Overnight – US Stocks miraculously end week higher after trump turmoil

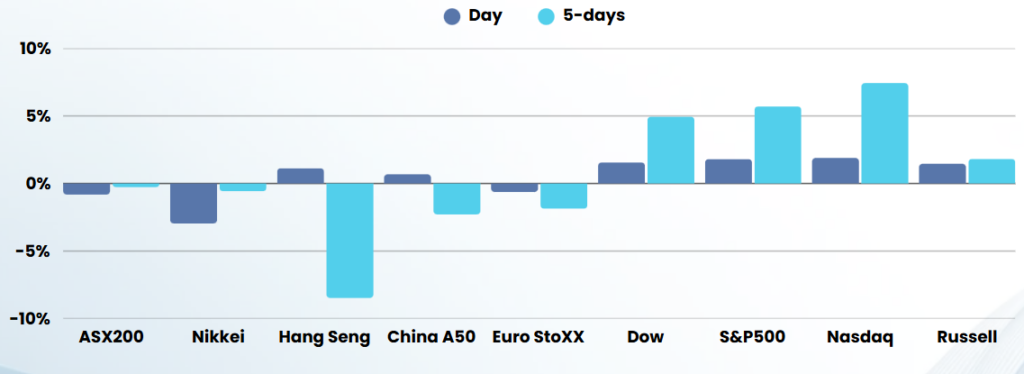

U.S. stocks ended the week on a positive note, with major indexes rising despite ongoing trade tensions and economic uncertainty. The Dow Jones Industrial Average increased by 5% for the week, while the S&P 500 added 5.7%, and the Nasdaq Composite surged 7.3%. This rebound came after a volatile week marked by significant fluctuations in response to President Trump’s tariff announcements and China’s retaliatory measures.

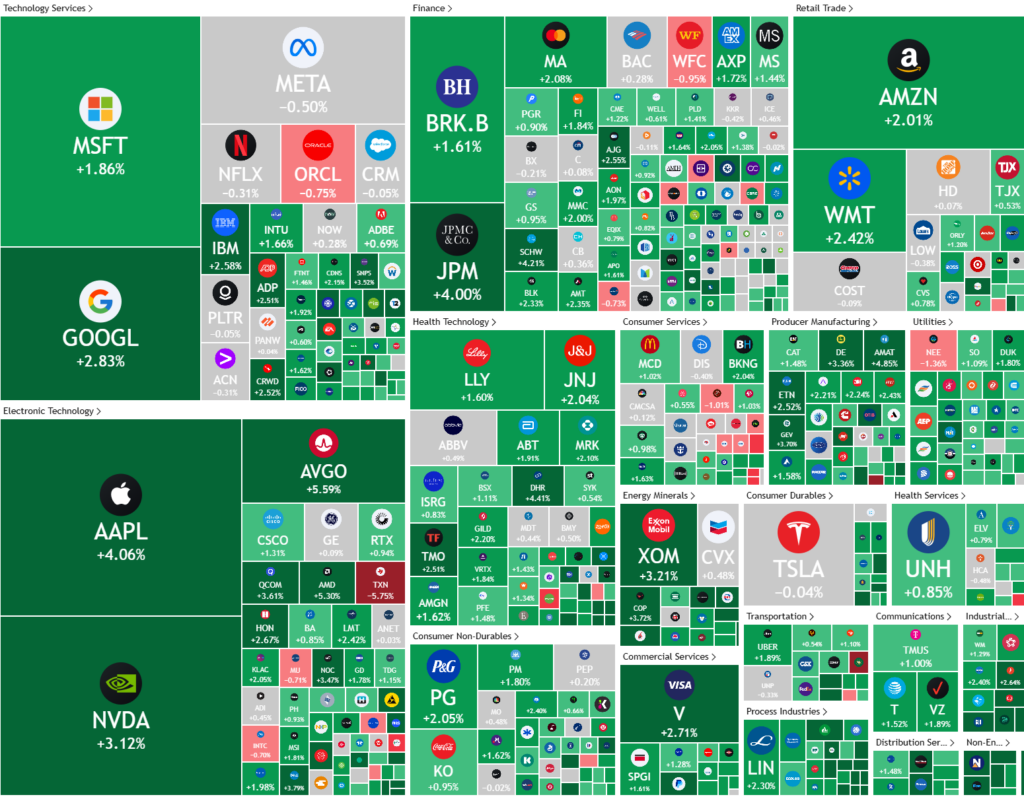

On Friday, key sectors such as Basic Materials, Oil & Gas, and Technology led the gains. Notable performers included Apple Inc., which rose 4.06%, and JPMorgan Chase & Co., which added 4%. Monolithic Power Systems Inc. was the top performer on the S&P 500, increasing by nearly 10%. Conversely, Walt Disney Company and Salesforce Inc. were among the worst performers, with slight declines. The Nasdaq saw dramatic gains in biotech stocks, with HCW Biologics Inc. rising by an astonishing 3,646.94%.

