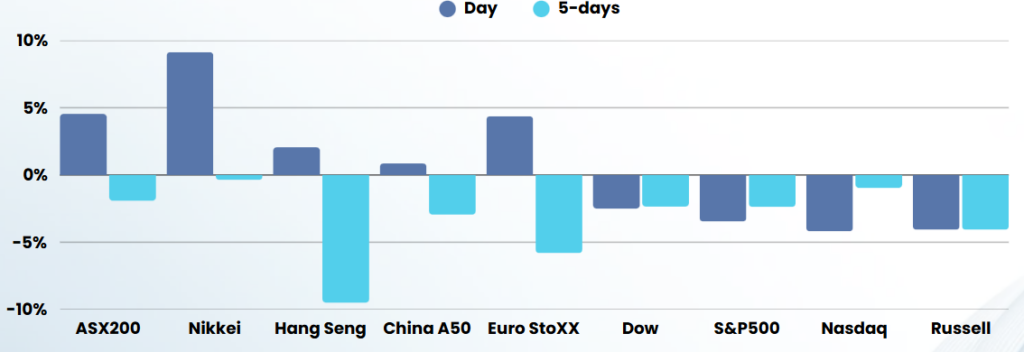

Overnight – Investors sell into yesterday’s gains as the market remains nervous

Investors took the opportunity to sell into yesterdays gains, as nerves remained around Trumps tariff policies

The U.S.-China trade war has intensified with the White House confirming that tariffs on Chinese imports now stand at 145%, following a series of escalations. This development comes after China raised tariffs on U.S. goods to 84% in retaliation against U.S. measures. The heightened tensions have led to market volatility, with stocks closing lower on Thursday. Despite the economic concerns, President Trump remains optimistic about the U.S. economy, while China emphasizes its openness to dialogue based on mutual respect and equality.

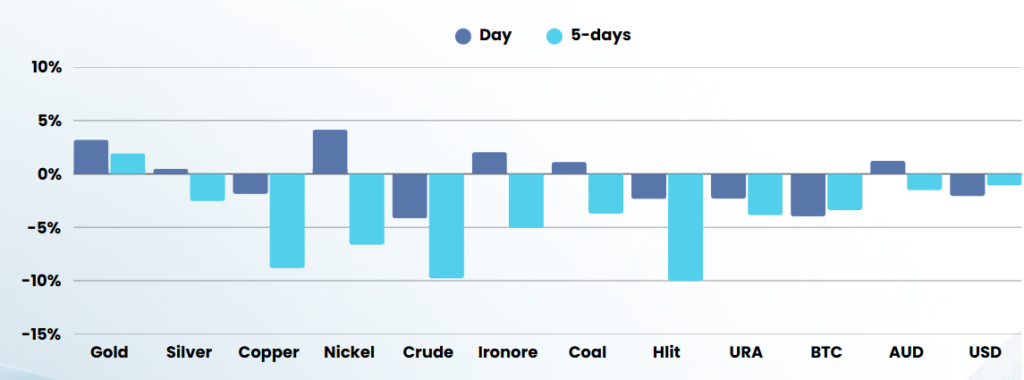

The tariff escalation has significant implications for global markets. Investors are worried that the ongoing trade spat between the two largest economies in the world could easily result in a global recession. Goldman Sachs has cut its growth forecasts for China, now expecting the Asian giant’s real GDP to grow 4.0% in 2025 and 3.5% in 2026, down from its previous forecasts of 4.5% and 4.0%, respectively. This reduction reflects the potential economic damage from prolonged trade tensions.

