What's Affecting Markets Today

Asia-Pacific markets traded mostly lower on Wednesday as investor sentiment weakened following overnight declines on Wall Street and ongoing concerns over US-China trade tensions. Earnings season results and geopolitical uncertainty weighed on risk appetite.

Hong Kong’s Hang Seng Index led regional losses, falling 2.11%, while China’s CSI 300 dropped 0.84%. This came despite China reporting stronger-than-expected Q1 GDP growth of 5.4%, surpassing economists’ expectations of 5.1%. However, mounting tariff pressures prompted several investment banks to revise their forecasts downward. UBS cut its 2025 GDP forecast for China to 3.4%, and just 3% for 2026, citing a potential 2 percentage point drag from increased US tariffs.

Japan’s Nikkei 225 slipped 0.3%, while South Korea’s Kospi and Kosdaq fell 0.47% and 0.44% respectively, reflecting broader regional caution.

In a further sign of escalating trade tensions, Bloomberg reported that China has instructed domestic airlines to halt deliveries of Boeing aircraft amid the intensifying tariff standoff with the United States—an unexpected move that could pressure both sides toward renewed negotiations.

ASX Stocks

ASX 200 - 7,790.5 (+0.40%)

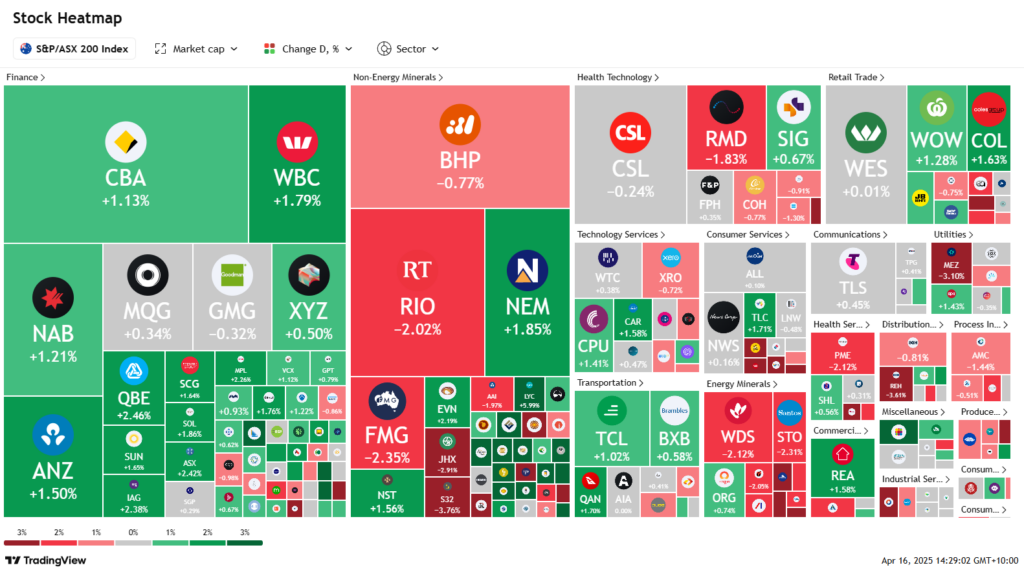

The Australian sharemarket maintained modest gains on renewed hopes of a US-China trade deal, despite lingering global economic uncertainty. By 2pm, the S&P/ASX 200 Index had risen 0.3% to 7782.10, while the All Ordinaries added 0.2%. Financials led six of eleven sectors higher, buoyed by strong US bank earnings and resilience in consumer spending.

President Trump signalled openness to a trade agreement, though the White House expects Beijing to initiate talks. Investor sentiment remained cautious, with US futures trending lower and a Bank of America survey showing equity exposure at a 30-year low.

Locally, Westpac climbed 1.8% and CBA rose 1%. Defensive sectors also advanced, with Woolworths and Coles up 1.3% and 1.5% respectively. Genesis Minerals jumped 9.1% as gold prices approached US$3200.

Conversely, energy stocks retreated, with Woodside down 2.6% and Santos off 2.3%, following a downward oil demand revision by the IEA. Zip surged 19.3% after upgrading FY earnings guidance. Bank of Queensland rose 5.3%, while Star Entertainment fell 2.7% upon trading resumption. Rio Tinto slipped 2.2% on weak iron ore output.

Leaders

ZIP ZIP Co Ltd (+20.95%)

IPX Iperionx Ltd (+12.30%)

GMD Genesis Minerals Ltd (+9.14%)

RRL Regis Resources Ltd (+6.01%)

RMS Ramelius Resources Ltd (+5.83%)

Laggards

SHV Select Harvests Ltd (-15.43%)

PPT Perpetual Ltd (-7.85%)

WA1 WA1 Resources Ltd (-7.33%)

MIN Mineral Resources Ltd (-7.23%)

WHC Whitehaven Coal Ltd (-6.77%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!