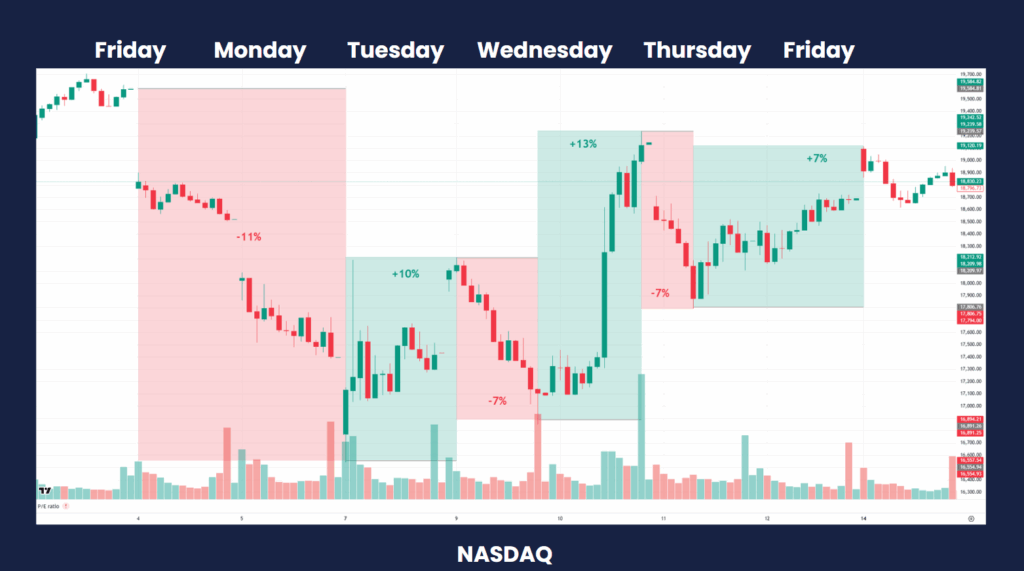

- The week of volatility saw significant market fluctuations.

- Gold miners are currently more profitable than tech companies.

- Strategic buying decisions were made during market dips.

- Future market predictions suggest potential for further volatility.

- Having a solid investment plan is essential for navigating market uncertainties.

Since Week 1 of February, we have been 50-60% cash, 5% Gold miners, 5% Physical Gold

Monday 7th April – we deployed 10% of our cash in MQG, WTC & GEAR ASX200 leveraged Index ETF

Switched Physical Gold ETF to Gold Miners ETF (currently 15.5% better off)

Tuesday 8th April – Bought a Fixed Coupon with a 13%pa coupon for 2 years

GMG -31% from High, WDS -52% from high, WTC -51% from high, with a further 40% barrier

Wednesday 9th April – we deployed a further 10% cash in GMG, CSL & Vaneck Global Healthcare ETF. In the USA we bought NVDA, META, CITI

Thursday 10th April – Took 24% profit in GEAR ASX200 leveraged

Friday 11th April – Sold defensive name WOW (which has outperformed by 16% over the period) with the intent to buy Monday

Monday 14th April – Bought more MQG, CSL, GMG on the open, (+3% already)

Disclaimer: The recommendation given is general advice only. It does not take into account your personal objectives, financial situation, or specific needs. This information should not be your sole resource when making such decisions. We strongly recommend you to seek the advice of financial, taxation, and legal professionals before finalising any investment decisions.