What's Affecting Markets Today

Asia-Pacific markets rallied Thursday, following Wall Street’s strongest session since 2008 after U.S. President Donald Trump announced a 90-day pause on higher tariffs for most trading partners, excluding China.

Japan led regional gains, with the Nikkei 225 jumping 8.35% and the Topix up 7.59%. South Korea’s Kospi rose 5.38%, while the Kosdaq advanced 5.09%. Australia’s S&P/ASX 200 climbed 4.67%.

Investors remained cautious on Chinese equities amid escalating trade tensions. The U.S. raised tariffs on Chinese imports to 125%, prompting Beijing to retaliate with an 84% levy on American goods. Mainland China’s CSI 300 edged up 1%, and Hong Kong’s Hang Seng Index added 1.92%. Indian markets were closed for a public holiday.

Wall Street’s surge overnight was driven by Trump’s tariff reprieve, igniting a broad-based rally. The S&P 500 soared 9.52% to 5,456.90—its largest gain since 2008 and third-largest since WWII. The Dow Jones rose 7.87% to 40,608.45, its best day since March 2020. The Nasdaq Composite surged 12.16% to 17,124.97, posting its second-strongest gain on record.

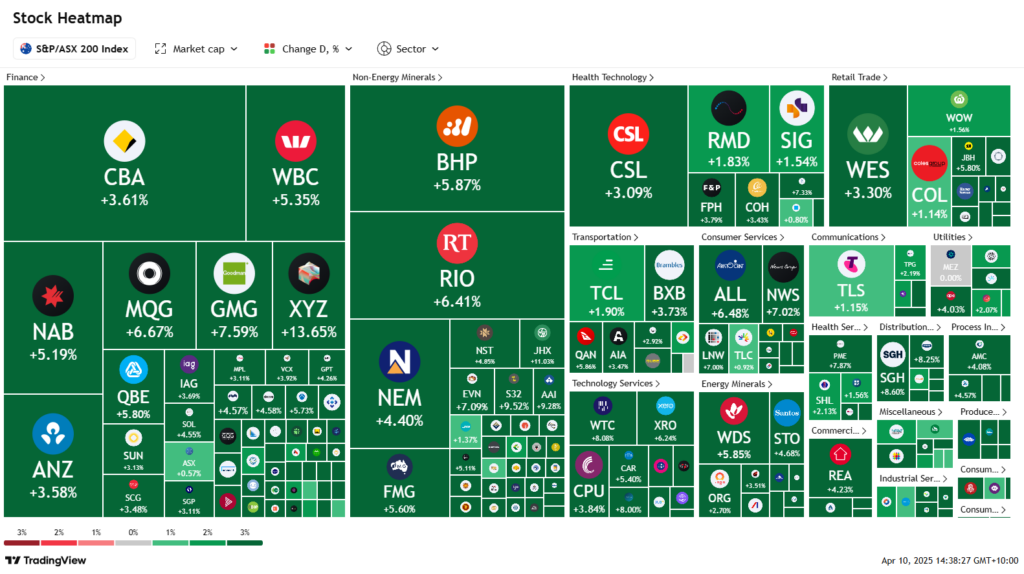

ASX Stocks

ASX 200 - 7,722.3 (+4.70%)

The Australian sharemarket is set to record its strongest session in five years, with the S&P/ASX 200 up 4.5% to 7708.9 points by mid-afternoon, buoyed by a sharp overnight rally on Wall Street. US President Donald Trump’s decision to pause reciprocal tariffs for 90 days on over 75 countries sparked a risk-on rebound, lifting sentiment across global markets.

Wall Street surged, with the S&P 500 posting its biggest one-day gain since 2008—up 9.5% and adding $US4.3 trillion in market value. However, volatility remains high. The US simultaneously increased tariffs on Chinese exports to 125%, prompting China to retaliate by raising its rate to 84%.

Mining, tech, and financial stocks led ASX gains. Mineral Resources surged 15.1%, while BHP added 6.1%. Commonwealth Bank rose 3.4%, and tech names WiseTech and Life360 climbed 7.4% and 10.5%, respectively. Goodman Group and DigiCo jumped 7.3% and 17% on data centre optimism.

Qube rose 4.1% after ACCC cleared its $333m acquisition with conditions, while Aussie Broadband advanced 4.5% on a new mobile network deal with Optus.

Leaders

ZIP ZIP Co Ltd (+23.14%)

ADT Adriatic Metals Plc (+17.63%)

DGT Digico Infrastructure REIT (+17.03%)

MIN Mineral Resources Ltd (+16.32%)

PDN Paladin Energy Ltd (+16.17%)

Laggards

MEZ Meridian Energy Ltd (‑0.75%)

CBO Cobram Estate Olives Ltd (‑0.28%)

LFS Latitude Group Holdings Ltd (0.00%)

NXL NUIX Ltd (0.00%)

BGP Briscoe Group Australasia Ltd (0.00%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!