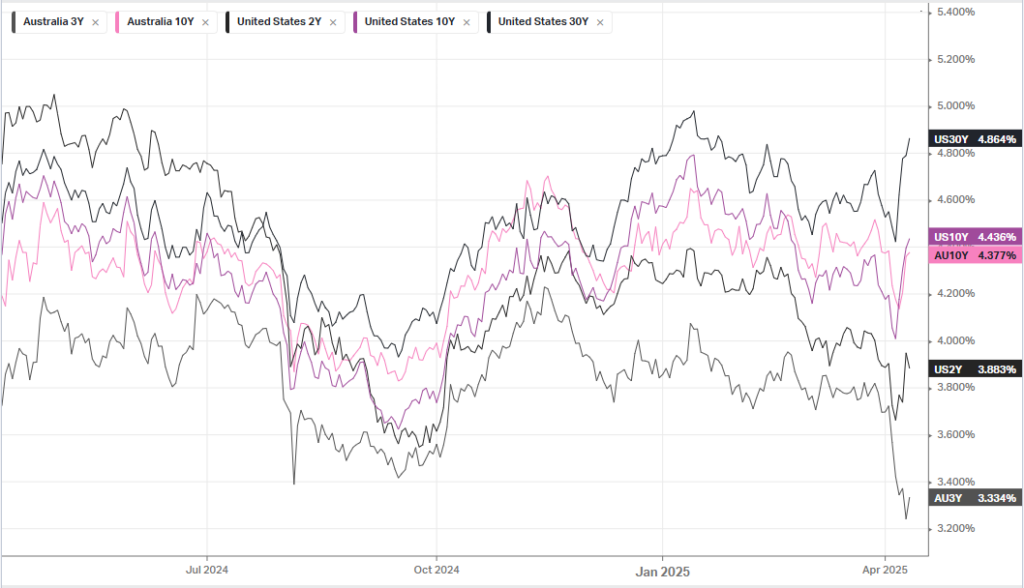

In addition to the trade tensions, recent economic data has shown mixed signals. The U.S. Consumer Price Index (CPI) rose by 2.4% year-over-year in March, which is below expectations, and actually declined by 0.1% on a monthly basis. While these figures suggest weakening inflationary pressures, analysts note that they cover a period before the full implementation of President Trump’s tariffs. As a result, the Federal Reserve may not feel immediate pressure to adjust interest rates based on these inflation numbers.

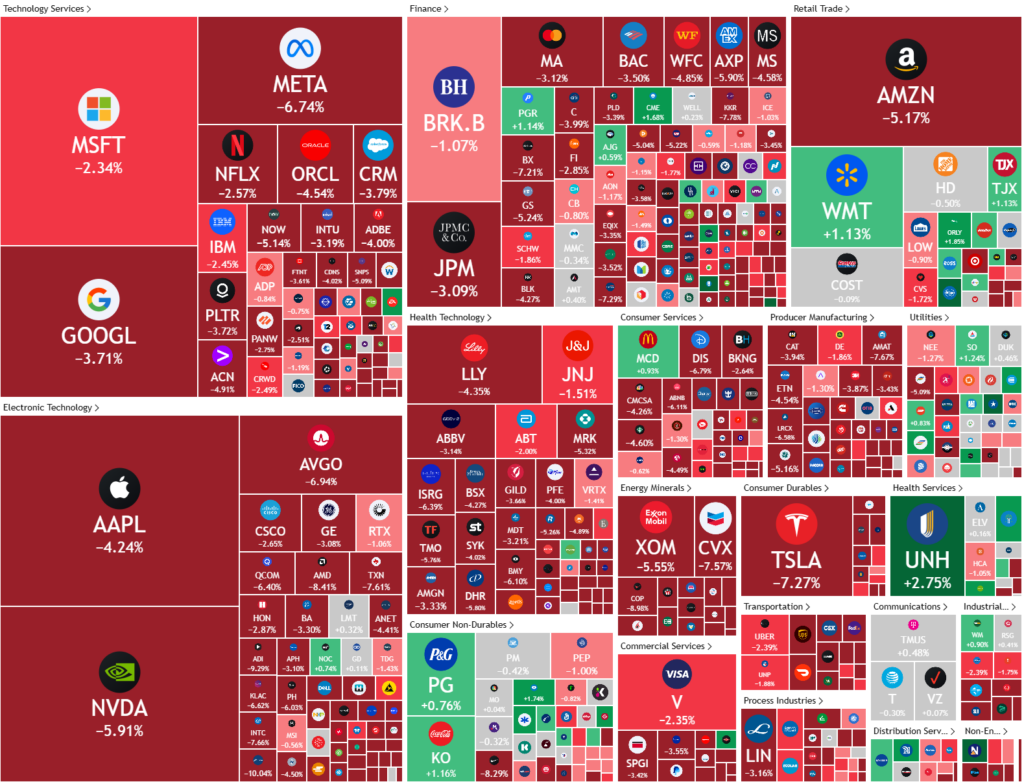

The tech sector has also been impacted by the ongoing tariff uncertainty. Stocks like Tesla, Apple, and NVIDIA experienced sharp declines, while Microsoft and Google fell more than 2% and 3%, respectively. This decline is attributed to concerns that the uncertainty surrounding tariffs could weigh on cloud and AI spending. Analysts at Wedbush estimate that 10%-15% of cloud and AI initiatives in the U.S. could be delayed or slowed during this period of uncertainty.

In the corporate sector, companies like Constellation Brands are feeling the effects of tariffs. Despite a slight stock increase, the brewer forecasted fiscal 2026 profits below expectations due to steep levies imposed by the Trump administration on its beers and spirits business. This highlights the broader impact of trade tensions on various industries beyond technology. Overall, the trade war between the U.S. and China continues to escalate, with both sides maintaining firm stances and the global economy facing potential risks.

ASX SPI 7622 (-1.49%)

The predictable selling into the bounce has occurred, giving investors a chance to sell some unwanted holdings yesterday, which will release the pressure valve for the short term.

Our ASX200 index position was exited yesterday on the open.

We have had a great week in a market of high uncertainty. We will continue to stick to our plan for the next 3-4 months of DCA (dollar cost averaging)