What's Affecting Markets Today

Asia-Pacific markets declined sharply on Wednesday as heightened trade tensions weighed on investor sentiment. The downturn followed the implementation of additional U.S. tariffs on Chinese imports, bringing the cumulative tariff rate to 104% after a 10% baseline was introduced over the weekend.

Japan’s Nikkei 225 dropped 3.14%, while the broader Topix fell 3.26%. South Korea’s Kospi slipped 0.95%, entering bear market territory after shedding 20% from its July peak. The Kosdaq lost 0.44%. Hong Kong’s Hang Seng Index tumbled 3.86%, with the Hang Seng Tech Index plunging 5.42%. Mainland China’s CSI 300 edged 0.26% lower, showing relative resilience amid the regional sell-off.

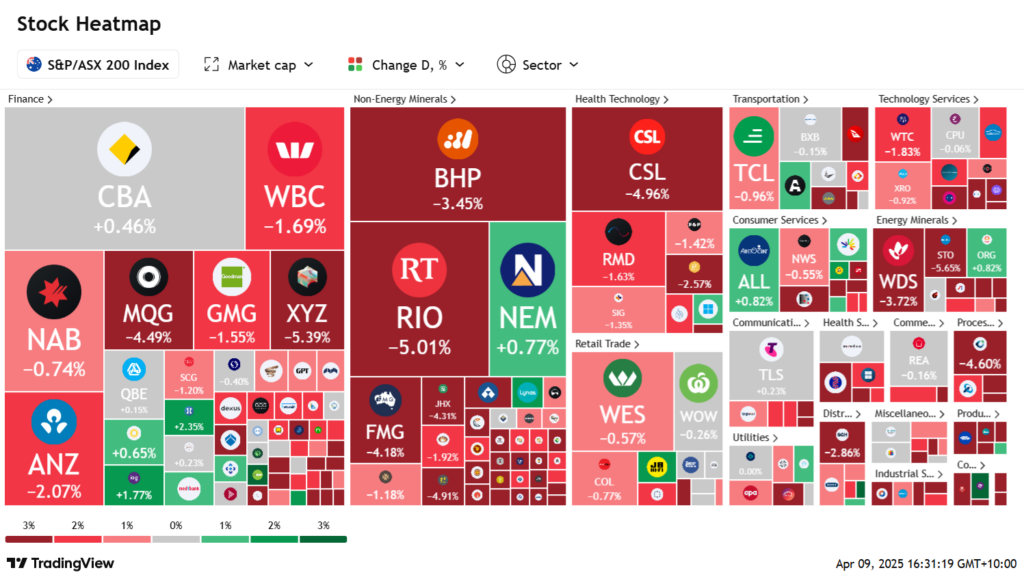

Australia’s S&P/ASX 200 Index declined 1.06% amid broad-based losses in commodity stocks, reflecting concerns over reduced Chinese demand.

In India, the Reserve Bank cut its policy interest rate by 25 basis points to 6%, in line with expectations. Despite the move, the Nifty 50 fell 0.39% as investors weighed global headwinds. Overall, markets across the region were pressured by escalating geopolitical risks and slowing global growth outlook.

ASX Stocks

ASX 200 - 7,375.2 (-1.80%)

The Australian sharemarket extended its sell-off on Wednesday, with the S&P/ASX 200 Index falling 146.6 points, or 2%, to 7363.4 by 2:30pm AEST. The decline follows renewed global trade tensions after the White House raised tariffs on Chinese imports to 104%, triggering fears of a broader economic slowdown. All 11 ASX sectors traded lower, with heavy losses in energy and mining stocks amid falling commodity prices.

BHP fell 3.6%, Rio Tinto declined 4.6%, and Mineral Resources plunged 12%, tracking a seven-month low in iron ore at US$93.35 per tonne. Oil dipped below US$60 a barrel, dragging Woodside and Santos down 3.7% and 5.2%, respectively. CSL slumped 5.4% on concerns over new US pharmaceutical tariffs.

The Australian dollar dropped below US60¢, while US futures pointed to continued selling on Wall Street. In corporate news, Regal Partners lost 9.3% after writing down its Opthea stake, and Nine Entertainment fell 2.6% despite a $210 million deal with Rugby Australia. Elsight rose 8.6% after signing a $7.1 million defence contract in Europe.

Leaders

HLS Healius Ltd (+4.48%)

SGLLV Ricegrowers Ltd (+4.42%)

BFL BSP Financial Group Ltd (+4.29%)

BAP Bapcor Ltd (+3.04%)

CMW Cromwell Property Group (+2.82%)

Laggards

NIC Nickel Industries Ltd (-14.14%)

CIA Champion Iron Ltd (-13.07%)

MIN Mineral Resources Ltd (-12.76%)

PNRDA Pantoro Ltd (-11.11%)

VUL Vulcan Energy Resources Ltd (-11.09%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!