The trade conflict between the U.S. and China intensified, with China imposing tariffs of 125% on U.S. imports in response to Trump’s decision to raise tariffs to an effective rate of 145%. Despite these tensions, investors found solace in strong earnings reports from major banks like JPMorgan Chase and Morgan Stanley. The Federal Reserve’s assurance of maintaining market stability also helped boost investor confidence.

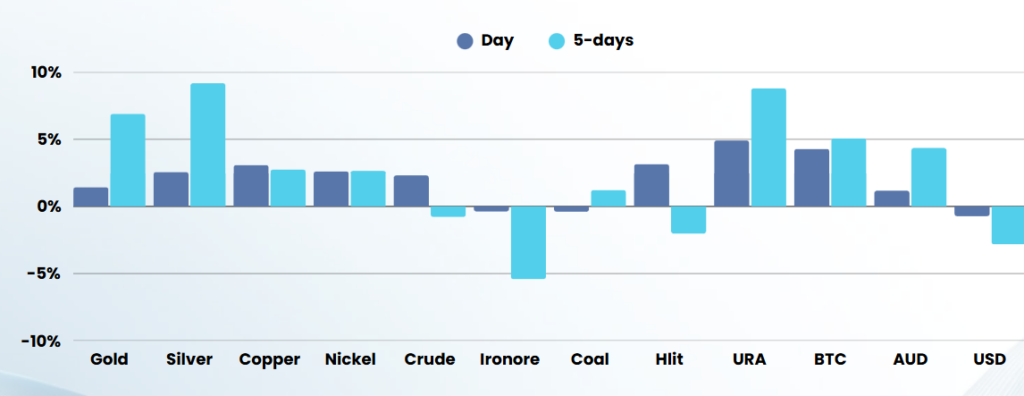

The week’s economic indicators showed mixed signals, with gold prices reaching record highs and oil prices climbing, while the U.S. dollar fell against major currencies. The CBOE Volatility Index decreased, indicating reduced market volatility, but concerns about the trade war’s impact on global growth remain. As the earnings season progresses, investors will closely watch for guidance from U.S. companies on how they plan to navigate the ongoing trade tensions.

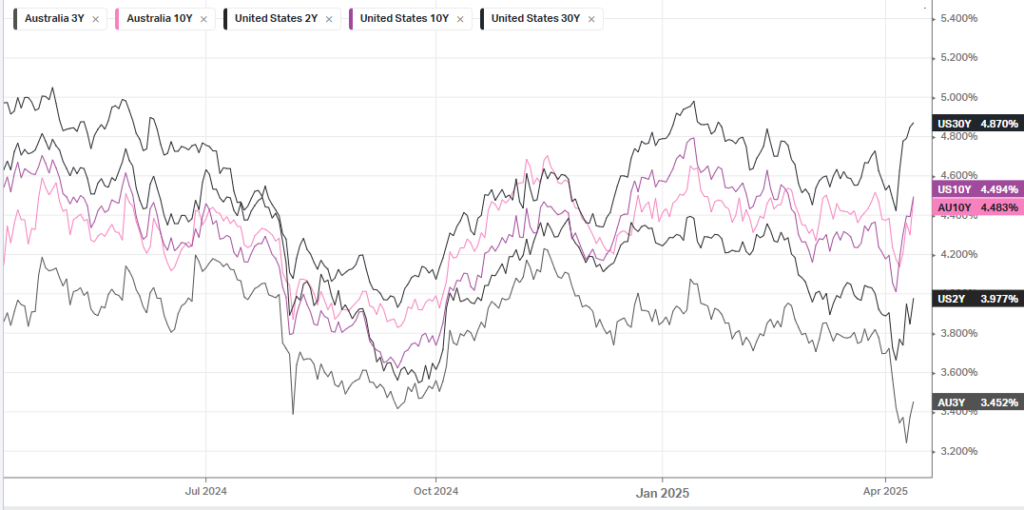

In addition to these developments, the broader economic landscape is expected to continue influencing market dynamics. The rise in Treasury yields, particularly the 10-year note, reflects investor concerns about inflation and economic stability. Meanwhile, the decline in the U.S. dollar against the euro and other currencies suggests a shift in investor sentiment towards safer assets. As global markets adjust to these changes, the resilience of U.S. stocks will be tested by ongoing geopolitical and economic challenges. The upcoming earnings reports will provide crucial insights into how companies are adapting to these conditions, potentially setting the tone for future market movements.

ASX SPI 7678 (+0.23%)

The Trump Tariff circus is likely to calm down with investors being cleaned out of any significant long or short positions after the volatility last week.

We think the next phase will be a grind higher over the coming weeks as investors focus on US company earnings which will be (retrospectively) positive against analyst forward predictions. We may start to see some weakness again as the DOGE job cuts start to show in next months employment data and the CPI starts to show tariffs in the numbers.

All in all we are predicting a rally for the next 4 weeks and the next few weeks are a likely buying opportunity