What's Affecting Markets Today

Asia-Pacific Markets Slide as Trade War Fears Resurface

Asia-Pacific equities declined sharply on Friday as renewed US-China trade tensions reignited risk-off sentiment across global markets. Australia’s S&P/ASX 200 led regional losses, plunging 2.28%. Japan’s Nikkei 225 slumped 5.46%, while the broader Topix shed 5.05%. South Korea’s Kospi dropped 1.55%, with the Kosdaq down 0.11%. Hong Kong’s Hang Seng Index fell 0.8%, and China’s CSI 300 dipped 0.13%.

The pullback followed a renewed sell-off on Wall Street, where all three major US indices gave back gains from the prior session’s rally. The S&P 500 tumbled 3.46%, the Nasdaq Composite sank 4.31%, and the Dow Jones lost 1,015 points or 2.5%.

Market jitters intensified after the White House confirmed the cumulative tariff rate on Chinese imports had risen to 145%, incorporating a new 125% levy and an additional 20% linked to the fentanyl crisis. Although President Trump announced a 90-day suspension on new reciprocal tariffs for most nations, ANZ analysts cautioned the delay “does not alleviate uncertainty,” and ongoing skepticism around trade talks continues to weigh on sentiment.

ASX Stocks

ASX 200 - 7,607.0 (-1.30%)

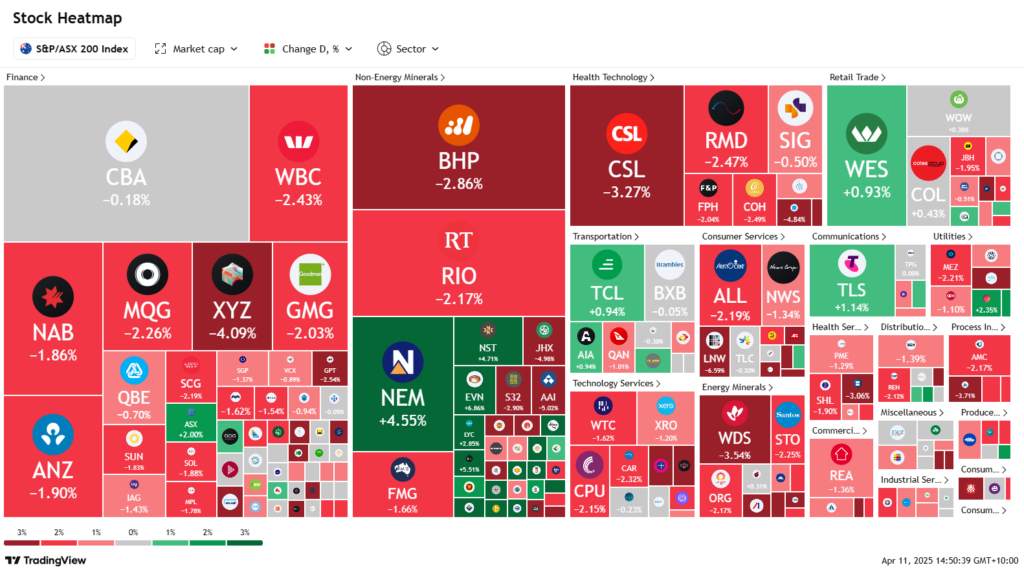

ASX Slumps as US Tariff Shock Deepens Global Market Rout

The Australian sharemarket fell sharply on Friday, extending its weekly losses amid renewed global risk aversion following a third US tariff hike on Chinese imports this week. The S&P/ASX 200 dropped 1.3% or 97.8 points to 7611.8 by 2:15pm, erasing much of Thursday’s five-year record rally. The benchmark is down 0.8% for the week and 4% since the start of April. The All Ordinaries lost 1.2%, with 10 of 11 sectors in negative territory, led by energy.

US stocks tumbled overnight, with the S&P 500 down 3.5% and Nasdaq plunging 4.3% as Tesla fell 7.3%. Markets recoiled after the White House confirmed total tariffs on Chinese goods had increased to 145%. President Trump acknowledged “transition problems” from the policy shift, dampening hopes of a near-term resolution with China.

Energy stocks led declines as oil prices retreated further. Woodside dropped 3.7% and Santos 2.6%, while gold miners rallied on safe-haven flows. Emerald Resources surged 7.8% and Newmont rose 4.3%. Among banks, NAB, Westpac, and Macquarie fell over 2%, while CBA edged 0.1% higher.

Leaders

OBM Ora Banda Mining Ltd (+10.65%)

PDI Predictive Discovery Ltd (+8.57%)

EMR Emerald Resources NL (+7.90%)

EVN Evolution Mining Ltd (+5.88%)

PNRDA Pantoro Ltd (+5.86%)

Laggards

MSB Mesoblast Ltd (-10.52%)

WA1 WA1 Resources Ltd (-8.09%)

DRO Droneshield Ltd (-7.85%)

A4N Alpha Hpa Ltd (-7.64%)

HMC HMC Capital Ltd (-7.29%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!