Overnight – Trump Trade Tantrum continues to decimate markets

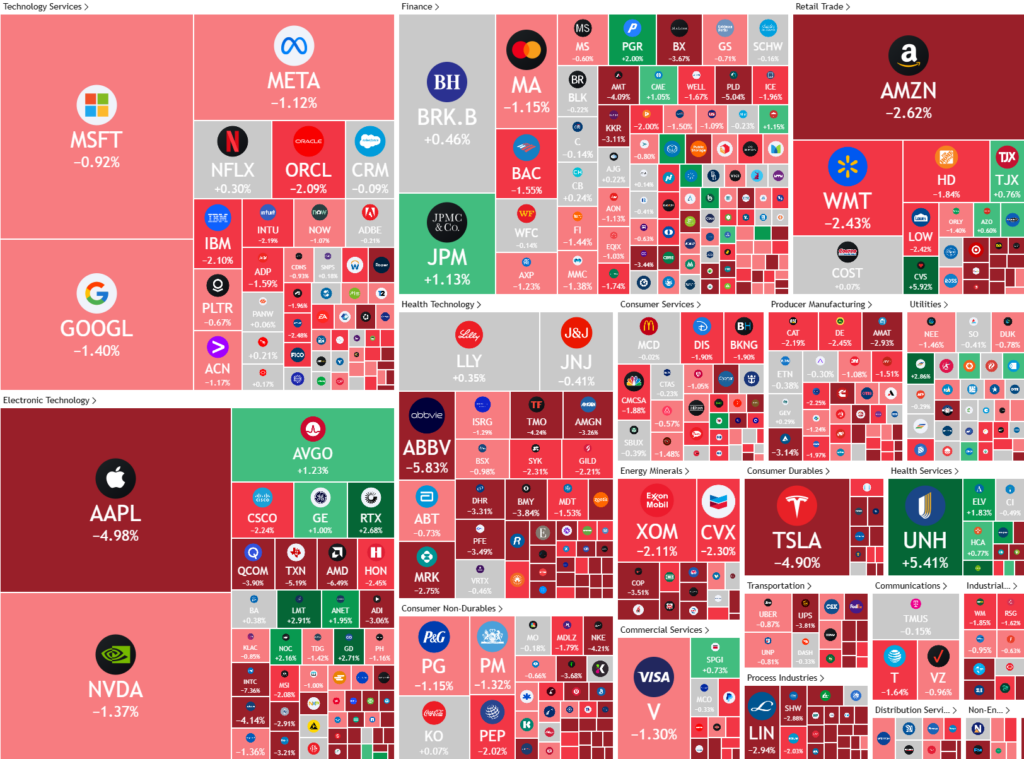

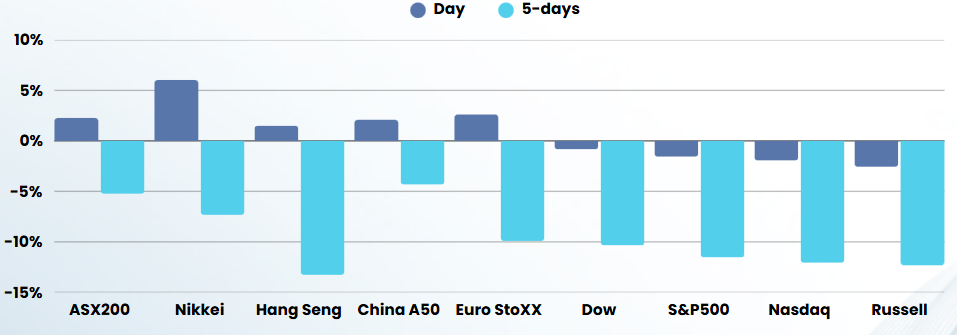

US stocks fell to a year low after a strong start to the session overnight after President Trump doubled down on his threats against China, escalating worries about global trade war.

