What's Affecting Markets Today

Global equities grind higher as US/China tensions ease

Investors remain cautious, awaiting key data such as China’s upcoming GDP report to gauge the impact of recent stimulus efforts.

President Trump is considering further temporary exemptions, particularly for auto tariffs, which spurred gains in technology and automobile stocks across Asia. BlackRock responded by upgrading US equities to “overweight,” though it still views tariffs as a lingering threat to economic growth. In Asia, most markets rose on optimism over potential tariff relief, with Japan’s Nikkei 225, South Korea’s KOSPI, and Singapore’s Straits Times index all advancing, led by tech and auto sectors.

However, Chinese stocks were volatile, fluctuating between gains and losses as the country faces escalating trade tensions with the US and imposed steep retaliatory tariffs. This uncertainty led major banks like UBS, Goldman Sachs, and Citigroup to downgrade China’s 2025 growth outlook, with UBS projecting just 3.4% growth—the lowest among major banks—and casting doubt on China’s ability to meet its 5% target.

In commodities, oil prices remained subdued, with Brent crude around $65 per barrel and WTI near $62, reflecting recession fears and increased OPEC+ output. Constructive US-Iran nuclear talks also raised the prospect of higher Iranian oil exports. Despite the positive momentum from Wall Street and hopes for more US tariff exemptions, gains were tempered by ongoing trade uncertainties and low trading volumes ahead of the Good Friday holiday.

ASX Stocks

ASX 200 - 7,768.1 (+0.25%)

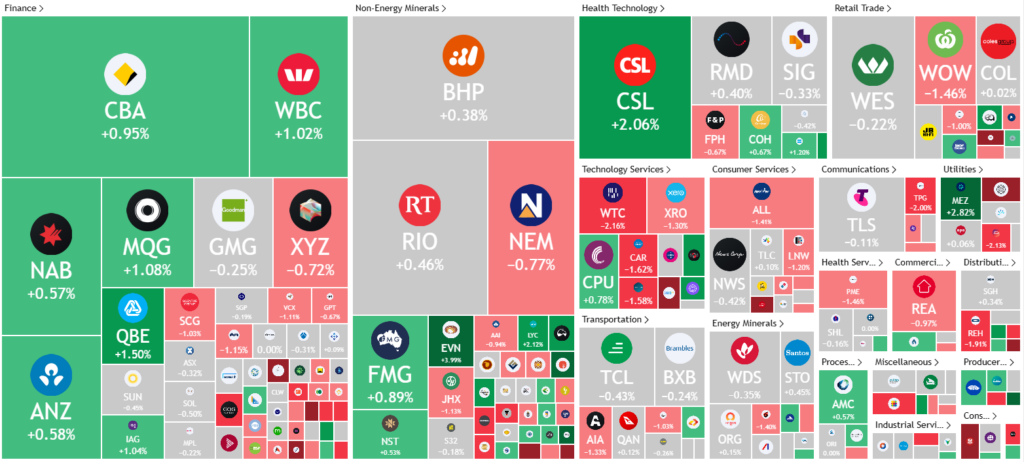

ASX up for second day led by banks and healthcare

The Australian sharemarket extended its gains for a second consecutive day, with the S&P/ASX 200 rising 0.4% to 7,778.7 points, building on Monday’s strong 1%+ advance.

The Reserve Bank of Australia released it April minutes, where it kept the cash rate steady at 4.1%, emphasizing a cautious approach and a commitment to returning inflation to target, with plans to hold government bonds until maturity.

Six of the 11 sectors finished higher, led by healthcare and financials, as defensive stocks like CSL (+2%) and ResMed (+1%) outperformed.

Major banks were key drivers, with Commonwealth Bank, Macquarie, and Westpac all rising between 1.1% and 1.8%. In contrast, technology stocks lagged, with WiseTech and TechnologyOne falling, and Bellevue Gold slumped 22% after a significant share placement.

Corporate news:

- Collins Foods CKF:ASX dropped 4.2%–6.2% after announcing its exit from Taco Bell in Australia,

- Perpetual PPT:ASX fell 1.8%–2.2% on news of surging net outflows

- Accent Group AX1:ASX rose 4%–4.5% after unveiling a partnership to launch Sports Direct in Australia and New Zealand.

- Star Entertainment SGR:ASX reported a $300 million half-year loss amid ongoing regulatory and financial pressures.

Leaders

OBM Ora Banda Mining Ltd (+10.65%)

PDI Predictive Discovery Ltd (+8.57%)

EMR Emerald Resources NL (+7.90%)

EVN Evolution Mining Ltd (+5.88%)

PNRDA Pantoro Ltd (+5.86%)

Laggards

MSB Mesoblast Ltd (-10.52%)

WA1 WA1 Resources Ltd (-8.09%)

DRO Droneshield Ltd (-7.85%)

A4N Alpha Hpa Ltd (-7.64%)

HMC HMC Capital Ltd (-7.29%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!