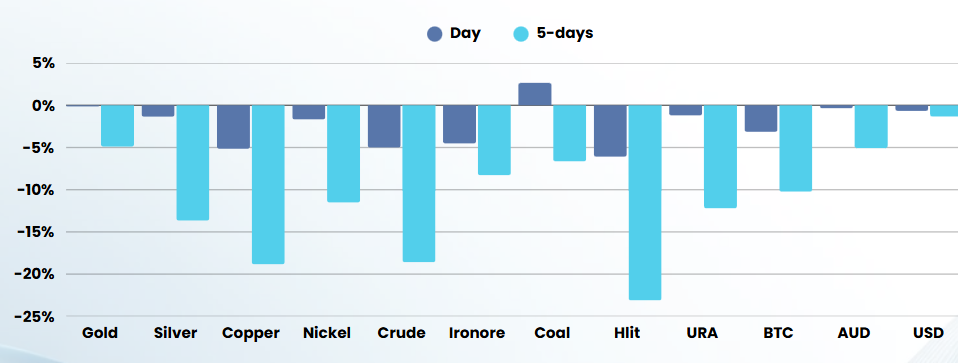

Global trade tensions have escalated significantly as President Trump reaffirmed his commitment to imposing reciprocal tariffs, particularly on China. The U.S. has introduced a comprehensive tariff regime, including a 10% baseline tariff on all imports, excluding Canada and Mexico, and a China-specific tariff that totals 54% as of April 9, 2025. In response, China has imposed a 34% tariff on U.S. goods, effective April 10, 2025, and has vowed to “fight to the end” in this trade conflict.

The situation has further intensified with Trump threatening an additional 50% tariff on Chinese goods if China does not withdraw its retaliatory measures, leading to a potential total tariff rate of 104% on Chinese imports. This escalation has sparked fears of a global trade war, with significant market volatility and potential economic hardship.

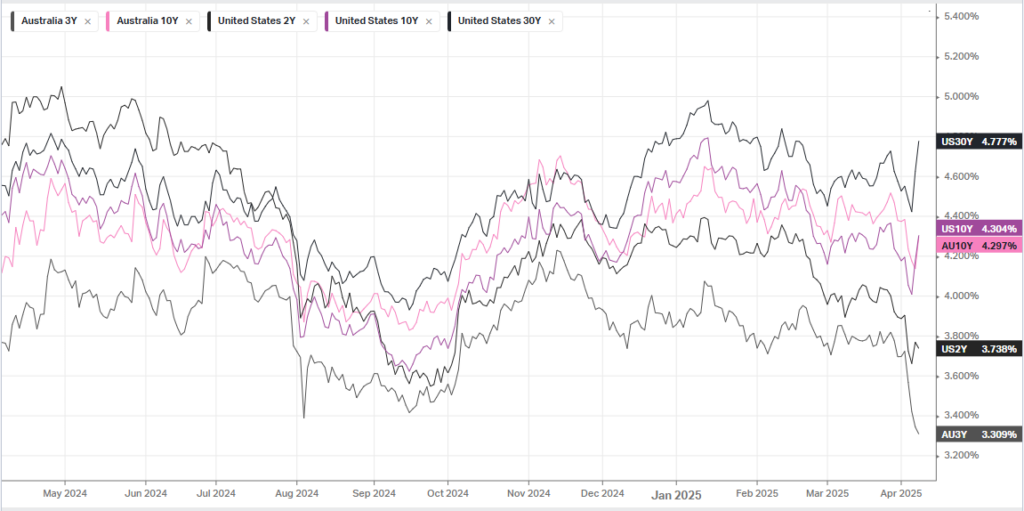

Despite these tensions, Treasury Secretary Scott Bessent indicated openness to negotiations with countries like Japan to reduce trade barriers. Meanwhile, economic leaders are watching the situation closely, with concerns about inflation and potential Federal Reserve intervention if equity markets decline further. The ongoing trade dispute continues to dominate global economic news, with no clear resolution in sight.

Healthcare stocks were in the ascendency on Tuesday after the Trump administration announced a higher-than-expected rate of 5.06% to private insurers for 2026 Medicare Advantage health plans.

Humana, UnitedHealth and CVS Health all posted strong gains, with the last company also helped by naming United Parcel Service executive Brian Newman its new Chief Financial Officer, the first top management change for the health insurer under CEO David Joyner’s leadership.

Broadcom gave up gains to trade marginally higher despite launching a new share buyback program of up to $10 billion, set to run through the end of the year.

Marvell Technology stock fell more than 3% giving up strong gains during the day even as German chipmaker Infineon said it would buy the company’s automotive ethernet business for about $2.5 billion in cash.

Other big tech names including NVIDIA, and Tesla, which have been battered recently, also off pared gains to close in the red. Apple gave up gains, slipping into the red.

ASX SPI 7391 (-1.88%)

There will be nowhere to hide today as the Trump Tariff “soap opera” is coming to a head and investors are likely to reach peak panic today as Trumps ego will push him to keep doubling down, rather than compromise.

We remain in at least 40-50% cash and will do so until further notice. As boisterous as Trump is being, the US isn’t in the position of strength it thinks and I suspect that Trump will need to do a deal quickly to save face. This will trigger a significant bounce, which (in my opinion) investors should sell into as there will be another leg down over the next 2-3 months. The next leg of this downturn will be about US recession fears